Forestry-related industry performance was mixed in February/March—not unlike the January data—in both the manufacturing and non-manufacturing sectors.

Total industrial production (IP) edged up 0.1% (+0.3%) in February after decreasing 0.3% in January (revised from +0.2%). Total IP in February was +3.5% Year-over-Year (YoY). Performance of major sub-groups was as follows:

-

Manufacturing output moved down 0.2% in February, its third consecutive monthly decline; data for both December and January were revised lower.

-

Wood Products output dipped by 0.5% in February

-

Paper remained unchanged

-

Construction IP declined 0.4%

-

Consumer Goods jumped by 1.0%.

Capacity at the all-industries and manufacturing levels moved higher, both by 0.2% (to, respectively, 134.0 and 132.1% of 2007 output). Wood Products extended its upward trend to 21 months when increasing 0.4% (to 117.6%). Paper, on the other hand, contracted by 0.2% to another new low (96.7%).

Capacity utilization (CU) for the industrial sector decreased to 78.9% in February, 1.2 percentage points below its 1972-2014 average. Wood Products CU slumped by 0.9% (to 69.8%) while Paper rose by 0.2% (to 83.7%).

Manufacturing and Non-Manufacturing Surveys

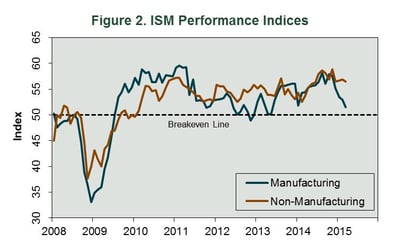

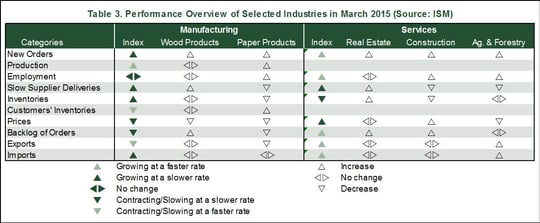

The Institute for Supply Management’s (ISM) monthly opinion survey, more a reflection of current attitudes than “hard” data, showed that growth of economic activity in the U.S. manufacturing sector slowed again in March. The PMI fell 1.4 percentage points, to 51.5% (Figure 2)—its lowest reading since May 2013. (50% is the breakpoint between contraction and expansion.) The key new-orders sub-index slipped again but remained in expansion (Table 3).

Wood Products expanded in March thanks to new and backlogged orders. Paper Products also expanded, with support among new orders, production and employment. "March business is improving over Jan-Feb," wrote one Paper Products respondent; "thawing out of this crazy winter."

The pace of growth in the non-manufacturing sector edged lower in March. The NMI registered 56.5% (-0.4 percentage point). The business activity sub-index declined while new orders marginally improved—both remaining in moderate expansion. Also, exports and imports both jumped. All three service industries we track reported expansion in March. The new orders sub-index was the most consistent source of strength.

The tenor of ISM's and Markit's surveys diverged markedly in March. Whereas ISM's PMI and NMI both reflected decelerating growth, Markit's U.S. Manufacturing and Services PMIs both showed "sharp" improvements.

Joe Clark

Joe Clark