Forestry-related industry performance for the latter part of March and the month of April remained largely unchanged over February data in both the manufacturing and non-manufacturing sectors.

Total industrial production (IP) decreased 0.6% (+2.0% YoY) in March, more than undoing February’s 0.1% gain. For 1Q2015 as a whole, IP declined at an annualized rate (AR) of 1.0%, the first quarterly decrease since 2Q2009. The 1Q2015 decline resulted from a 60% (AR) drop in oil and gas well drilling and servicing, and from a 1.2% decrease in manufacturing production. Performance of major sub-groups was as follows:

-

Manufacturing output moved up 0.1% for its first monthly gain since November.

-

Wood Products and Paper output dropped by 1.0% and 0.6%, respectively.

-

Construction IP fell 0.9%.

-

Consumer goods moved down 0.6%

Capacity at the all-industries and manufacturing levels moved higher (both by 0.2%) to 134.3% and 132.4% respectively, of 2007 outputs. Wood Products extended its ongoing upward trend (since July 2013) increasing by 0.4% to 118.0%. Paper, by contrast, contracted by 0.1% to another new low of 98.6% and paper capacity was 2.5% lower in March than a year earlier.

Capacity utilization (CU) for the industrial sector decreased 0.8% in March (to 78.4%), 1.7 percentage points below its 1972-2014 average. Wood Products CU slumped by 1.4% (to 68.2%, its lowest rate since December 2012) while Paper fell by 0.5% (to 82.0%).

Manufacturing and Non-Manufacturing Surveys

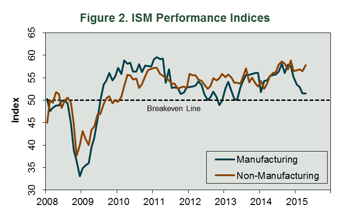

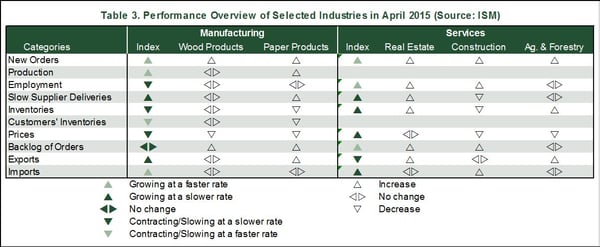

The Institute for Supply Management’s (ISM) monthly opinion survey indicated that growth of activity in the U.S. manufacturing sector was unchanged in April. The PMI registered 51.5%, the same reading as in March (Figure 2) and its lowest level since May 2013. (50% is the breakpoint between contraction and expansion.) The most apparent changes included increases in the new orders, exports and imports sub-indexes and contraction in employment (Table 3).

Wood Products expanded in April due to new and backlogged orders, which seems at odds with the lumber futures market in which the May contract dropped by over 6% during April. Paper Products also expanded with support from new and backlogged orders, production and exports.

The pace of growth in the non-manufacturing sector quickened in April. The NMI registered 57.8%, 1.3 percentage points above the March reading of 56.5%. The business activity sub-index rose noticeably, and new orders slightly less so. However, exports contracted (collapsing from 59 to 48.5%) and import growth markedly slowed.

Joe Clark

Joe Clark