4 min read

Global Wood Fiber Prices: 3Q2016 Western Hemisphere Benchmark

Daniel Stuber

:

November 2, 2016

Daniel Stuber

:

November 2, 2016

Forest2Market’s Western Hemisphere Benchmark allows producers to compare their own raw material costs to the market average in one of many ways:

- By end-product segment. If you produce boxboard, you can compare your costs to the market average for all boxboard producers.

- By species. If you consume conifer (softwood), you can compare your costs to those of all other softwood consumers (the same is true for hardwood).

- By region. If you are in the US South, for instance, you can compare your costs to average costs in the US South.

- By global competition. Because markets for pulp and paper are global, you can understand your relative cost position compared with other producers in the Western Hemisphere.

Delivered Wood Fiber Prices for End-Product Grades

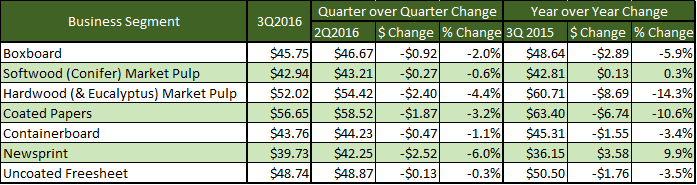

Wood fiber prices decreased for the majority of pulp and paper producers in the third quarter of 2016, particularly newsprint, the hardwood pulps, coated papers and boxboard segments. Forest2Market’s Western Hemisphere Benchmark shows that these three segments dropped by 2-6 percent, quarter- over-quarter.

On a year-over-year basis, wood raw material prices for newsprint producers have increased 10 percent. The only other segment that saw a rise in pricing is softwood pulp producers. All others saw decreases in their pricing, with the hardwood pulps seeing a drop of more than 14 percent, coated papers falling more than 10 percent and boxboard, uncoated freesheet and containerboard all falling at more moderate rates (3-6 percent).

Below are 3Q2016 results (average price change) compared to 2Q2016 and to 3Q2015 for various end-product segments:

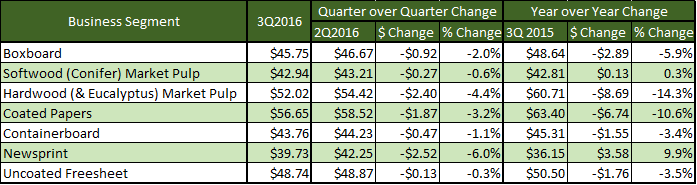

The following chart shows the trendlines for various end-product segments from 1Q2014 through 3Q2016. Prices were highest for coated paper and hardwood pulp producers, lowest for newsprint and softwood pulp manufacturers.

Delivered Conifer and Hardwood/Eucalyptus Wood Fiber Prices

Lowest Cost Regions: Brazil and the US South

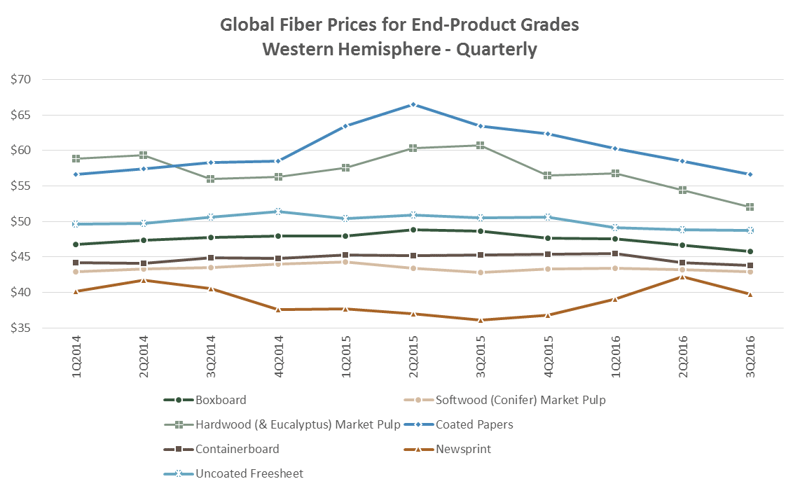

Conifer wood fiber prices started to fall in Brazil at the end of 2014, as the country’s economic and political crisis became serious. With a GNP that suffered a 3.8 percent reduction in 2015 and an unemployment rate that reached its highest level in 25 years, wood fiber prices fell significantly. In 2016, however, the economy showed signs of recovery as the country’s risk for investments was reduced, and the currency and GNP have strengthened. Conifer wood prices reflect this scenario, as they are basically flat on a fixed exchange rate basis since the first quarter of 2016.

Despite the fact that conifer prices in Brazil climbed by the equivalent of $1.70 per green short ton (GST) in the third quarter (5.5 percent), the region continues to be the lowest cost region for softwood fiber, a cost position it has held since the end of 2014.

The gap between the lowest cost markets—Brazil and the US South—showed a further tightening in the third quarter, however. In 1Q2016, the gap was USD$14.70/ton; in 2Q2016, the gap shrank to USD$10.50/ton. In 3Q2016, the gap was just $8.36/ton.

US South conifer fiber prices declined USD$0.45/ton (1.1 percent) to average USD$41.30/ton, which helped to reduce the gap as well. This decline is atypical in the US South at this time of year, as mills typically start building inventory in the third quarter, increasing demand and therefore price.

Despite the decline, softwood fiber prices continue to be more stable in the US South than they are in any other region in the Western Hemisphere.

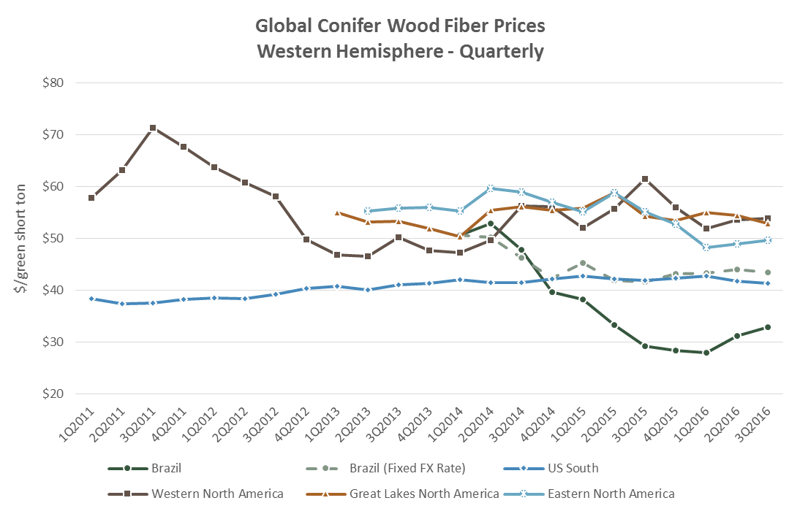

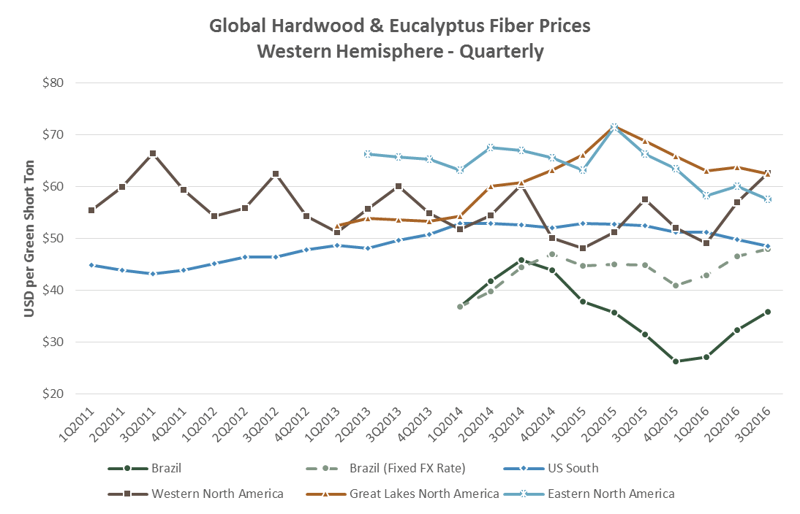

In Brazil, prices continued to increase, gaining the equivalent of USD$3.53/ton (11 percent) for Eucalyptus wood fiber. The eucalyptus fiber industry in Brazil is taking advantage of the favorable currency exchange rate to increase sales and attract more investments. Although industries are cutting costs to survive in the crisis period, the eucalyptus fiber industry, mainly pulp mills, are investing heavily in new facilities or new machines to increase production and efficiency. The fiber prices reflect this optimistic scenario. If the exchange rate were fixed to pre-recession levels, prices would have been on par with those in the US South.

Hardwood wood fiber prices fell in the US South for the 7th consecutive quarter, this time falling USD$1.26/ton (3 percent) to USD$48.53/ton. Slack demand is the largest driver behind falling prices.

Highest Cost Regions: North America—West, Great Lakes and East Regions

Western North America (US Pacific Northwest and British Columbia) and the Great Lakes region of both the US and Canada continue to compete for the highest cost position in Western Hemisphere markets. The western region was higher this quarter, as it typically sees a seasonal effect in the third quarter because mills are building inventory ahead of winter weather. Prices gained USD$0.27/ton to USD$53.86/ton. In the Great Lakes region, conifer wood fiber prices averaged USD$52.87/ton, a decline of USD$1.62/ton (3.0 percent) from 2Q2016. With multiple buyouts and mergers complete (New Paper/Verso, Expera/Thilmany and Wausau, and PCA/Boise), companies have reorganized and are now taking advantage of new synergies; as a result, the market seems to have settled down. In Eastern North America (Northeast US and Eastern Canada), conifer wood fiber prices averaged USD$49.72/ton in 3Q2016, an increase of USD$0.78/ton (2.0 percent) from 2Q2016.

Western North America and the Great Lakes region are also competing for the highest cost position in hardwood markets. Prices in the western region increased 10 percent or USD$5.56/ton to USD$62.55. In the Great Lakes region, hardwood fiber prices averaged USD$62.49/ton in 3Q2016, falling USD$1.30/ton or 2 percent. Hardwood fiber prices in eastern North America also fell in 3Q2016, down USD$2.57/ton (4 percent) to USD$57.56/ton.

Methodology

For the Western Hemisphere Benchmark, we report stemwood (i.e. tree-length pulpwood or bolts) and wood fiber chips (wood fiber chips only, not energy chips) delivered through the supply chain to the end producer’s mill gate. We then convert the price and unit of measurement to US dollars/short ton. For stemwood, we also convert the product to a wood fiber chip equivalent and add a cost of five US dollars/green ton for debarking and chipping to the chip pile. We then compute a weighted average price for all combined wood fiber.