3 min read

Oil Prices Near 7-Year High; Will Delivered Wood Fiber Prices Increase?

John Greene

:

August 19, 2021

The answer to this question has generally been “no.” Across the forest products industry, the reality is that other factors - including weather, demand and inflation – have historically exerted more influence on delivered fiber prices than oil and diesel prices.

The supply and demand of logs and wood fiber is ultimately what drives the price of these products on the market, which is independent of fuel price. However, the cost of producing the logs and fiber is not independent of fuel price, or the price of any other input that goes into generating these products; at some level, steel, labor, tires, etc. all affect the cost of producing logs and fiber. The interplay of these factors eventually impacts supplier margins.

But does this conclusion still apply in markets increasingly impacted by trucking shortages and economic conditions that may be significantly different than they were just two years ago?

Oil Market Snapshot

The monthly average US-dollar (USD) price of West Texas Intermediate (WTI) crude oil rose by $1.50 (+2.1%) to $73.28 per barrel in July amidst falling inventories and decelerating growth of supply. The year-over-year (YoY) price of WTI is now up over 74%. The recent price increase was attributed to market expectations that demand will continue to rebound while output will receive only a modest increase from the OPEC+ alliance.

However, oil’s future trajectory will be influenced to a significant extent by how (or whether) production-quota and other disagreements between Saudi Arabia and the United Arab Emirates (UAE)/other OPEC+ nations may be resolved. OilPrice.com’s Cyril Widdershoven contends “major cracks appear to be forming in the OPEC+ alliance... after several years of unprecedented cooperation.” Oil prices could take a hit if the UAE and Abu Dhabi break ranks and begin to pump at will.

Another wild card is oil demand in the face of continuing efforts to contain emerging Covid variants. Lockdowns clearly impacted demand in 2020 and as those restrictions eased, demand has largely recovered. That said, renewed government-imposed lockdowns in response to virus variants risk curtailed demand (and possibly production) in the near term.

With so much price volatility amid shifting political and economic landscapes, wood products manufacturers need greater insight into the cost components of their delivered prices.

Delivered Price Snapshot

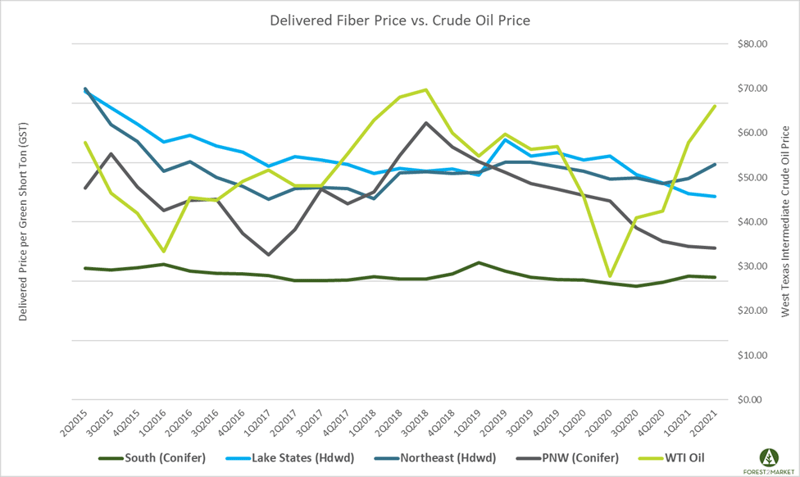

In the chart below, note the largely independent trends between regional delivered fiber prices and West Texas Intermediate crude oil price over the last six years

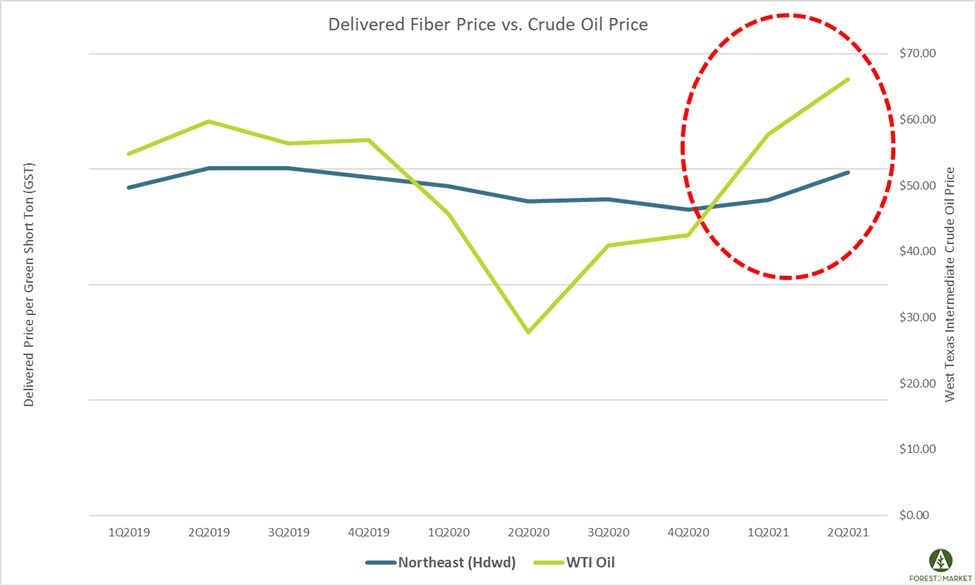

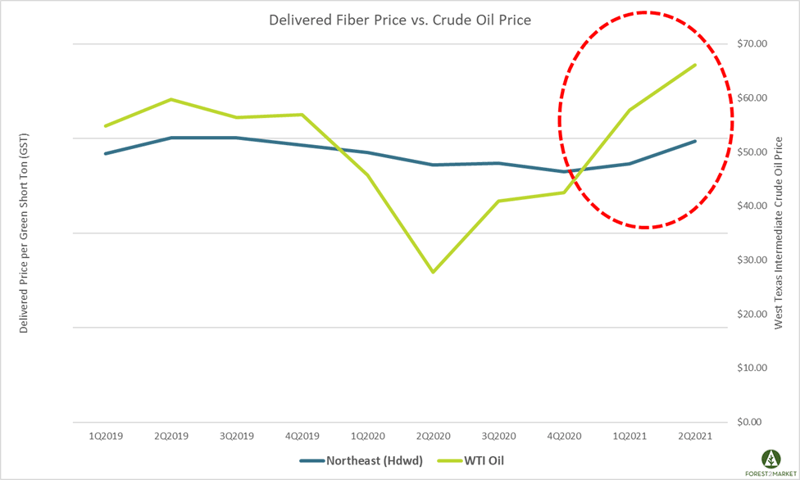

Now, note the tremendous increase in oil price that began in 3Q2020. While delivered prices in the Northeast have trended higher over the last year, prices in the other three regions have decreased or remained flat.

Per the American Trucking Associations, the US was short 60,000 drivers in 2019 and that number is anticipated to increase to 100,000 by 2023. Bloomberg recently wrote: “The U.S. has been grappling with a chronic lack of drivers for years, but the shortage reached crisis levels because of the pandemic, which simultaneously sent demand for shipped goods soaring while touching off a surge in early retirements. The consequences have been both dire and far-reaching: Filling stations have had gasoline outages. Airports have run short on jet fuel. A stainless-steel maker declared force majeure. And lumber prices hit a record, with some suppliers partly blaming delivery delays.”

This shortage will continue to apply upward price pressure on all supply chains as truck availability remains limited.

In the case of the Northeast, there is an additional transportation-related dynamic that could be impacting delivered prices. On average, the Northeast has a significantly longer haul distance compared to other North American wood baskets. Average haul in the region is nearly 100 miles, while average haul in the US South is about half that total. This extra mileage adds up and impacts the freight cost component that makes up total delivered costs in the Northeast.

Margins Drive Process Improvements

Forest2Market is in the business of helping companies make better operational decisions through the application of unique, proprietary datasets that drive efficiency improvements and profitability. To assist in this process, we benchmark price to help our customers manage their supply chain costs.

Forest2Market measures stumpage, freight, cut-skid-load and “margin” as cost components in its delivered price benchmarks. In the case of a wood fiber supplier, the margin component is best viewed as an unfixed indicator of supplier profitability. For example, should the price of wood remain flat between two time periods while the price of diesel goes down, the supplier makes a higher margin. In such a scenario, there is generally less incentive to improve efficiency. If the opposite happens and diesel prices surge as they have in recent months, the supplier’s margins will get squeezed.

Pump diesel is currently $3.40 per gallon - a 42% YoY increase. While this scenario will temporarily impact supplier profitability, it will also force efficiency improvements in the supply chain and, as a result, the supplier may find cost-cutting solutions to maintain profitability. This works on the consumer side of the supply chain as well, when wood price increases and supplier margins expand.

While there is cause for concern about America’s shortage of trucking capacity that is driving freight prices higher, this problem is largely independent of oil price. However, longer hauls translate to higher freight costs. There are always savings opportunities in the forest supply chain. Identifying these opportunities with Forest2Market’s transaction-based data leads to business improvements that drive increased profitability.