2 min read

Forestry Related Industry Performance At a Glance: May 2010

Suz-Anne Kinney

:

June 7, 2010

Suz-Anne Kinney

:

June 7, 2010

Up during eleven of the last twelve months, new orders at the total manufacturing level increased $5.0 billion (1.3 percent) to $391.5 billion in March. New orders for nondurable goods provided most of that impetus by increasing $6.0 billion (2.9 percent) to $212.8 billion. But durable goods orders dropped by $1.0 billion (0.6 percent) to $178.7 billion, after three consecutive monthly increases. Excluding transportation (the biggest “negative”), new durables orders increased 3.1 percent.

Economic activity in the manufacturing sector also expanded in April for the ninth consecutive month according the Institute for Supply Managements (ISM).15 “The rate of growth as indicated by the Purchasing Managers’ Index [60.4 percent] is the fastest since June 2004,” said Norbert Ore, chair of ISM’s Manufacturing Business Survey Committee. “Manufacturers continue to see extraordinary strength in new orders, as the New Orders Index has averaged 61.6 percent for the past 10 months. The signs for employment in the sector continue to improve as the Employment Index registered its fifth consecutive month of growth. Overall, the recovery in manufacturing continues quite strong, and the signs are positive for continued growth.” With the Non-Manufacturing Index registering 55.4 percent, the service sector expanded at the same pace in April as it had in March.

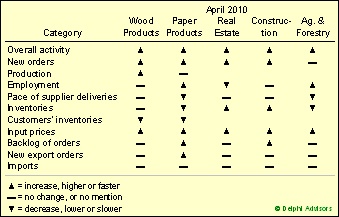

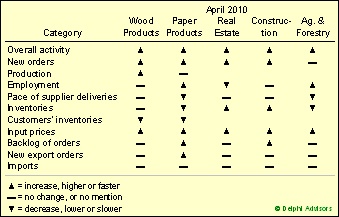

The performance of individual industries that are at least somewhat related to the forest products sector improved “across the board” during April. All industries except Agriculture, Forestry, Fishing & Hunting reported growth in new orders; however, only Paper Products reported growth in new export orders. All but Real Estate, Rental & Leasing reported stable or growing employment.

Input costs were higher in April, although the gains were smaller than in March. Commodities whose prices rose in April included fuel, corrugated containers, pulp, envelopes, lumber and wood products, OSB, paper, and paper products.

Table 1. Performance overview for Forest-Related Industries.

Data source: Institute for Supply Management

Based on its semiannual survey of purchasing and supply executives, ISM expects economic growth to continue in the U.S. manufacturing and non-manufacturing sectors throughout the remainder of 2010.16 Wood Products led the list of 15 manufacturing industries expecting growth of at least 3 percent in 2010, while Paper Products was ranked fifth in terms of expected growth rates. Agriculture, Forestry, Fishing & Hunting was the only relevant service industry expecting growth in 2010. Manufacturers forecast a 3.8 percent increase in input prices, while non-manufacturers think their cost increases will remain below 1.7 percent for the entire year.

If you would like detailed information about the future of forest-related industries, subscribe to Forest2Market’s Economic Outlook, a 24-month forecast of performance in GDP, currency exchange rates, housing starts, oil prices and more.

Let Forest2Market do the groundwork; subscribe to the Economic Outlook and focus your resources on identifying and acting on the strategic advantages you'll discover every month.