4 min read

Oregon Forestry Outlook: Sharp Declines Impact PNW Lumber Market

Harvey Greer

:

February 2, 2023

Harvey Greer

:

February 2, 2023

Oregon forestry remains the largest producing US state for both lumber and plywood. But the region’s forecast remains shaky with an ongoing affordable housing crisis and residual impacts of the 2020 Oregon Labor Day forest fires.

How will these factors impact Oregon forestry and the whole of the PNW lumber market?

Drop in Starts and Permits Suggests Pessimism in Housing

As we reported in January's Forest2Market Economic Outlook report, current housing sentiment suggests a pessimistic outlook when it comes to housing starts. Pandemic excluded, November had the lowest sentiment data since June of 2012.

Total starts and permits saw dips with a 15.1% year-over-year decrease in housing starts. Again, discounting the pandemic, these numbers haven’t hit such lows since 2011 for starts and 2009 for permits.

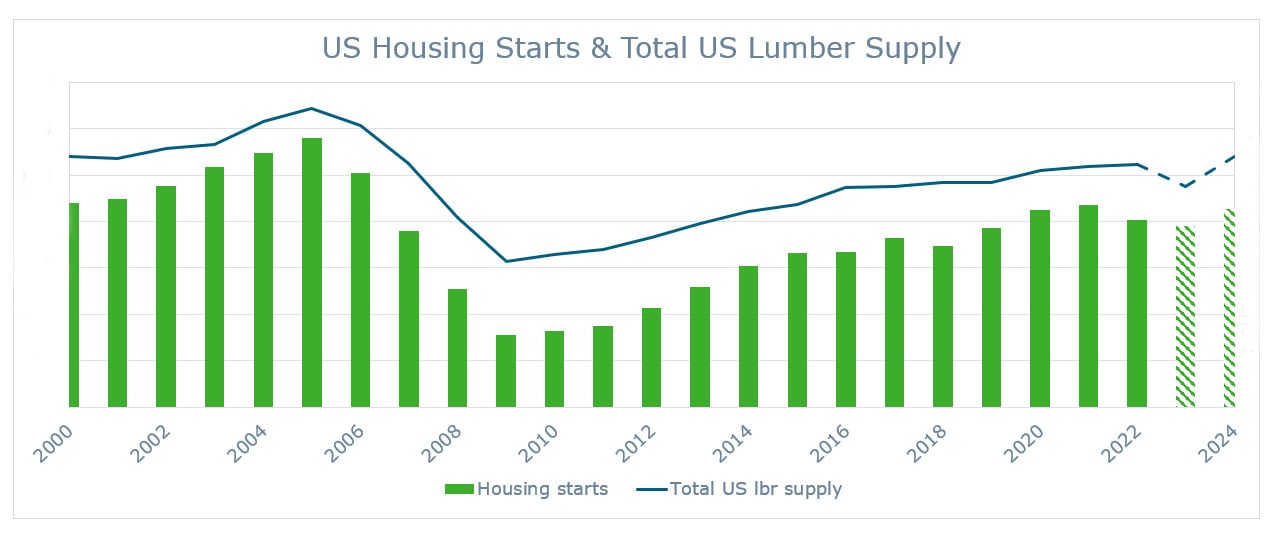

(Figure 1: General trends for housing starts continue plunging downward with some slowing for multi-family starts)

Figure 1 shows a few noteworthy observations:

- Single-family housing permits were down again in November for the ninth consecutive month.

- Multi-family permits also dropped similarly to single.

- Single-family starts dropped eight months out of the last nine.

- Home resales fell for the tenth month in a row.

According to NAR Chief Economist Lawrence Yun, multiple aspects contributed to where the market now stands:

"In essence, the residential real estate market was frozen in November, resembling the sales activity seen during the COVID-19 economic lockdowns in 2020. The principal factor was the rapid increase in mortgage rates, which hurt housing affordability and reduced incentives for homeowners to list their homes. Plus, available housing inventory remains near historic lows."

These continued lows suggest a potential housing recession to many economists. Others argue that the 2023 market is different enough to not necessarily mean the same recession outcome as 2008. Nevertheless, the depressed numbers and increased interest rates continue to make a solid case for some form of housing contraction on the horizon.

Affordability, Housing, and Lumber

From an economic standpoint, another compounding issue within housing comes in the form of affordability. To put it simply, the US is suffering from a shortage in affordable housing. As interest rates rise to help curb increasing inflation problems, the problem will only worsen.

As Fannie Mae Executive VP and CEO Jeffrey Hayward discussed, shortages were caused by the housing bubble crash from the 2008 Great Recession. The number of new homes built between 2008 and 2018 was lower than any other decade since the 1960s.

The pandemic only worsened the issue thanks to disruptions across the global supply chain market – including lumber and plywood. The problem has driven up prices across the US and created the crisis of affordability we are seeing today.

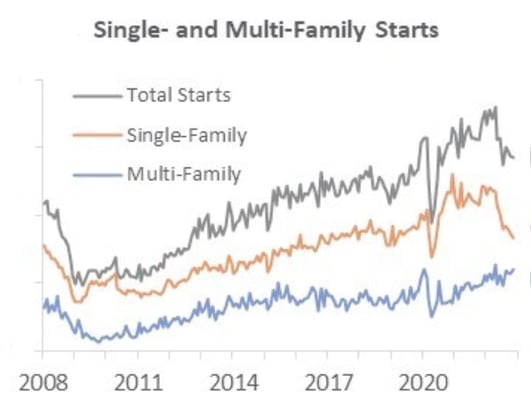

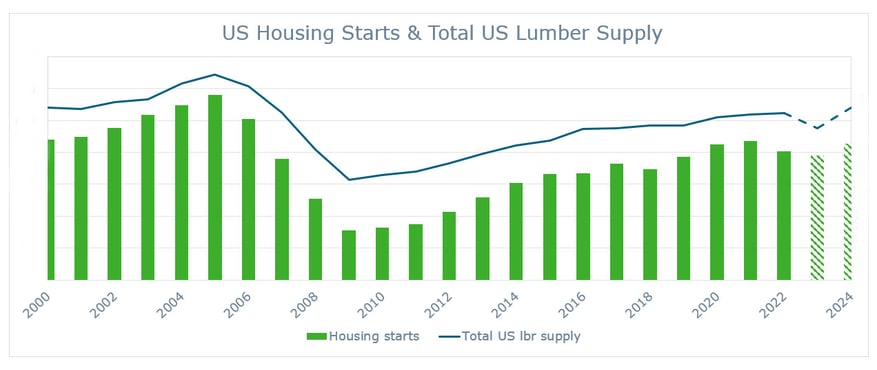

As Figure 2 reveals, we can see a somewhat steady connection between total US lumber supply and US housing starts.

(Figure 2: Decreased lumber supply marks at least some correlation between US housing starts historically)

Some projected data shows an uptick in both starts and lumber supply. But there is certainly more to the story than this correlation of data.

Oregon Forestry: Lumber Supply Sees Substantial Drop

Zooming the lens into the northwest, we can see further indications of supply issues. Lumber supply shortages impact the greater supply chain, which ripples across all production costs.

So, one question we should ask is: What’s causing lumber numbers to drop in Oregon?

The answer to this question comes in two parts, which we will explore below.

1. Reduced supply of lumber due to 2020 Oregon Labor Day fires

Major weather events produced significant windstorms during the 2020 Labor Day holiday. Consequently, dry forest conditions led to five separate, simultaneous "megafires." Megafires are fires sized at 100,000 acres or more.

Additionally, 12 further fires ranging from a few hundred to over 50,000 acres ravaged the landscape. All of these fires started or amplified during the September 7-8, 2020 weekend. Within a few days, close to 1 million acres burned on both private and public lands.

The resonating effects of such a massive event will continue to have repercussions in Oregon forestry for decades to come.

Based on findings from Mason, Bruce & Girard of the Oregon Forest Resources Institute, timber harvest will reduce by 7 BFF across the next 40 years. Devastation like this has unfortunately reduced the overall Oregon harvest potential – and will continue that way for years to come.

2. Restrictions due to Oregon’s Private Forest Accord (PFA)

Beginning in 2020, representatives from Oregon forestry and wood products met with those from the environmental and fishery communities engaged in a series of meetings and negotiations. The goal was to help set up a mutually agreed set of standards for both forestry and habitat/environmental management and conservation.

Over time, this evolved into the Private Forest Accord. The details of the process are available via the Oregon Forest Resources Institute (OFRI).

Since October 2022, some major changes have taken effect regarding how and where lumber harvests can occur. As the OFRI describes it:

“The Oregon Board of Forestry approved more than 100 changes to the Forest Practices Act, based on the recommendations of the Private Forest Accord report. The changes will impact timber harvest activities on more than 10 million acres of private and non-federal forests in the state.”

With additional restrictions now becoming cemented in law, the impacts on the Oregon forestry industry are still being determined. Forecasters predict a loss of up to 7 thousand jobs – a major blow to the local economies in many of these logging regions.

The Path Ahead for Oregon and Other PNW Lumber Markets

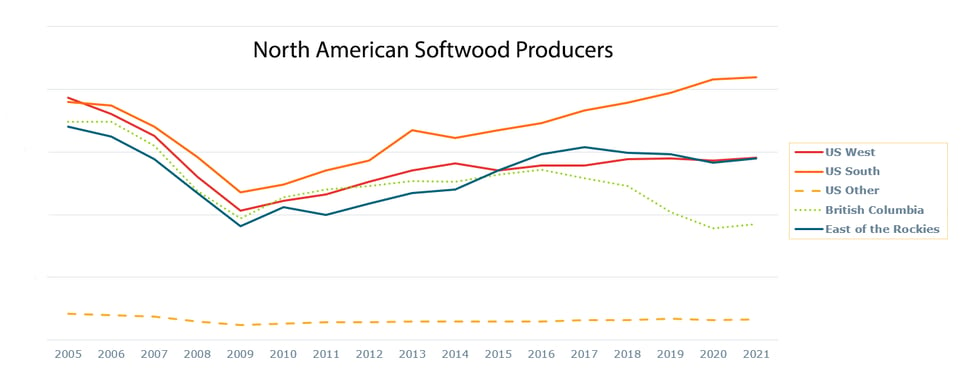

Both the reduction in labor and the added limitations on harvestable lumber will inevitably drive down forestry across Oregon and the greater PNW. The rise in southern lumber as the largest softwood producer in North America (Figure 3) also contributes to the issue at-hand.

(Figure 3: The US South continues to climb higher as the largest producer of softwood across North America)

Some of the conclusions we can draw from this data include the following:

- Persistent shortages of affordable housing continue to affect the lumber markets.

- We need softwood lumber and plywood for both new home and home repairs/renovations.

- Oregon mills remain competitive in the US and global economies…

- …But these mills have been impacted in available supply due to forest fire losses and tighter environmental restrictions.

- These factors have contributed to the rise of the US South as the top softwood producer and supplier within global market share.

While Oregon forestry has seen some contraction in its market share and standing, it remains an important piece of the North American lumber picture. Forest2Market will continue to monitor these trends and developments as 2023 presses onward.

More Data and Insights from Forest2Market

Forest2Market, a ResourceWise company, provides subscribers with a range of industry analytics and forecast products. Our Economic Outlook report offers an in-depth look at all of the critical elements impacting the global forestry market.

Learn more about forest industry analytics for the insights your business needs to succeed.