Forestry-related industry performance in both the manufacturing and non-manufacturing sectors for the latter part of June and July followed the marginally up/down trend that it has maintained for most of 2015.

After annual revisions in late July that included changing the benchmark year to 2012 (from 2007), total industrial production (IP) increased 0.2% in June but fell at an annualized rate of 1.6% during 2Q2015. Manufacturing output edged down by 0.1%. At 107.1% of its 2012 average, total IP in June was 1.7% above its year-earlier level. Wood Products output fell by 1.9% (-1.4% YoY) but Paper rose by 0.5% (+0.3% YoY).

Capacity at the all-industries and manufacturing levels moved higher—all-industries: +0.1% (+1.8% YoY) to 137.6% of 2012 output; manufacturing: +0.1% (+1.1% YoY) to 138.2%.

-

Wood Products increased by 0.2% (+2.4% YoY) to 158.8%

-

Paper was unchanged (-1.1% YoY) at 116.9%.

Capacity utilization (CU) for all industries increased 0.1% (-0.4% YoY) in June to 77.8%, below the threshold (82-85%) that some consider conducive to inflation:

-

Wood Products CU declined 2.1% (-3.7% YoY) to 68.0%

-

Paper rose by 0.5% (+1.4% YoY) to 83.9%

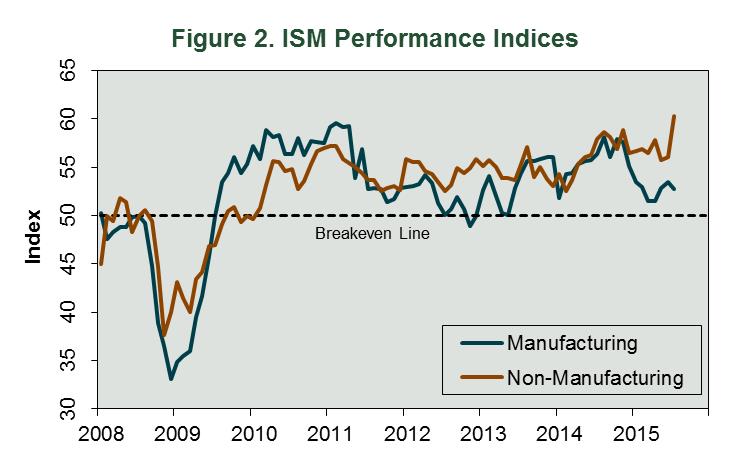

Manufacturing and Non-manufacturing Surveys

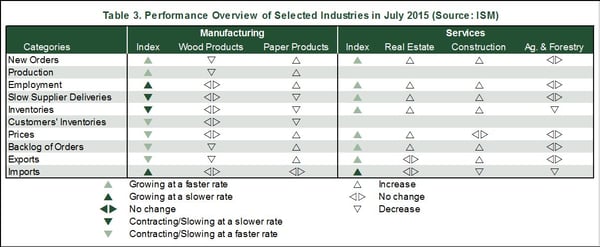

The Institute for Supply Management’s (ISM) monthly opinion survey showed that growth of economic activity in the U.S. manufacturing sector slowed in July (Figure 2). The PMI fell 0.8 percentage point, to 52.7% (50% is the breakpoint between contraction and expansion). Notable changes included a slowdown in employment growth, shrinking inventories, order backlogs and exports, and declining input prices (Table 3).

Wood Products contracted, dragged down by declines in production and orders. Paper Products expanded, with broad-based support among the sub-indexes.

Unlike manufacturing, the pace of growth in the non-manufacturing sector hit its highest level in July. The NMI jumped 4.3 percentage points, to 60.3%. The sub-indexes were higher virtually across the board. Real Estate and Construction also reported expansion in July.

Joe Clark

Joe Clark