This post is excerpted from Forest2Market's monthly Economic Outlook, a 24-month forecast of macroeconomic indicators.

Industrial Production

Bucking expectations of a 0.2% increase, industrial production (IP) instead dropped by 0.3% in January; that retreat erased December’s gain. The report showed:

- Manufacturing declined by 0.8%, well off December’s +0.3%. Inclement weather was blamed for the retreat

- Wood Products contracted by 2.6%, extending December’s 2.4% drop.

- Paper nudged down by 0.2%, partially reversing December’s 0.4% gain.

- Construction fell by 1.0%, deepening December’s 0.6% loss.

- Consumer Goods gave up 0.5%, largely offsetting December’s 0.6% increase.

Capacity utilization of all industries declined by 0.5% (to 78.5%). Wood Products fell by 2.9% while Paper ticked down by 0.1%. Capacity among all industries expanded by 0.2%, the same rate as in December; Wood Products jumped by 0.4% while Paper shrank by 0.1%.

F2M forecasts that 1Q2014 IP will increase relative to 4Q2013 by an annualized rate of 2.5%. IP growth will subsequently fluctuate between -0.6% and +4.3% through the remainder of the forecast, averaging 1.9% overall.

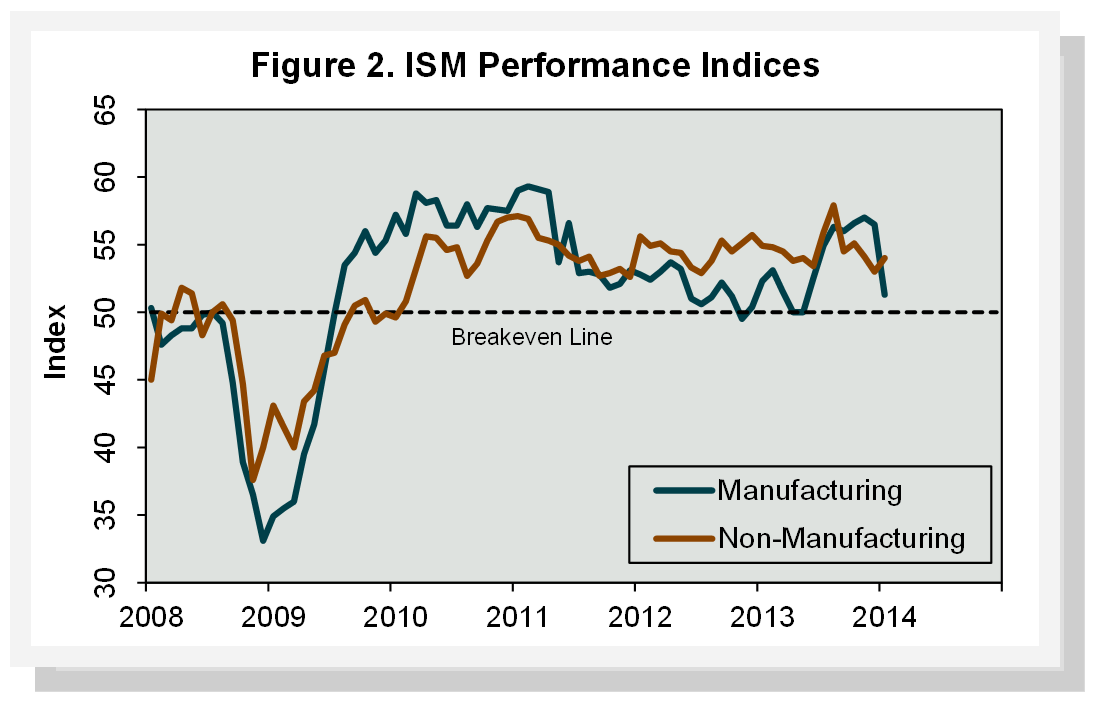

Manufacturing and Non-manufacturing

Expansion of economic activity in the U.S. manufacturing sector nearly stalled in January, according to the Institute for Supply Management (ISM). The PMI registered 51.3% (Figure 2), a drop of 5.2 percentage points (50% is the breakpoint between contraction and expansion). “A number of comments from the [respondent] panel cite adverse weather conditions as a factor negatively impacting their businesses in January,” said Bradley Holcomb, chair of ISM’s Manufacturing Business Survey Committee, “while others reflect optimism and increasing volumes in the early stages of 2014.”

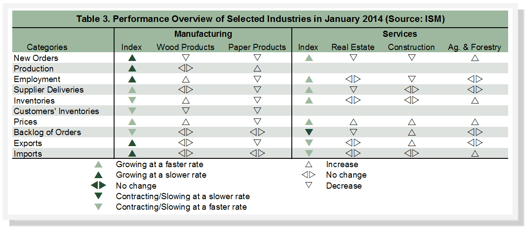

Except for input prices and the pace of supplier deliveries (both of which increased faster), January’s general manufacturing sub-indices either rose more slowly or contracted more quickly than in December (Table 3). Perhaps most notable is that manufacturers’ and customers’ inventories dropped further in January. This may be signaling the dramatic 3&4Q2013 inventory buildup is coming to an end; that, in turn, could have adverse implications for 1Q2014 GDP growth. Wood Products expanded in January, as employment and inventory growth more than offset the drop in new orders and shrinking customer inventories. Paper Products contracted, with only production growth rising.

Growth in the non-manufacturing sector (which accounts for roughly two-thirds of the U.S. economy) nudged higher in January. The NMI registered 54.0%, a 1 percentage point increase. Except for those related to order backlogs and international trade, service sub-indices rose at a faster pace during January. “The majority of respondents’ comments reflect an improvement in business conditions,” said Anthony Nieves, chair of ISM’s Non-Manufacturing Business Survey Committee. “Some of the respondents indicate that weather conditions have impacted their business. There remains a bit of uncertainty about the overall economy for some of the survey respondents; however, the majority feel positive about continued economic growth.

Among the individual service industries we track, only Construction contracted (thanks to declining new orders and employment). Real Estate expanded despite a downturn in new and backlogged orders. Positive support among Ag & Forestry’s sub-indices was more diverse.

Suz-Anne Kinney

Suz-Anne Kinney