US forest industry performance in April and May was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) fell 11.2 percent in April (-15.0 percent YoY) for its largest monthly drop in the 101-year history of the index, as the pandemic led many factories to slow or suspend operations. Manufacturing (NAICS basis) output dropped 13.8 percent, its largest decline on record, as all major industries posted decreases. The output of motor vehicles and parts plummeted by more than 70 percent; production elsewhere in manufacturing dropped 10.3 percent. The indexes for utilities and mining decreased 0.9 percent and 6.1 percent, respectively.

Capacity utilization (CU) also took a substantial hit in April, -8.3PP to 64.9 percent, a rate that is 14.9PP below its long-run (1972-2019) average and 1.8PP below its all-time low set in 2009. Manufacturing CU was 61.1 percent, 9.7PP lower than in March and 2.6PP below its recession trough of June 2009 (NAICS manufacturing: -13.8 percent, at 61.4 percent). The operating rate for durable manufacturing also dropped below its 2009 low to 55.3 percent and was held down by decreases in every major industry group. Likewise, CU for nondurables set a new low, falling 6.1PP to 68.0 percent.

New orders tumbled 13.0 percent (-22.6 percent YoY), thanks to the aforementioned weakness in motor vehicles, and also nondefense aircraft; excluding transportation equipment, new orders declined by a less-severe 8.5 percent. In real (inflation adjusted) terms, however, new orders have now sunk to nearly 11 percent below the trough of the Great Recession. Finally, business investment spending decreased by 6.1 percent (-7.8 percent YoY).

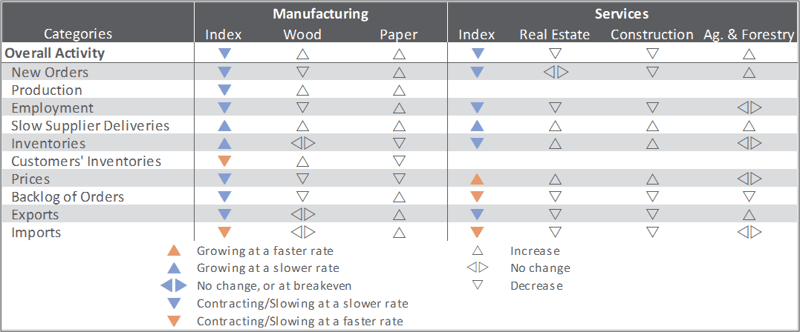

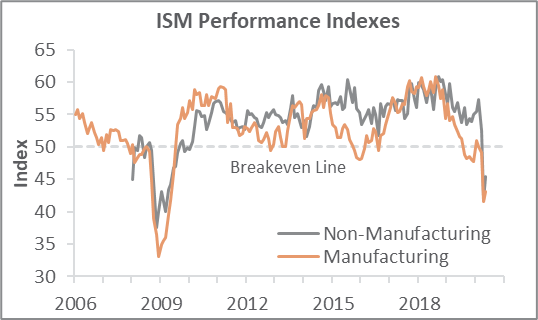

The Institute for Supply Management’s (ISM) May survey showed an “improved trajectory” in the retrenchment of U.S. manufacturing; the PMI registered 43.1 percent (+1.6PP). All of the sub-indexes turned higher except for imports, which shrank further (-1.4PP). The non-manufacturing sector also contracted more slowly (+3.6PP, to 45.4 percent). Here, too, imports exhibited the most notable downturn (-5.6PP).

Concurrent findings by IHS Markit paralleled ISM. “The U.S. economy remained in a steep downturn in May,” wrote Markit’s Chris Williamson. “Encouragingly, the rate of contraction has eased considerably since the height of the lockdown in April as some firms get back to work and economic activity starts to resume.

The consumer price index (CPI) declined 0.8 percent in April (but +0.3 percent YoY), the largest MoM decline since December 2008. A 20.6 percent decline in the gasoline index was the largest contributor, but the indexes for apparel, motor vehicle insurance, airline fares, and lodging away from home all fell sharply as well. In contrast, food indexes rose in April, with the index for food at home posting its largest monthly increase since February 1974.

Meanwhile, the producer price index (PPI) declined 1.3 percent (-1.2 percent YoY), the largest decrease since the final-demand index began in December 2009. Over 80 percent of the decrease in the index can be traced to a 3.3 percent drop in prices for goods (especially a 56.6 percent tumble in the gasoline index).

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products: +0.7 percent (-0.7 percent YoY)

- Lumber & Wood Products: -1.9 percent (-1.0 percent YoY)

- Softwood Lumber: -11.2 percent (-0.7 percent YoY)

- Wood Fiber: +0.3 percent (-1.6 percent YoY)

Joe Clark

Joe Clark