Forestry-related industry performance for the latter part of April and May was mixed over March data in both the manufacturing and non-manufacturing sectors.

Total industrial production (IP) decreased 0.3% (0.0% expected) in April, its fifth consecutive monthly loss. At 105.2% of its 2007 average, total IP was 1.9% above its April 2014 level. Manufacturing output was unchanged in April; March was revised from +0.1% to +0.3%. The fall-off in oil and gas well drilling caused a 0.8% drop in mining output (its fourth consecutive monthly decrease) in April; the output of utilities also declined 1.3%. Performance of major sub-groups included:

-

Wood Products rose by 1.3% (+2.0% YoY)

-

Paper output rose by 0.2% (-2.3% YoY).

-

Consumer spending on goods improved slightly (from +0.05% to +0.10%)

Capacity at the all-industries and manufacturing levels moved higher: +0.2% (to 134.5% of 2007 output) and +0.1% (to 132.6%), respectively. Wood Products increased by 0.3% (+4.9% YoY) to 118.4%. Paper, on the other hand, contracted by 0.1% (-2.4% YoY) to another new low (98.5%).

Capacity utilization (CU) for the industrial sector decreased 0.5% in April to 78.2%, or 1.9 percentage points below its long-run (1972-2014) average. Wood Products and Paper CU both bucked the larger trend by rising +0.9% (to 69.2%) and +0.4% (to 83.6%) respectively.

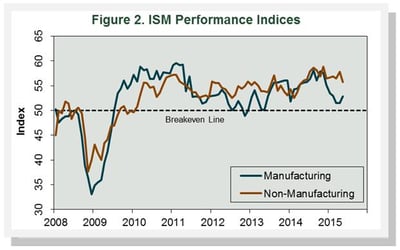

Manufacturing and Non-Manufacturing Surveys

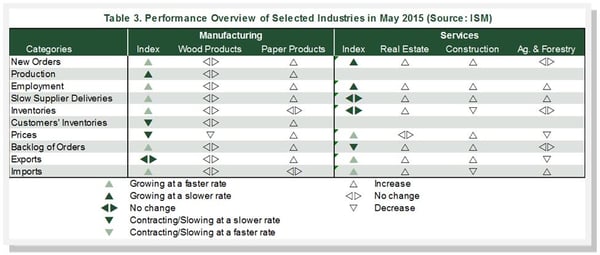

The Institute for Supply Management’s (ISM) monthly opinion survey indicated that growth of activity in the U.S. manufacturing sector quickened slightly in May (Figure 2). The PMI rose 1.3 percentage points, to 52.8%. (50% is the breakpoint between contraction and expansion.) Virtually all sub-indexes were higher in May (Table 3), but the most obvious change was a substantial moderation in the pace of input price decreases.

While Paper Products expanded amidst widespread support in May, Wood Products was unchanged. After essentially trading flat since mid-April, the July lumber futures contract abruptly increased by $26/MBF (10.5%) between mid-May and the first week of June. We suspect the price rise reflected stronger demand from April’s housing start surge, and supply disruptions from wet weather across the mid-South (particularly Texas).

The pace of growth in the non-manufacturing sector slowed in May. The NMI dropped 2.1 percentage points to 55.7%.

Joe Clark

Joe Clark