Every month, Forest2Market publishes updated forecasting products designed specifically for participants in the forest value chain. The Economic Outlook is a macroeconomic indicator forecast that supplies critical information, context and insight about general economic trends and direction, and the 4Cast supports regional operational decision making for those who buy and sell timber. With an understanding of economic indicators, future stumpage prices and insight into buying and selling windows (periods in which buyers or sellers hold relative market advantage), subscribers are better able to time sales or purchases, negotiate prices, manage workloads and control inventory levels. The following commentary is just a sampling from the most recent Economic Outlook for May, 2019.

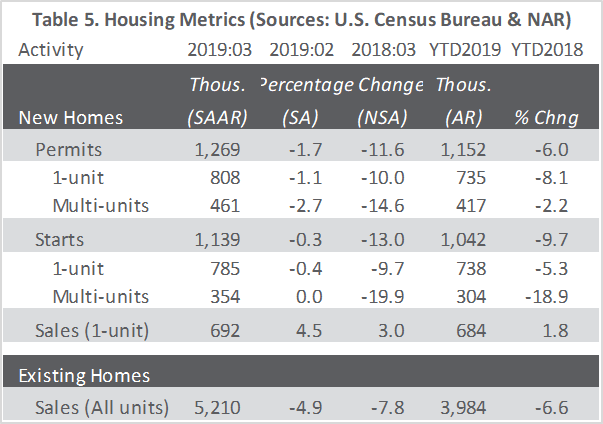

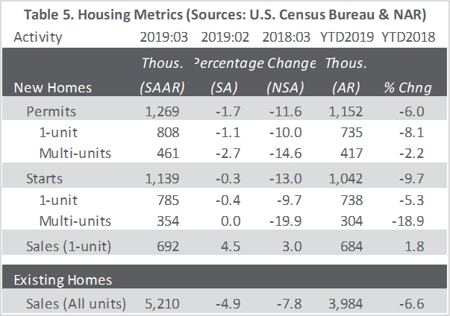

Residential construction resembles a boat riding the back side of a wave—with the bow (permits and starts) falling and the stern (new sales) rising. Residential construction spending in March (-1.8% MoM; -6.7% YoY) and resales were also standing on the prow.

Just how big the wave could prove to be is unknown. If pending home sales (which “surged” 3.8 percent MoM in March, but -3.2 percent YoY) are “a good indicator of the health of the housing market in the next couple of months,” as some claim, housing’s drop could be short-lived. “We are seeing a positive sentiment from consumers about home buying, as mortgage applications have been steadily increasing and mortgage rates are extremely favorable,” National Association of Realtors’ Lawrence Yun said. While the overall market is still underperforming, there is pent-up demand that should drive gains in the coming quarters and years, he said.

The Fed’s Senior Loan Officer Opinion Survey for 1Q2019 paints a darker picture than does Yun, however. Banks reported weaker demand across all surveyed residential loan categories, including home equity lines of credit. Equally disturbing for the broader economy, demand for commercial and industrial loans tumbled to the lowest level since the end of the financial crisis. Such a sharp decline in loan demand seems inconsistent with an economy reportedly exceeding a 3 percent annualized rate of growth.

The Census Bureau’s residential vacancies and homeownership report indicated the US homeownership rate was 64.2 percent in 1Q2019, down 0.6PP from 4Q2018 but unchanged relative to 1Q2018. This breaks a streak of eight consecutive quarters of YoY gains. The flat change was primarily due to a strong uptick in new renter households, although growth among owner households continues to strongly outpace renters.

While the homeownership rate was flat YoY, 1Q2019 was the sixth consecutive quarter in which owner-occupied households grew by more than a million (nearly 1.1 million). At the same time, the number of new renter households jumped by close to 500,000. This is a significant change in trend, as renter households previously fell six out of seven quarters. Total household growth remains strong, topping 1 percent for six straight quarters, and continues the most significant streak of household growth in more than 12 years.

“These data show increasing evidence that not only are young homebuyers indeed pursuing the American dream of homeownership, but solid household growth overall should continue to support healthy demand over the next two decades,” wrote CoreLogic’s Ralph McLaughlin. He cited Harvard’s Joint Center for Housing Studies household projections from December 2018, which estimate 46 million new households under the age of 30 will push up demand for both owner and renter-occupied homes over the next two decades. “Despite recent headwinds and signs of a market cooldown, these demographic fundamentals should lead to a healthy housing demand through at least 2040,” McLaughlin concluded.

In the short run, though, a shortage of entry-level homes will stymie the housing market this year, nullifying much of the impact of lower mortgage rates, according to a forecast by Diane Swonk, Grant Thornton chief economist. “The canary is still singing, but without some major changes to zoning laws, construction costs and changes in how student debt is serviced, the music could come to an end in 2020,” Swonk wrote. Swonk’s list of challenges could logically include home-price impacts from local oligopolization of home construction; the largest five builders account for over 90 percent of production in a typical housing market, and thus have pricing power that would not be possible in a more competitive environment.

We think total starts will fluctuate between SAARs of 0.935 and 1.271 million units (MU), with 2019 averaging 1.203 MU (-3.7 percent compared to 2018).