2 min read

Pandemic-Fueled Uncertainty Continues to Hobble Labor Market

Forest2Market

:

September 29, 2021

The Bureau of Labor Statistics’ (BLS) establishment survey showed nonfarm employers added 235,000 jobs in August - falling “disappointingly” short of the 720,000 expected. On a brighter note, June and July employment changes were revised up by a combined 134,000 (June: +24,000; July: +110,000). Meanwhile, the unemployment rate (based upon the BLS’s household survey) declined by 0.2PP, to 5.2%, as gains among the employed (+509,000) significantly outpaced expansion of the civilian labor force (+190,000).

Although the number of employment-age persons not in the labor force edged lower (-49,000) to 100.1 million. the labor force participation rate was unchanged at 61.7%. Given an overall employment-age population of 261 million, Calculated Risk’s Bill McBride argues the official unemployment rate paints a rosier picture of the employment situation than is warranted. He estimated an alternative rate by including the number of people who have left the labor force since early 2020, and the expected growth in the labor force. McBride’s alternative rate of 7.9% is more in line with the BLS’s “U-6” or “underemployment” rate of 8.8%.

Goods-producing industries gained a rather miniscule 40,000 jobs; service-providers: +195,000. Notable job gains occurred in professional and business services (+74,000), transportation and warehousing (+53,200), private education (+40,200), and other services (+37,000). Employment in retail trade (-28,500), and food service and drinking places (-41,500) declined over the month. Manufacturing added 37,000 jobs. That result is at odds with the change in ISM’s manufacturing employment sub-index, which contracted in August. Wood Products employment rose by 1,800 (ISM was unchanged); Paper and Paper Products: +800 (ISM fell); Construction: -3,000 (ISM rose).

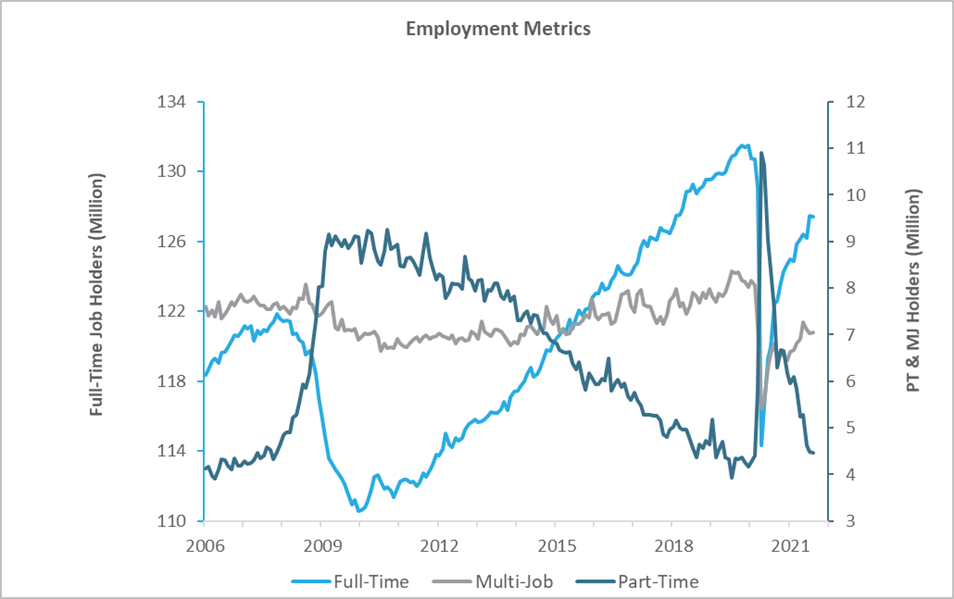

Full-time jobs nudged down (30,000) to 127.4 million. Workers employed part time for economic reasons slipped by 14,000, whereas those working part time for non-economic reasons jumped by 272,000; multiple-job holders advanced by 15,000.

Average hourly earnings of all private employees increased by $0.17 (to $30.73), for a YoY increase of +4.3%. Since the average workweek was unchanged at 34.7 hours, average weekly earnings increased by $5.90, to $1,066.33 (+4.4% YoY). With the CPI running at an annual rate of +5.4% in July, even those who are employed are—on average—not keeping up with the official inflation rate.

The pandemic’s resurgence was almost universally blamed for the dismal jobs numbers. E.g., comments by Glassdoor’s Daniel Zhao were representative: “The labor market recovery hit the brakes this month with a dramatic showdown in all industries,” Zhao said, adding, “Ultimately, the Delta variant wave is a harsh reminder that the pandemic is still in the driver’s seat.”

Although the robustness of any rebound in employment could be hindered by pandemic fears and the Biden administration’s vaccine mandate that (if it survives legal challenges) now includes a wider swath of the private sector, expiration of extended unemployment benefits in early September is likely to encourage workers to look for jobs—even if only gradually as employers and workers alike undergo what the Washington Post has dubbed the “great reassessment” of employment. For those reluctant to return to work, the loss of benefits will force them to limit spending, adding another constraint on the economy.