1 min read

Global Wood Pellet Trade Reached Record-High 29 Million Tons in 2021

Håkan Ekström

:

April 26, 2022

Håkan Ekström

:

April 26, 2022

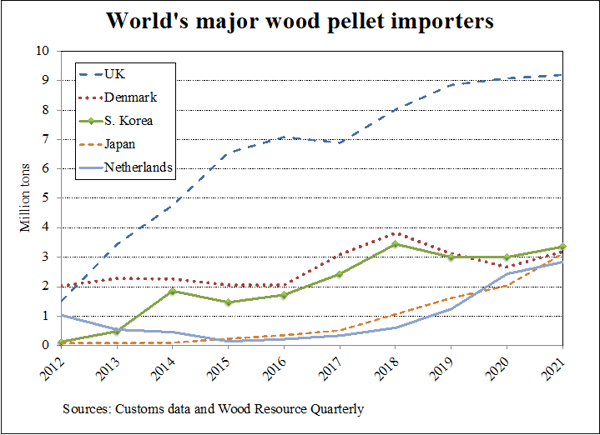

The world's thirst for renewable energy continues, and demand for wood pellets—mostly made from sawmill byproducts—is increasing. As a result, the total global wood pellet trade in 2021 was up 9% YoY to 29 million tons, 50% higher than in 2017.

Europe has been the largest market for the past decade, with net imports more than doubling from 2012 to 2021, when it reached over 11 million tons. However, exports from North America to Europe have leveled off over the past three years. Instead, intra-continental trade has gone up as investments in pellet capacity have risen, particularly in Latvia, Western Russia, Estonia, and Belarus, in descending order.

Russia has become an essential supplier of wood pellets to European power companies and shipped about 2.2 million tons in 2021, a majority to Denmark and Belgium. However, this trade came to a halt when Russia invaded Ukraine. Shipping pellets to alternative markets in Asia would be cost-prohibitive, so it is likely that Russian pellet producers will be forced to shut down.

South Korea and Japan were the world's second and fourth largest wood pellet importers in 2021, respectively (see chart below). Both countries' import needs have risen substantially from practically no demand ten years ago to 6.5 million tons for the two countries combined in 2021. The outlook is for continued rising demand as the countries seek to replace fossil fuels and nuclear power with renewable energy sources.

The primary wood pellet supplier in the world continues to be the US, with a 26% share of global trade, unchanged over the past four years. A large majority of the shipments have been destined for the United Kingdom market, which in 2021 accounted for 72% of the total US exports.

Canada's exports have taken off since 2017, driven by the increase in pellet demand in Asia. Europe is still an important market for Canadian pellet producers, but its share of total shipments has fallen from almost 80% five years ago to 50% in early 2022.

Vietnam has quickly become the premier source of wood pellet in Asia and was the world's second-largest exporter in 2021. Practically all of the country's export volume (3.8 million tons in 2021) was shipped to Japan and South Korea. Other exporting countries in Asia in 2021 included Malaysia, Indonesia, and Eastern Russia.