4 min read

How the Forest Industry Survives Down Markets, COVID-19 Crisis

Pete Stewart

:

March 23, 2020

Pete Stewart

:

March 23, 2020

Just two months ago, Americans watched cautiously from a distance as the COVID-19 contagion caused a nearly unimaginable scenario by upending China’s entire economy and social structure. It seemed like a situation right out of a dystopian movie set; something both fantastical and horrifying at the same time.

The news that leaked out during early 1Q2020 left plenty of room for misinterpretation, but the global economy forged ahead with a watchful eye on China.

At the same time on the home front, the DJIA was at record levels and unemployment, GDP and nearly every other indicator of economic fitness suggested we were on solid footing. But as a reminder to just how quickly things can change in a global economy, the first cracks in the West appeared in late February when the DJIA lost roughly 2,000 points during a week of trading amid fears of a pandemic.

The cascading reactions that ensued in the wake of that trading week – both economic and otherwise – have truly been unprecedented. The situation has been so dramatic, in fact, that it has resulted in measures that seemed previously inconceivable:

- Global supply chains are fraying under tremendous stress.

- The DJIA has shed 35 percent of its value as of this writing amid wildly volatile trading sessions that demonstrated 3,000-point swings.

- Oil prices plummeted to their lowest levels in over 20 years to $22.80/barrel.

- NCAA and professional sports seasons have been postponed indefinitely or canceled altogether.

- International travel has ceased, and professional conferences and trade shows have been terminated.

- Americans are being asked to “shelter in place” to avoid contact with others.

- Millions of workplaces are facing closures that will spawn a massive wave of new unemployment claims in the coming months; Treasury Secretary Mnuchin said unemployment could rise to 20 percent without government intervention.

- The FED took its most dramatic step since the Great Recession of 2008 by cutting its target interest rate to near zero.

- The FED has also injected over a trillion dollars into the credit markets to temporarily preserve liquidity; more emergency funds are on the way.

- General anxiety is high and gun/ammunition sales are through the roof as a result. FBI background checks were up 34 percent in February alone, and March numbers will likely be much higher.

The 50-year expansion of globalism has come to a grinding halt in less than a month. As Americans attempt to draw some historical correlations for guidance in such a stressful time, there simply aren’t any in recent history from which to glean prudence. We are truly in uncharted waters.

Where do we go From Here?

Despite the high-flying economic times we have experienced since 2016, we have all been cautiously awaiting an event that would trigger a change of that good fortune. Maybe not a true bear market or bona fide recession, but a prolonged pullback and moderated contraction that is a natural part of economic cycles.

Many economists have also warned us to pump the brakes over the last several months as the numbers just seemed too unbelievable to sustain. Rather than taking our foot off the gas to meet the caution sign, COVID-19 has now forced us to slam on the brakes.

We can’t, however, control what spurs an economic contraction or when it strikes. COVID-19 seemed an unlikely hazard to derail the strongest economy in history, yet we’re reeling from its effects after just a few weeks.

There is a silver lining here, however, and it will benefit the forest industry in the long term.

Near-Term Forest Industry Outlook

As a country, America has demonstrated extraordinary levels of resolve throughout its history, and we will emerge on the other side of this pandemic perhaps scathed, but stronger, wiser and better prepared for the future. Of this, I have no doubt.

As an industry, the forest sector very much mirrors the steadfast fortitude of American culture. Yes, the sector is subject to some of the vulnerabilities that come with being global in nature, but its supply chains are stable, its markets are entrenched and demand for forest raw materials is strong.

While the current fear is palpable and the adjustments will be temporarily painful, the situation has been a catalyst for the forest industry to rationalize production in the current market. And this is a sign of industry health! Many other industries will not be so fortunate.

Is the forest sector prepared to react to such a cataclysmic event as the COVID-19 pandemic, and is it equipped to scale for new demand when we reach the other side of this unique situation? I would resoundingly answer “YES!” to both questions.

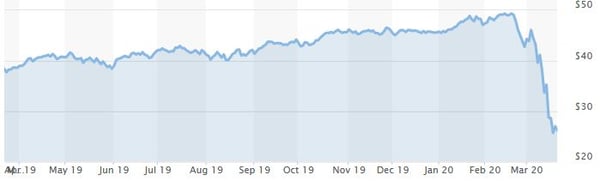

To wit: Homebuilding is on a hiatus for the foreseeable future, per CNBC: “The SPDR S&P Homebuilders ETF (XHB) has seen an outsized decline relative to the S&P 500 year to date as investor worries about a possible economic slowdown tied to the global spread of the coronavirus multiply, with the group falling nearly 24.5% versus the S&P’s more than 20.5% loss.”

SPDR S&P Homebuilders ETF: XHB

As a result of the sudden tumble in building activity, many lumber and panel producers recently announced significant near-term curtailments as a reaction to dramatically shifting market signals. West Fraser and Interfor, for example, are both trimming production amid high levels of uncertainty.

On the other side, however, tissue and towel demand is through the roof, and manufacturers are able to react to entirely different market signals and scale production to meet what surely must be historic levels of demand.

As we continue to navigate through the uncertainty associated with the current pandemic, the U.S. Department of Homeland Security has also identified the wood products industry as an “essential critical infrastructure workforce” in the nation’s response to solving the crisis. Homeland Security designated “Workers who support the manufacture and distribution of forest products, including, but not limited to timber, paper, and other wood products” as essential.

Again, these are signs of industry vitality and health, not indicators of an industry in a state of structural decline.

We know how this is likely to unfold across the forest supply chain based on demand patterns we saw in 2008: Log consumption will decrease as curtailments take effect, prices will creep down as a reaction to that drop in demand, and the industry will rationalize production in the current market and make adjustments as needed over the next several months.

While there remains a high level of uncertainty surrounding the containment of COVID-19 and a potential vaccine, we are also just months away from a highly contentious presidential election generating plenty of uncertainty on its own. As an industry, we are well prepared to deal with these challenges in the near term, and we are positioned to take advantage of tremendous upside opportunities once we make it through the valley.

As I write this, volatility is moderating across global markets – a good indication that some of the reactionary panic is subsiding. Look for a return to normalcy as a real marker of improvement and entry point for growth prospects.

When Americans return to their ballgames and favorite restaurants, share excitement over The Masters, return to work by the millions and head out of town for summer vacations, we will have returned to the that sense of normalcy – that unwavering dedication to progress that so defines the American spirit.