2 min read

Forestry-Related Industry Performance: November/December 2014

Suz-Anne Kinney

:

January 30, 2015

Suz-Anne Kinney

:

January 30, 2015

Forestry-related industry performance at the end of 2014 was mixed. (Read Forestry-Related Industry Performance: November 2014.)

Industrial production (IP) was positive in November. Total IP increased 1.3% (+5.2% YoY), the biggest month-to-month rise since May 2010 and well above expectations of +0.7%. In addition:

- Manufacturing output increased 1.1%, with widespread gains among industries. The gain in factory output was its largest since February and well above its average monthly pace of +0.3% during the previous five months.

- Wood Products and Paper output rose by, respectively, 1.3 and 0.1%.

- Construction gained 0.5%, extending October’s +0.2%.

- Consumer goods jumped by 2.5%, swamping October’s -0.1%.

Capacity utilization (CU) for all industries increased 0.8 percentage point in November to 80.1%, a rate equal to its long-run (1972-2013) average. Wood Products CU was 72.2% (+0.9%), 44% higher than this cycle’s trough and 1.4% below its peak. Paper CU was 83.3% (+0.4%), 14.9% above its trough and 2.6% below this cycle’s peak.

Declining new orders for durable goods (-0.7% in November, the third decline in four months) partially offset the positive IP report, although orders for nondefense capital goods (e.g., machines used to produce other goods) increased 0.5%.

Manufacturing and Non-manufacturing

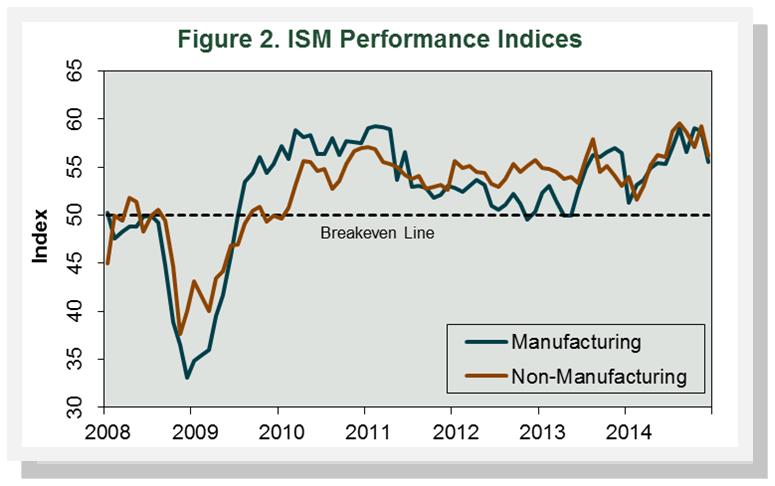

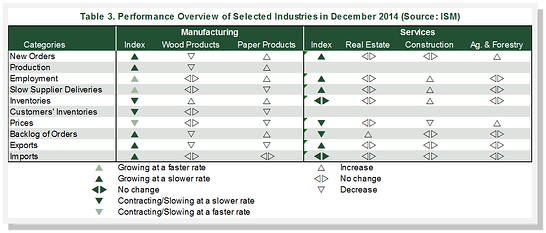

The Institute for Supply Management’s (ISM) monthly opinion survey suggested that growth of economic activity in the U.S. manufacturing sector slowed markedly in December, missing expectations by the most since January. The PMI slid from November’s 58.7% to 55.5% in December (Figure)—its lowest value since June. All sub-indices except employment and slow supplier deliveries were lower in December (Table).

Wood Products contracted, as virtually all reported changes in the sub-indices pointed to slower activity. Paper Products’ expansion, by contrast, was tarnished only slightly by falling export orders.

The pace of growth in the non-manufacturing sector also slowed in December. The NMI registered 56.2%, 3.1 percentage points below November’s 59.3%. It was the biggest miss to expectations since September 2013, and the lowest value since June. The sub-index values were lower “across the board” in December.

Two of the three service industries we track (Construction and Ag & Forestry) reported expansion in December, although supporting evidence was fairly thin. Real Estate registered virtually no changes.

Further confirmation of a December slowdown came from Markit’s U.S. Manufacturing and Services PMIs. “[Manufacturers] are citing greater uncertainty about the outlook, especially in export markets,” said Chris Williamson, Markit’s chief economist, “leading to some scaling back of expansion plans and a greater reluctance for customers to place orders compared to earlier in the year, which suggests a slowdown could become more entrenched unless demand revives.” Capping off 4Q2014, Williamson said, “[Markit’s] PMI surveys suggest the pace of U.S. economic growth slowed in 4Q” to perhaps 2%.