2 min read

How the Rise in E-Commerce Has Facilitated the Value of Mixed Paper

Savannah Franklin

:

January 19, 2021

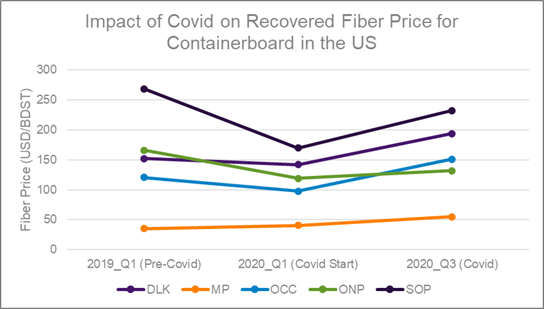

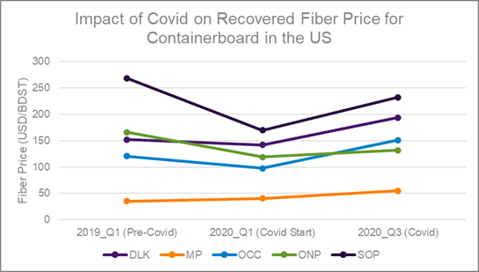

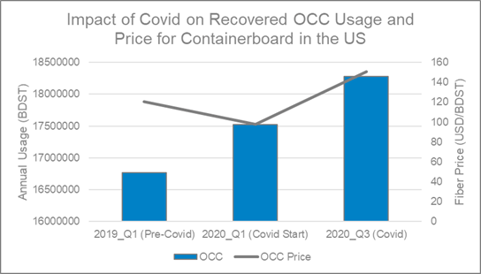

The effects of the stay-at-home orders and lockdowns that were set in place at the beginning of 2020 due to the COVID-19 pandemic have created a number of changes in daily habits. The rise in e-commerce amid the pandemic has been one of the most significant changes to have occurred. This change in shopping habits has been beneficial for the pulp and paper industry as demand for paper and packaging materials used to ship goods to consumers has substantially increased. However, we are now seeing that this rise in e-commerce has also allowed US paperboard producers to turn recycled catalogs, boxes, and newspapers into new paper products.

Roughly two years ago, the market for recycled catalogues, boxes and newspapers collapsed after the standards for waste imports in China tightened. However, a number of paper and cardboard mills are now taking advantage of all the junk mail and delivery boxes being discarded from the increased number of delivered packages to consumers during lockdowns. These mills have figured out how to turn this waste into new toilet paper, coffee cups, paper towels and cardboard boxes.

In the past, many mills avoided curbside recycling programs due to the low quality of paper that was mixed in with other materials such as glass, cans and even common household trash—which made it difficult to effectively reuse the paper. However, better screening for contaminants has been implemented and the increase of e-commerce boxes mixed into recycling bins has made these new bundles of mixed paper more appealing. For example, fine screens have been added to pulping equipment to filter out the polyethylene plastic films inside coffee cups in order to make it easier to turn into pulp.

Since many businesses have switched to a work-from-home mode of operating, the demand for printing and writing paper has decreased significantly. Even though this was an unexpected hit to a segment already in a state of decline, some mills have found a silver lining and have been substituting mixed paper from recycling programs for the discarded office paper. Georgia Pacific has invested roughly $45 million at mills in Green Bay, Wisconsin and Muskogee, Oklahoma to produce pulp that is made from more paper recovered from recycling programs, including coffee cups.

Corrugated cardboard makes up a large percentage of the paper that enters recycling plants from homes, so the surge that has occurred due to the pandemic and the rise in e-commerce has significantly increased the value of mixed paper. New tissue paper and cardboard is created from the longer fibers in the discarded cardboard, which helps to strengthen mixed-paper pulp and produce improved material.

Overall collection volume from recycling programs in the United States is up about 7% from this time last year, and it’s expected that prices for mixed paper will continue to rise in 2021 as e-commerce orders continue to increase. The United States’ largest trash collector, Waste Management Inc., has responded to this new development by opening new regional plants in Chicago and Salt Lake City to help efficiently process recycled materials. They also have plans to open a plant in Raleigh, NC to take advantage of the significant increase in mixed paper value.

As we navigate into 2021, we expect to see demand for corrugated cardboard continue to increase in tandem with e-commerce, as well as demand for mixed paper as more mills seek to take advantage of a viable waste stream and substitute it where applicable.