As we wrote last month, active timberland management in certain areas of the US South is getting increasingly difficult due to the population boom and urban sprawl that is driving widespread land use changes across the region. And the Southward exodus isn’t likely to slow anytime soon; one of the cascading impacts from the Covid pandemic has been more Americans fleeing high-population urban centers for more sparsely populated options, and the South is a primary destination.

Even before the current boom cycle (from 2000 and 2010), the Atlanta urban area alone increased by over 680 square miles—the most of any urban area in the US during that period. The U.S. Forest Service speculates that from 1997 to 2060, the South will lose between 11 million (7%) and 23 million (13%) acres of forests, nearly all to urban expansion.

This kind of growth will continue to pressure regional forest resources and make forest management more challenging. Prescribed burns—arguably the best tool that forest managers have in their tool kit—is no longer even an option in many areas in the South due to safety and legal concerns. Additional anxieties for Southern forest owners are zoning regulations that prohibit or severely limit timber harvesting, other environmental and regulatory burdens, littering and dumping, trespassing, illegal hunting, drains on water resources, and hurricanes and pollution (air, noise, and water).

As the South’s environment and natural resource markets rapidly change, landowners and forest managers are oftentimes in the dark when it comes to determining fair market value for forest raw materials.

Determining Fair Market Value for Timber

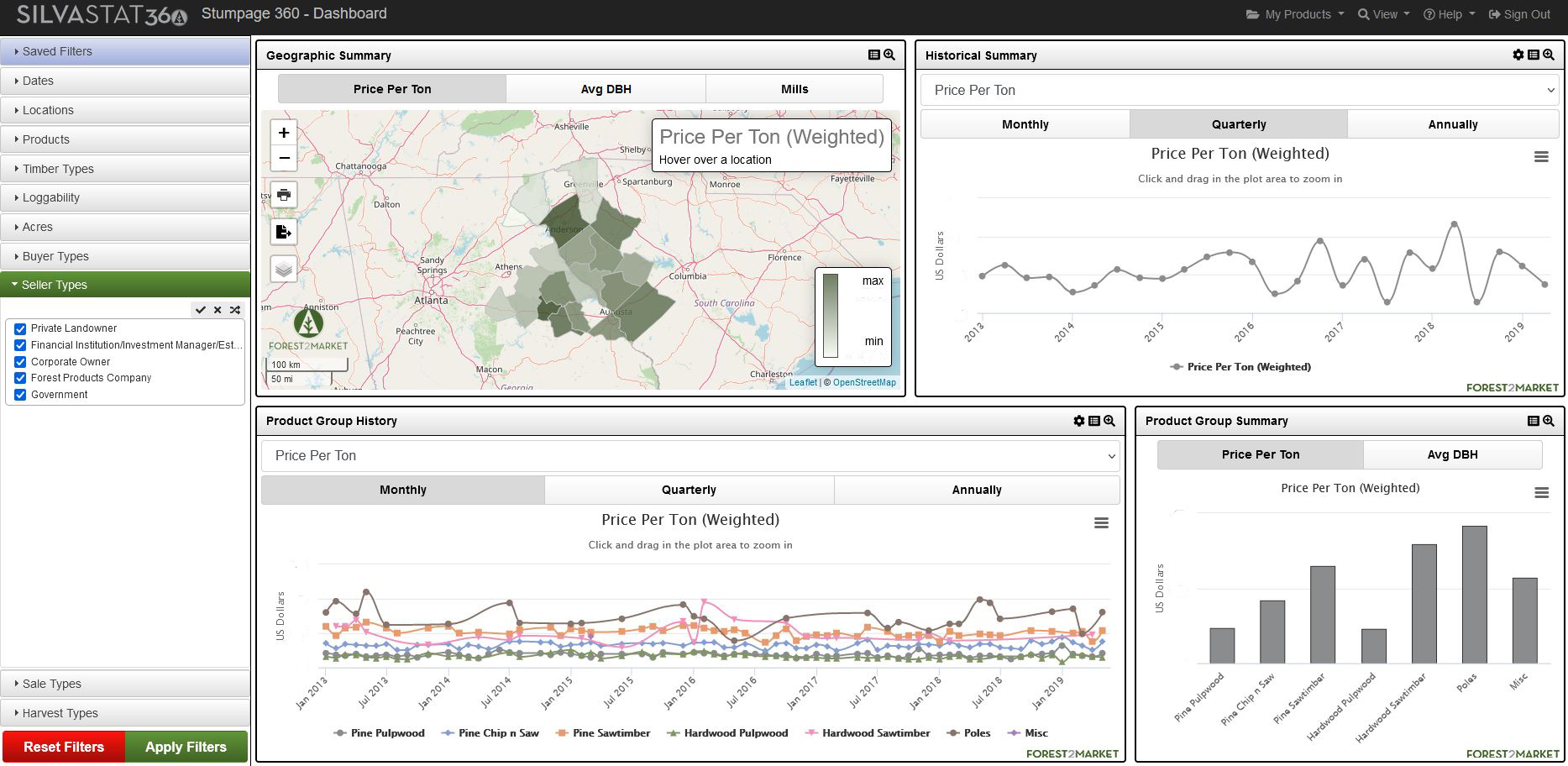

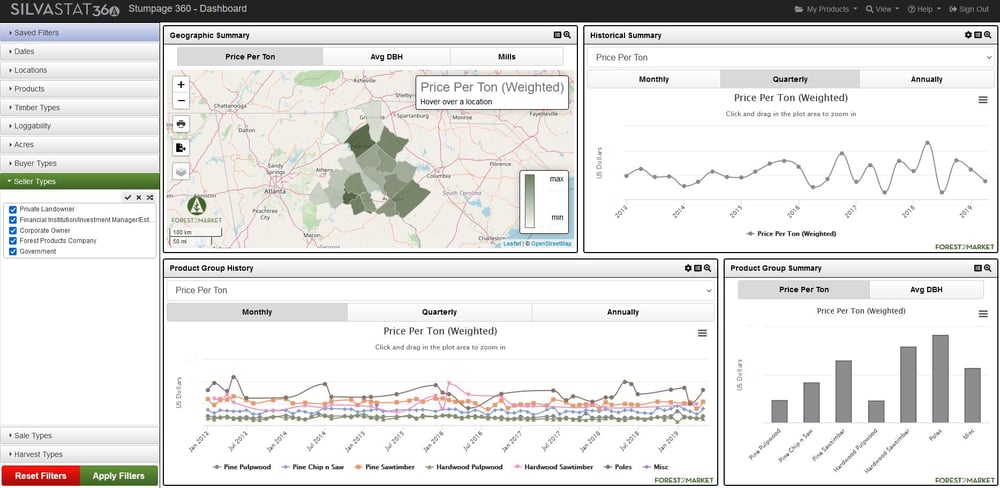

Determining fair market value for Southern timber can be a complex undertaking. The most precise starting point available is Forest2Market’s Stumpage 360 database, which provides transparency into the details of millions of actual timber transactions throughout the US South over the last 20 years. Stumpage 360 allows users to sort and filter actual timber sales down to the county level and then further filter by date, product, acres, buyer/seller types, harvest types and other important criteria.

This is a powerful tool for both buyers and sellers of timber, however, every acre of land is different and adjustments may be required to account not only for changing external factors, but also for the unique characteristics of the timber tract itself.

The primary external factors typically relate to changes in demand and supply. The general economy, the housing market, the pulp and paper market, export markets and emerging bioenergy industries all affect demand in individual timber markets. As new facilities open or close, demand expands or shrinks. If a particular class of timber is being used by several competitors in a local wood basin, it will be in high demand. If a mill closes in the area, demand will contract and prices may adjust downward.

Changes in supply have a similar effect. If plenty of timber is available for sale in a select area, the market price may reflect this oversupply, and local mill inventories will be sufficient to meet demand in the near term. If facilities are having difficulty finding timber, the opposite may be true. Procurement managers oftentimes pay more for logs when inventories are low and access to harvestable timber tracts becomes scarce, which happens frequently during the winter months throughout the South.

These changes in supply and demand may necessitate adjustments in price if changes have occurred in the market. However, the transactional pricing via Stumpage 360 will reflect exactly what is occurring in the market.

Other important variables that affect market value have to do with the individual tract of timber being sold. Each tract is characterized by a large range of variables that are unique, and each of these characteristics may require an adjustment to the price:

- Species: Prices for individual species will differ depending on location and as a result of changing market demand. For example, there is significant volatility in pine pulpwood stumpage prices between markets, which can range from $3/ton in low-demand areas to as high as $27/ton in high-demand areas.

- Size: Height and diameter matter. Taller, larger diameter trees contain higher usable volumes than smaller ones, and trees with higher volumes and use value typically bring higher prices. For instance, veneer-sized hardwood logs are more valuable than pine sawlogs, and pine sawlogs are more valuable than hardwood pulpwood.

- Quality: Large, straight, knot-free trees bring higher prices. High quality trees are sturdy and free of defects, with few branches on the lower portion of the tree. Any obvious knotting/defects or bends reduce the value of the trees.

- Volume of sale: Logging operations are capital intensive. Equipment costs, costs to construct roads and loading decks, drainage structures and moving equipment between jobs add up. With large volume tracts, buyers can afford to pay more for stumpage since their fixed costs are much lower per unit of volume.

- Site accessibility: Tracts with access roads and easy access to highways make it easier for log trucks to get in and out of a site, thereby reducing the cost of logging and increasing tract desirability.

- Logging difficulty: Ease of logging can save a tremendous amount of time. Flat, well-drained tracts generate more interest and higher prices than tracts with steep slopes and high levels of soil moisture.

- Contractual restrictions: Requesting specific harvesting and skidding techniques to protect residual trees, water sources and soil conditions can affect price, as they may add to the cost of logging.

Ultimately, the value of a tract of timber is whatever the buyer and seller agree to. Armed with actual local market prices via Stumpage 360, an assessment of the market changes in the area, and a knowledge of the positive and negative characteristics of the timber tract, timber buyers and sellers can proceed through the bidding and negotiating processes with confidence that the timber’s fair market value will be realized.