Among our predictions for 2015, we noted the likelihood that two events would occur. First, weakening world economies would mean increased imports of wood and paper products to the US. Second, that an insufficient rebound in solid wood markets, on top of the increase in imports, would degrade the economics for lumber mills.In the Northwest, these lumber market predictions have already begun to take shape. According to the Southern Forest Products Association (SFPA), softwood lumber imports in January 2015 were 10 percent higher than they were in January 2014 and 23 percent higher than they were in January 2013. In February, imports were 13 percent higher than they were in February 2014 and 20 percent higher than they were in February 2013. In addition, housing market performance has stalled.

As a result of these two factors, softwood lumber prices have fallen and mills in the Northwest have started announcing closures and curtailments, citing market conditions:

- F.H. Stoltze Lumber Company in Montana has announced a two-week curtailment

- Hampton affiliates in Oregon has announced rolling curtailments at six mills

- Banks Lumber announced an indefinite curtailment in its Oregon mill

- Roseburg Forest Products announced it would curtail rather than operate on a limited basis while new equipment is being installed.

This downtime will be especially hard for mills like Roseburg that are just going into, or coming off, major capital expenditures and acquisitions.

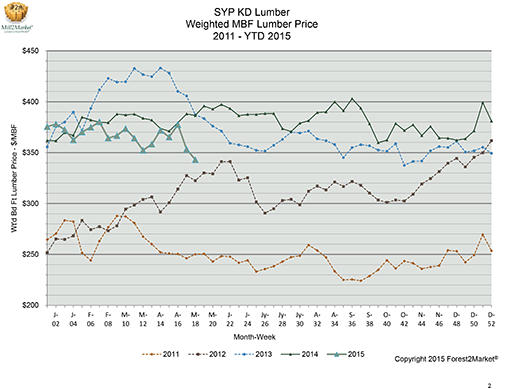

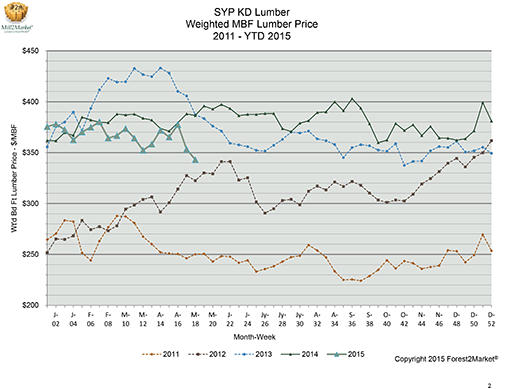

This softness has just begun to hit southern yellow pine markets in the South, however. The latest pricing data shows that, while on a mild downward trajectory since September 2014, the southwide weighted average price for SYP KD lumber fell 6.4 percent in the last week of April alone and then continued to drop in the first week of May.

Mills are taking fewer orders and just last week made a significant effort to ship out of inventory, but the reactions seem all too late. Even though prices have been trending downward, mill production has continued to increase at a rate of 0.4 percent per month. And while no curtailments have been announced in the South, Forest2Market analysts believe that the indicators are in motion for the South to follow the Northwestern trend: in essence, the Southern market will continue to feel pressure from Canadian imports, and prices will likely continue to soften. If that happens, curtailments will spread to the Southeast as well.