The South Carolina forest industry is poised for growth over the next decade. By 2020, annual harvest volumes are expected to increase by four to eight million tons, or 20 to 40 percent over the current 20 million tons. This is just one of the positive numbers to come out of a study conducted by the 20/15 Project’s Forest Resource Committee that I had the opportunity to chair.

The 20/15 project, a joint effort between the South Carolina Forestry Commission, the South Carolina Forestry Association (SCFA) and other partners, was developed to strengthen the South Carolina forest industry. An economic impact study commissioned in 2008 (based on 2006 data) showed the forest industry had a $17.4 billion annual impact on the South Carolina economy. This number quantified forestry as the state’s leading industry in terms of both jobs and payroll. The overall goal of the 20/15 project is to grow the forest industry in South Carolina to $20 billion by 2015.

The role of the Forest Resource Committee was to provide an overview of the future of South Carolina forests for other committees to utilize when developing marketing and outreach strategies for the state. We designed a study to project future wood supply across low, medium and high-demand scenarios and identify opportunities based on the results. Scenarios were based on announced changes in production or capacity (short-run) and expected demand trends (long-run).

Hardwood inventories were kept stable throughout the course of the study. Total additional roundwood demand for the three scenarios ranged from 3.4 to 7.6 million green tons for the low- and high-demand scenarios by 2020. Study results included:

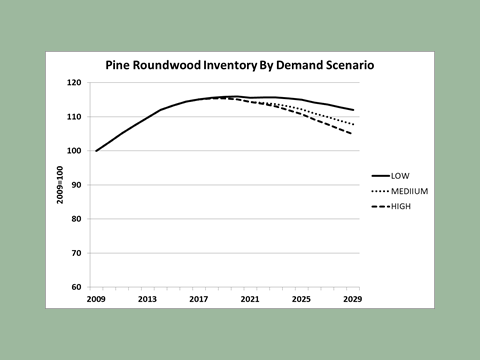

- Total pine inventory in 2029 will be higher than pine inventory was in 2009.

- Dramatic differences in age class distribution will lead to significant size class differences.

- The Coastal Plains will contribute more to pine harvests than the Piedmont and also incur the largest reductions of young pine acres.

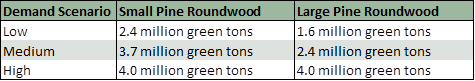

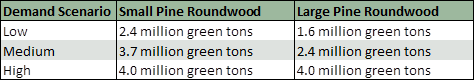

By the end of the decade, additional demand for small pine roundwood will amount to 2.4 to 4.0 million tons. Additional demand for large pine roundwood is expected to range between 1.6 and 4.0 million tons.

Total pine inventories are projected to rise and remain above the 2009 start point in both the low- and medium-demand scenarios. In the high demand scenario, total pine inventory is expected to decline between 2019 and 2029 as demand for large roundwood increases and the pulpwood age class gap matures into sawtimber. Despite this trend, the inventory of large roundwood will remain significantly higher than 2009 inventory.

North Carolina State University professor Dr. Bob Abt authored the study and will present its results at the SCFA annual meeting in Asheville, North Carolina later this week.

Comments

11-04-2013

Based on your comments, I’m curious what the projected growth/drain for the respective products will be over the next 15 years?

Comments

11-07-2013

The study considered existing standing inventory rather than a growth/drain forecast. Inventories are expected to increase or remain flat across the state for all demand scenarios. In all likelihood, the future growth/drain cycle will emulate the historical cycle.