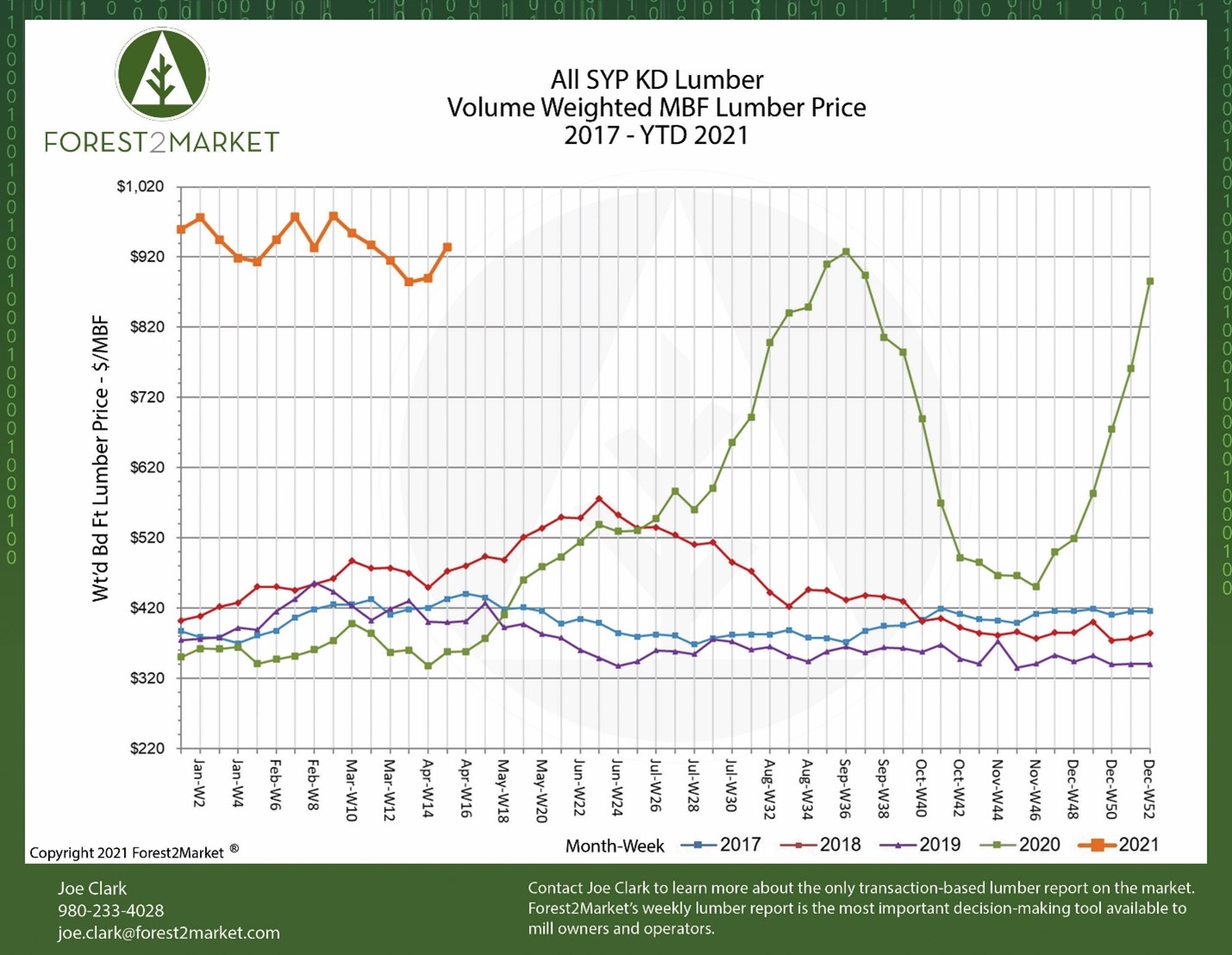

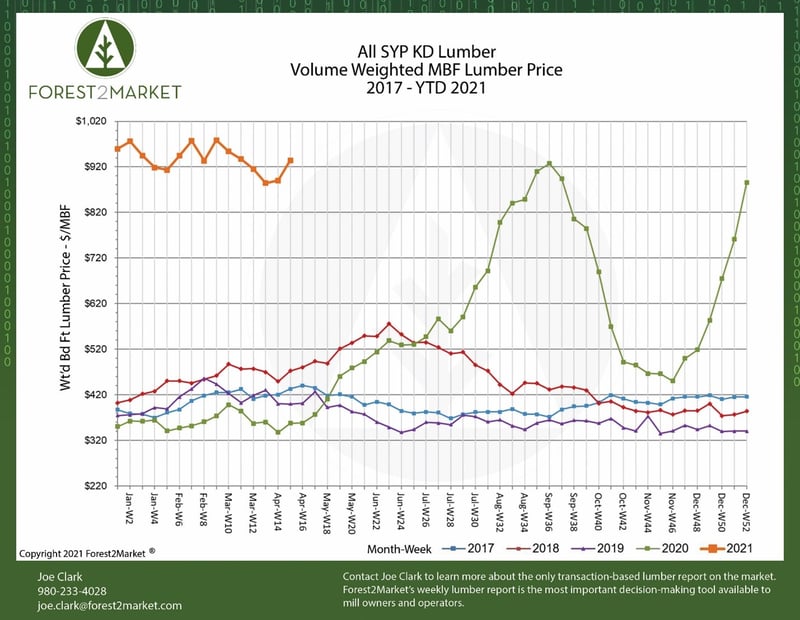

The volatile North American softwood lumber market continues to keep us guessing as we enter 2Q2021. Southern yellow pine (SYP) lumber prices set new records in February before temporarily dropping four weeks in a row. As we usher in warmer temps and the building season gets into full swing, we’re now seeing a two-week rally take shape that has driven lumber prices higher, and the trend is likely to continue.

Forest2Market’s composite SYP lumber price for the week ending April 16 (week 15) was $934/MBF, a 4.9% increase from the previous week’s price of $890/MBF and a 161% increase over the same week last year. A look back at 2020 price trends illustrates the incredible surge that developed in 2Q before peaking in 3Q, and the trend that has formed thus far in 2021 is equally astonishing.

- 1Q2020 Average Price: $360/MBF

- 2Q2020 Average Price: $456/MBF

- 3Q2020 Average Price: $761/MBF

- 4Q2020 Average Price: $595/MBF

- 1Q2021 Average Price: $941/MBF

Demand Pattern

While North American lumber production was up in 2020, demand simply outstripped supply and drove prices to new highs. New housing data suggests that this trend is far from over.

Despite significant decreases in January and February, fresh data from the US Census Bureau shows that privately-owned housing starts soared in March to their highest level since 2006. March starts were at a seasonally adjusted annual rate of 1.74 million units (MU), which is 19.4 percent above the revised February rate of 1.46 MU and 37.0 percent above the March 2020 rate of 1.27 MU.

A recent piece in Fortune posits that while wholesalers have been buying just enough wood to cover their orders – and hoping for prices to come down in the interim - there’s simply no flexibility in the supply chain. If manufacturers and wholesalers have been playing a game of “chicken” for the last 10 months, manufacturers are clearly winning.

Fortune notes that prices are up 193% from a year ago and there are no signs of a reversal on the horizon. “On Monday [April12], the May futures contract price per thousand board feet of two-by-fours jumped $32 to $1,158. That uptick would have been higher had circuit breakers not been halted 20 minutes into trading—something that occurs when the commodity is up more than $32 during a single trading day.”

Two market dynamics to watch in the near term:

- Trucking and transportation costs make up a significant chunk of delivered lumber costs, and it is this piece of the supply chain that often gets bottlenecked and stressed during periods of high demand. Additionally, diesel prices were up 20% in 1Q and those prices are likely to keep climbing. This combination of factors is keeping upward pressure on lumber prices across the country, especially as building season kicks off in earnest and demand remains high.

- Builders remain concerned about rapidly increasing materials, land and labor costs (not to mention surging fuel, food, and home energy costs), and interest rates are beginning to tick back up. If this trend continues, affordability will become a real roadblock for the new construction market. Lumber manufacturers must take appropriate safeguards not to “overdrive their headlights” should affordability issue stall the market.

A reasonably robust economy (all things considered) has driven strong demand for new homes, which has combined with record low interest rates to push prices higher. “It is a sign of the fact that, given time, builders have real demand/traffic in front of them, and expect to be able to build out those possible sales in the future,” said Robert Dietz, NAHB’s chief economist.