2 min read

Global Sawlog Price Index Finally Dips After 40% Gain Over 2 Years

Forest2Market

:

January 31, 2023

Wood raw-material costs for sawmills in North America and Europe eased in the third quarter 2022 as demand and prices for lumber fell.

A few countries faced slight log price increases in their local currencies. But with the strengthening US dollar, practically all markets worldwide had lower log costs in dollar terms compared to the second quarter of 2022.

As a result, the Global Sawlog Price Index (GSPI) fell about five percent from its all-time high in the previous quarter. Since the index fell to a ten-year low in early 2020, it has climbed steadily and was up 40% over two years.

Strong Softwood Sawlog Market Persists in US and European Markets

Unprecedented strong markets for wood products and record-high lumber prices caused record demand for wood raw-material in both Europe and North America during 2021 and early 2022.

On a worldwide basis, softwood sawlog prices (in USD) have gone up the most since 2020 in the following areas:

- Brazil (+76%)

- Western Canada (+70%)

- Estonia (+68%)

- Germany (+59%)

Only the Nordic countries, Oceania, and China, have seen more modest price adjustments in the past few years.

Dramatic Fluctuations Define Past 5 Years of Pricing Data

The past five years resulted in the most substantial price fluctuations Wood Resource Quarterly has observed in almost 30 years of tracking wood markets. In 2017, sawlog prices were at levels that had been practically unchanged for nearly a decade.

The situation changed when Central Europe was flooded with insects and storm-damaged timber in 2018-2020. As a result, log prices fell to the lowest levels in over ten years.

High demand for lumber, declining availability of quality logs in the Czech Republic and Germany, and reduced log imports from Belarus, Russia, and Ukraine resulted in a surge in log prices on the continent.

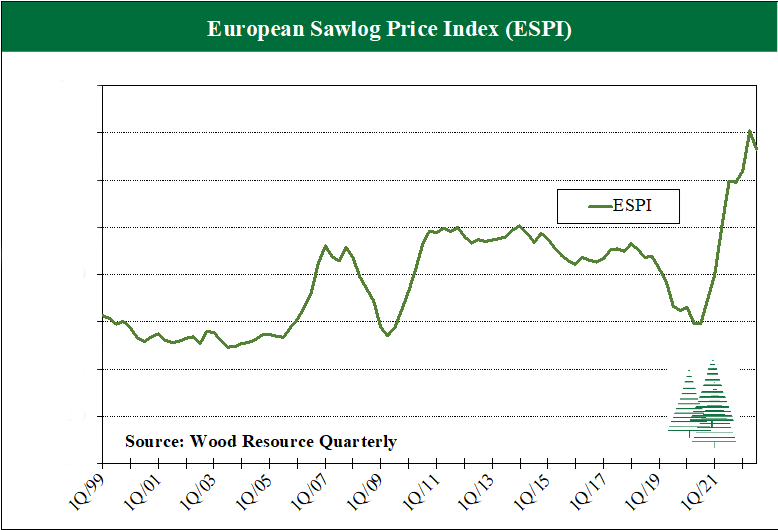

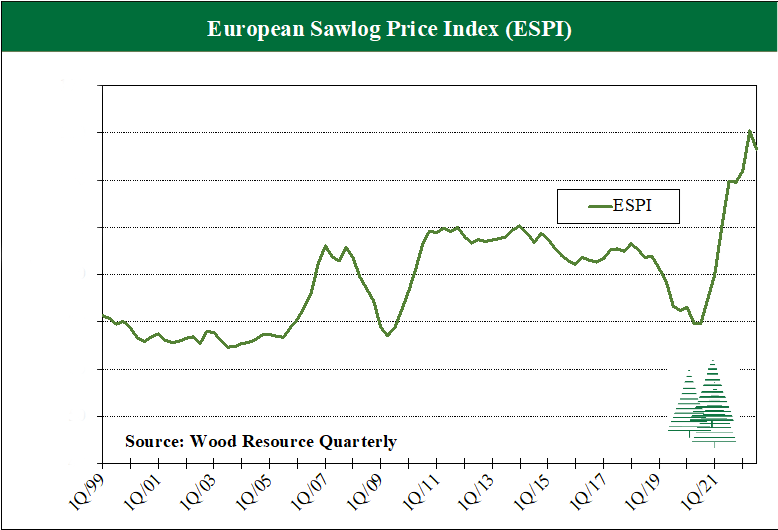

Consequently, the European Sawlog Price Index (ESPI) jumped over 40% from the third quarter of 2020 to the second quarter of 2022. As the chart shows, the index reached an all-time high in the spring of 2022.

In the third quarter of 2022, lumber demand weakened and reduced upward price pressures on sawlogs. Some markets even saw declines in prices.

Nevertheless, prices continued to be the highest in Central and Eastern Europe. Additionally, sawmills in the Nordic countries continued to have substantially lower raw-material costs than their European competitors.

Expert Pricing Data Made Easy with WoodMarket Prices

This post comes from Wood Resource Quarterly (WRQ), an ongoing report from Wood Resources International, a ResourceWise company.

WRQ data is now also available as an online business intelligence platform, WoodMarket Prices (WMP). WMP tracks prices for sawlog, pulpwood, lumber and pellets and reports on trade and wood market developments in most key regions worldwide.

Users can quickly find specified trade and pricing information relevant to their business interests. This information will improve strategic decision-making and planning in a potentially volatile global marketplace.

Schedule a demo today to see how WoodMarket Prices can benefit your bottom line.