Every month, Forest2Market publishes updated forecasting products designed specifically for participants in the forest value chain. The Economic Outlook is a macroeconomic indicator forecast that supplies critical information, context and insight about general economic trends and direction, and the 4Cast supports regional operational decision making for those who buy and sell timber. With an understanding of economic indicators, future stumpage prices and insight into buying and selling windows (periods in which buyers or sellers hold relative market advantage), subscribers are better able to time sales or purchases, negotiate prices, manage workloads and control inventory levels. The following commentary is just a sampling from the most recent Economic Outlook for February, 2019.

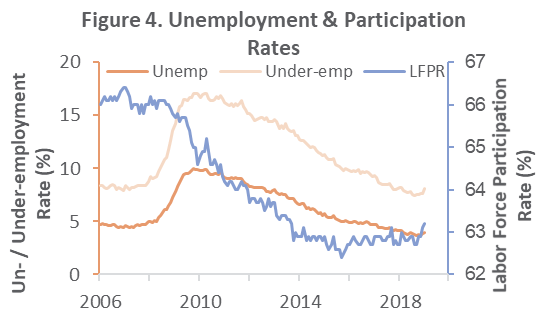

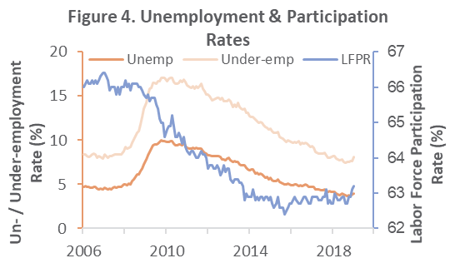

According to the Bureau of Labor Statistics’ (BLS) establishment survey, non-farm payroll employment rose at a blistering pace of 304,000 jobs in January—nearly double expectations of +158,000. In a less-positive move, combined November and December employment gains were revised down by 70,000 (December’s -90,000 was the largest monthly revision since 2010). Meanwhile, the unemployment rate (based upon the BLS’s household survey) ticked up to 4.0 percent under the influence of new/re-entrants to the labor force and impacts on private-sector employment stemming from the partial government shutdown.

We welcome the apparent strength of the employment report, but caution—as we do each February—against drawing too many inferences from the data. As explained by the BLS, “Establishment survey data have been revised as a result of the annual benchmarking process and the updating of seasonal adjustment factors. Also, household survey data for January 2019 reflect updated population estimates.” The “knock-on” effects of workers being furloughed during much of January further confounded the survey results; hence, at least another month may be necessary before trends become discernible.

With those caveats in mind, the number of employment-age persons not in the labor force tumbled by 639,000 in January, to 95.0 million. This metric has been trending lower since August as more potential workers conclude their prospects are improving and (re)enter the workforce. As a result, the labor force participation rate bumped up to 63.2 percent in January.

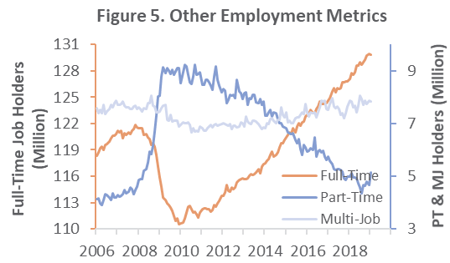

Full-time jobs retreated by 76,000. Those employed part-time for economic reasons jumped by 490,000; nearly all of this increase occurred in the private sector and according to the BLS, “reflects the impact of the partial federal government shutdown.” Those working part time for non-economic reasons fell by 285,000 while multiple-job holders slid by 16,000.

Manufacturing gained 13,000 jobs in January. That result is reasonably consistent with ISM’s manufacturing employment sub-index, which expanded—albeit at a slower pace—in January. Wood Products employment grew by 3,100 jobs (Institute for Supply Management [ISM] declined); Paper and Paper Products: -1,700 (ISM increased); Construction: +52,000 (ISM increased). Temporary help, generally considered a good leading indicator of the US economy, was stagnant again at just +1,000.

Average hourly earnings of all private employees edged up by $0.03, to $27.56 (+3.2 percent YoY). Since the average workweek was unchanged at 34.5 hours, average weekly earnings increased by $1.03, to $950.82 (+3.2 percent YoY). With the CPI running at an annual rate of 1.9 percent in December, workers are—by official metrics, at least—gaining purchasing power.

“Certainly, the economy has slowed, and that will undoubtedly be apparent in [upcoming] data,” said Plante Moran Financial Advisors’ Jim Baird. “Still, the jobs market remains a bright spot. Employers are still hiring at a strong pace. That’s good news for the consumer sector, and ultimately good news for the economy.” In summary, the January employment report seems solid even with the aforementioned caveat; again, we note such employment strength is entirely consistent with late stages of a business cycle.