Just as quickly as housing starts took a nose dive in October, they reversed course in November to post respectable gains as we approach the end of 2015 and what has been a tumultuous housing ride. We’ll have to wait on December data (published next month) to see how the yearly performance looks, but the metric is on course to hit its 1.1 million unit forecast despite some slip-ups during Q2 and Q3. This number would be the highest level of starts posted since 2007, and up from 1 million units overall in 2014.

November housing starts were at a seasonally-adjusted annual rate (SAAR) of 1,173,000, or 10.5 percent above the revised October estimate of 1,062,000. This number is also 16.5 percent above the November 2014 rate of 1,007,000, which marks the eighth straight month that starts have remained above 1 million units. Additionally, single-family housing starts were at a rate of 768,000, which is 7.6 percent above the revised October figure of 714,000.

Building permits increased in November; privately-owned housing unit permits were at a SAAR of 1,289,000, or 11 percent above the revised October rate of 1,161,000. Single-family authorizations were at a rate of 723,000, 1.1 percent above the revised October figure of 715,000.

“There is a great deal of pent-up demand for housing,” PNC senior economist Gus Faucher noted. “With steady job growth of around 200,000 per month, a falling unemployment rate, rising wages, very low mortgage rates, rising household formations, and better access to credit, demand for new homes is steadily improving.”

Demand may be improving incrementally, but it is worth noting that the US Census Bureau data was accumulated and published prior to the Fed raising the range of its benchmark interest rate by a quarter of a percentage point to between 0.25 percent and 0.50 percent. "The Committee judges that there has been considerable improvement in labor market conditions this year, and it is reasonably confident that inflation will rise over the medium term to its 2 percent objective," the Fed noted in its policy statement.

Will a fractional hike (more symbolic than representative of real economic strength) put a damper on the larger housing sector in the near-term? It’s doubtful. Inventories remain tight and borrowing costs remain low; the average 30-year mortgage rate was 3.94 percent for the month of November. As we noted last month, that figure is in line with the 3.83 percent average for 2015, as the rate has only crested 4 percent once all year (July).

"Homebuilders are making progress addressing the shortage of newer vintage single-family homes we see in many markets, especially affordable housing products with a price of under $200,000," stated Tian Liu, chief economist at Genworth Mortgage Insurance in North Carolina.

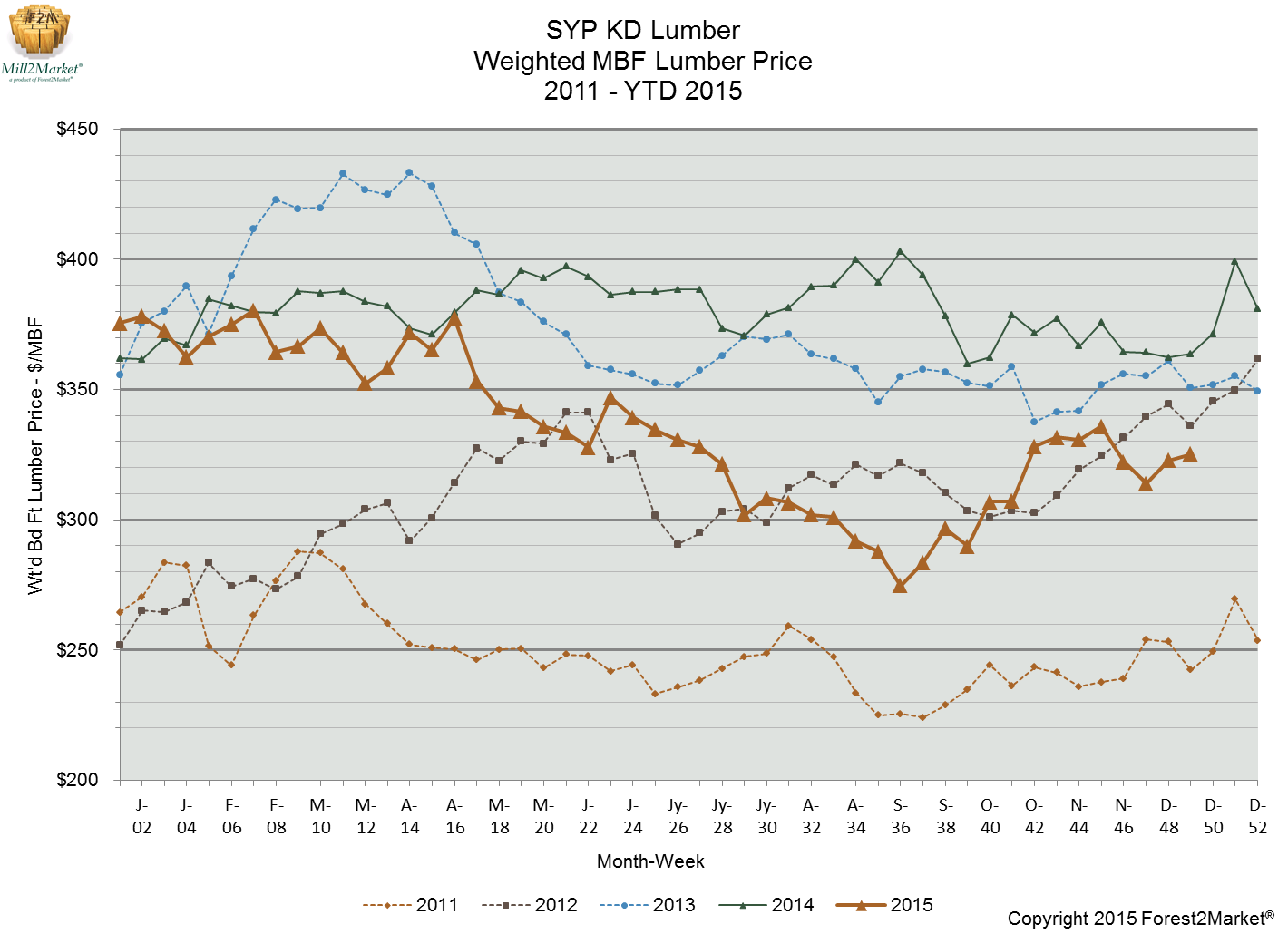

Also as we noted last month, Forest2Market’s index for kiln-dried SYP lumber has trended up in recent weeks; from a yearly low in mid-September of $275/mbf, the index finished the second week of December at $325/mbf, which represents an 18 percent increase.

November’s housing starts are good news for a segment that continues to be one of the few growth areas in the larger economy. As noted above, we’ll have to wait until next month to see the full results for 2015; we’ll also be waiting to see how the already-fragile economic environment responds to the Fed rate hike in Q12016.