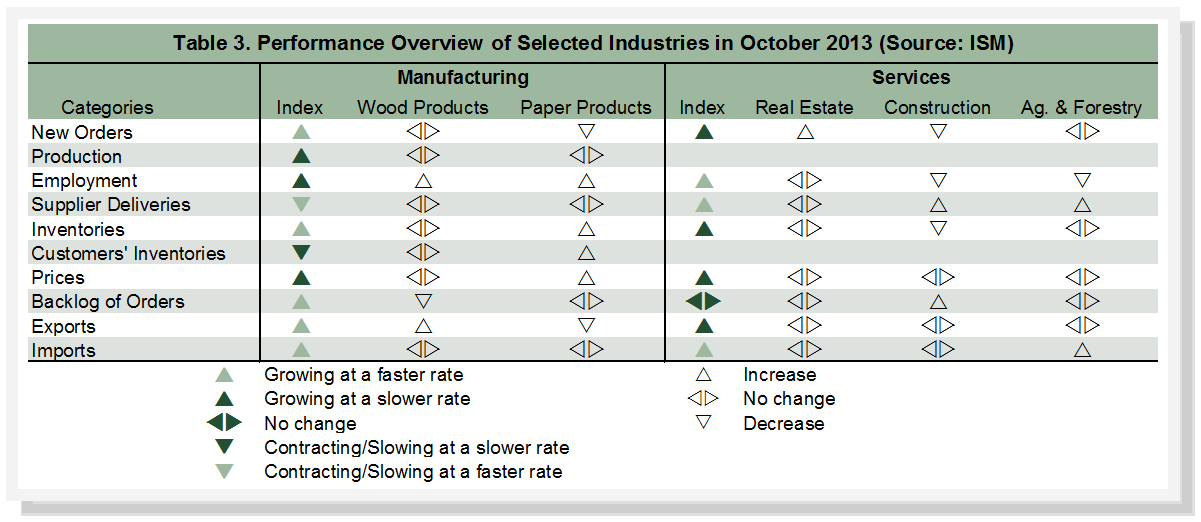

Most general manufacturing sub-indices were more positive than in September (Table 3); the slowing growth rates of respondents that expanded production and employment were the most notable exceptions. Both Wood and Paper Products reported overall expansion. Support was rather sparse (just employment and new export orders) in the case of Wood Products, however. For Paper Products, inventory build-ups could result in slower future expansion, especially when coupled with observations that growth in new domestic and export orders slowed in October.

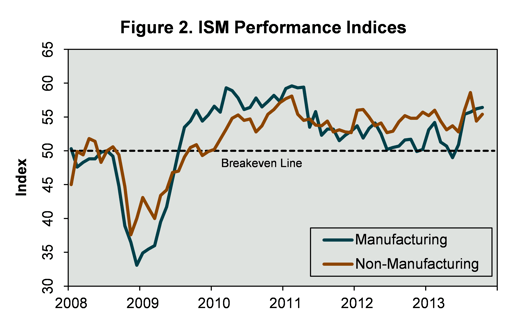

The service sector recouped some of September’s dramatic slowdown in growth (Figure 2), although most of the extra business activity was concentrated in employment and imports (Table 3). The NMI registered 55.4 percent (1.0 percentage point higher than in September), bucking expectations of a drop to 54.0 percent. Forward-looking indicators seem to lean toward the possibility of slower future growth, as new domestic and export orders dipped; also, more respondents consider current inventory levels to be too high.

Among the individual service industries we track, only Real Estate expanded -- and that was only because new orders grew. For Construction and Ag & Forestry, new orders were either unchanged or slowing while imports were either stable or increasing. Employment shrank in the latter two industries.

Commodities up in price included corrugated boxes. Caustic soda was down in price. Some respondents indicated paying more for gasoline and diesel, while others reported paying less.

Suz-Anne Kinney

Suz-Anne Kinney