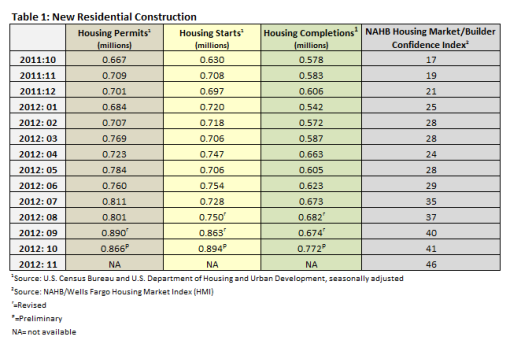

Builder confidence jumped 5 points to 46, its highest level since May 2006 in response to several strong residential construction numbers and signs that the market will get even better in 2013 (Table 1). Housing starts improved by 3.6%, up from 836,000 to 894,000. This is 41.9% higher than October 2011. Permits fell 2.7% from 890,000 to 866,000, still a 29.8% improvement over this time last year.

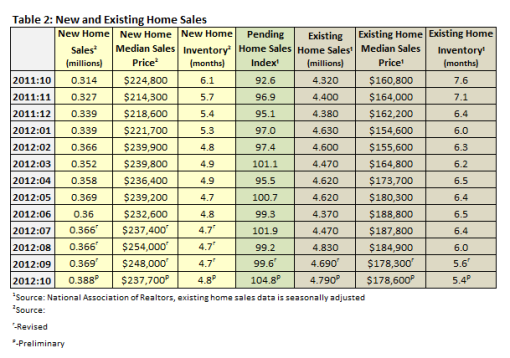

New home sales were down slightly, falling 0.3% from 369,000 to 368,000. This is 17.2% above October 2011, however. Inventory stands at 4.8 months at current sales rates, slightly higher than September, on the strength of completions, which saw a 14.5% increase.

Existing home sales continued to improve, shrinking inventory and making way for additional new construction (see Pete Stewart's Housing Market Improves). Existing home sales gained 2.1% month over month and 10.9% year over year (Table 2). Months of inventory fell to 5.4 months, a 3.6% improvement month over month and a 28.9% improvement year over year. Driven by shrinking inventory, prices of existing homes increased, having gained 11.1% since this time last year (now at $178,600). The Case-Shiller Home Price Index reported broad-based price increases, with the national composite rising 3.6 percent year over year in the 3Q2012 (2.2% over 2Q2011). Average prices are now back to their mid-2003 levels.

Pending home sales show that strong existing home sales will continue: the pending home sales index gained 5.2% and now stands at 104.8, the highest level since March 2007 (minus a few readings during the period when the first-time home buyer credit was artificially influencing the market).

News on the foreclosure front is surprisingly positive. Many analysts believed that we would see a glut of new foreclosures on the market once the market started to recover and that prices would plunge again as a result. It now appears as if this will not happen. Steps taken by banks and the federal government to walk this potential crisis back have apparently been successful. A combination of forgiving debt, modifying payment plans and approving short sales is working: shadow inventory has decreased from 8.8 million homes in 2010 to 5.36 million in November.

The numbers can be found in the tables below:

Suz-Anne Kinney

Suz-Anne Kinney