This post is excerpted from Forest2Market's monthly Economic Outlook, a 24-month forecast of macroeconomic indicators.

Industrial Production

In one of the more positive recent notes for the economy, industrial production (IP) rose 0.6% in May, more than turning around April’s 0.3% decline. Total IP was 4.3% above its level of a year earlier. Other details from the report showed:

· Manufacturing output also increased by 0.6%, much better than April’s -0.1%.

· Wood Products output jumped 1.7%; building on the +0.9% increase in April.

· Paper declined by 0.5%, partially reversing April’s +1.8%.

· Construction notched an 0.8% increase, far better than -0.6% in April.

· Consumer Goods edged up 0.1% in the wake of a 1.1% decline in April.

The capacity utilization rate for manufacturing increased 0.3 percentage point in May (to 77.7%). Wood Products capacity utilization jumped by 1.3%. Paper retreated by 0.3%.

Manufacturing capacity expanded by 0.2 in May. Wood Products capacity extended its upward trend with a 0.4% rise. Paper, on the other hand, contracted by 0.1% to its lowest point since January 1986.

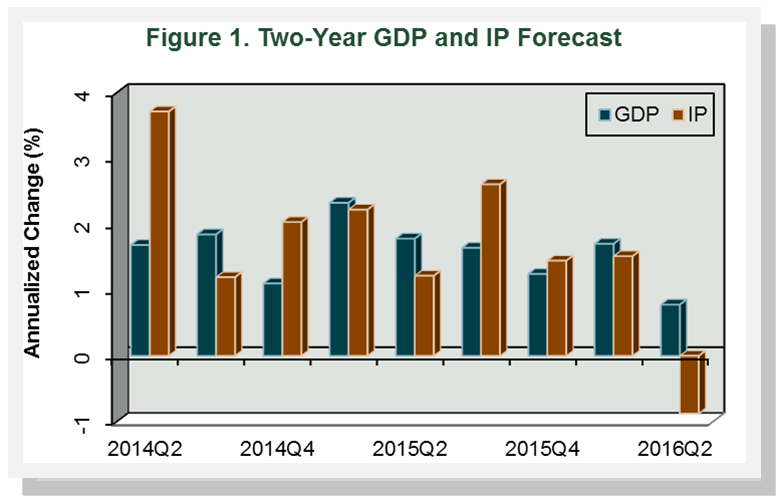

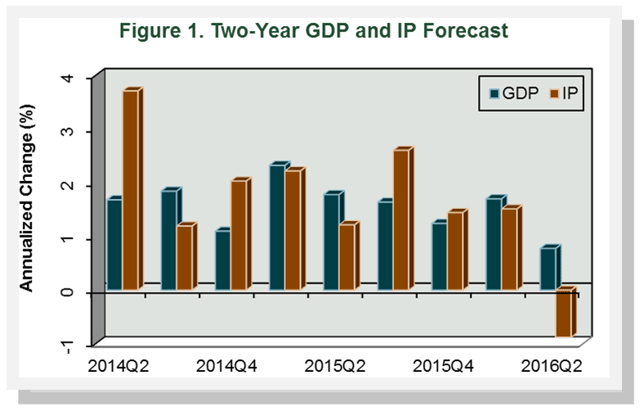

F2M forecasts that 2Q2014 IP will increase relative to 1Q2014 by an annualized rate of 3.7% (Figure 1). IP growth will subsequently fluctuate between -0.9% and 2.6% through the remainder of the forecast, averaging 1.7% overall.

Manufacturing and Non-manufacturing

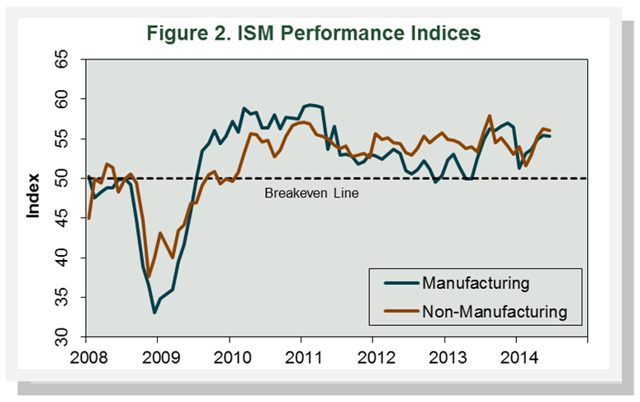

The Institute for Supply Management’s (ISM) monthly opinion survey showed that expansion of economic activity in the U.S. manufacturing sector slowed slightly in June. The PMI registered 55.3% (Figure 2), a decrease of 0.1 percentage point (50% is the breakpoint between contraction and expansion).

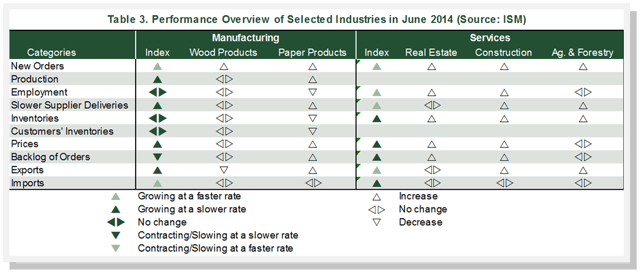

Jumps in the new-orders and imports sub-indices were the main sources of support for the expansion (Table 3).

Wood Products and Paper Products both expanded in June—although in the case of Wood Products, the only positive contribution came from more new orders. Paper Products exhibited much greater support among the sub-indices. “Orders are picking up, but pricing has declined in last month,” wrote one Wood Products respondent. “Not the norm for this time of year.”

The pace of expansion in the non-manufacturing sector, which accounts for 80 percent of the economy and 90 percent of employment, also edged lower in June. The NMI registered 56.0 percent, 0.3 percentage point lower than in May.

All three of the individual service industries we track expanded in June; moreover, all of the respective sub-indices were either unchanged or increased. One Construction respondent indicated the “industry is extremely strong [and] business conditions look positive going forward.”

Commodities up in price included gasoline and diesel, lumber, paper, and natural gas. No relevant commodities were down in price. Wood pallets were once again in short supply.