2 min read

Proposed Chinese Tariffs: Potential impacts for the PNW Forest Industry

Joel Swanton : August 15, 2018

On August 8, China's Commerce Ministry released a preliminary list of proposed tariffs on $16 billion in US goods, which came just a day after the U.S. Trade Representative's office released a finalized list of $16 billion in Chinese goods that will be hit with tariffs.

The tariffs are scheduled to be activated on August 23, the Chinese ministry clarified, which is the same day that the US plans to begin collecting an additional 25 percent in tariffs on $16 billion in Chinese goods.

The list identified duties of 5, 10, 20 or 25 percent on 5,207 US imports that include a number of wood products such as softwood and hardwood logs, veneer and lumber, chips, pellets, MDF, OSB, wood pulp, paper and other processed and unprocessed wood materials.

You can view an unofficial version of the HTS (Harmonized Tariff Schedule) at the following links:

If enacted, these tariffs will have a significant impact on US markets, particularly the Pacific Northwest (PNW). Due to its proximity to Asian markets, the PNW region exports a number of wood products to China, including softwood logs, lumber, chips, wood pulp, paper, and other processed wood materials.

What will these proposed tariffs mean for the forest products industry in the PNW?

- Landowners/Land Managers

Harvests have been near sustainable long-term levels and there has been very little wiggle room in regional private harvests over the last year. Those involved in the log export market could see diminished export opportunities, which will cause a shift to domestic markets that will result in lower pricing due to increased supply.

- Sawmills/Veneer Mills

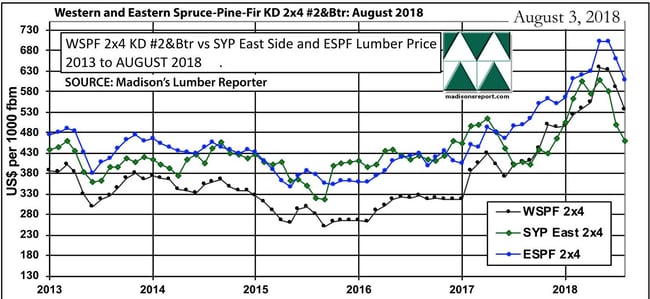

These mill facilities may benefit from increased log supply and lower pricing due to restricted export markets. While lower raw material costs would be a welcomed change for these manufacturers, North American lumber pricing has dropped precipitously over the last two months. Raw material cost gains may be offset by challenging condition for lumber, veneer and residual chip pricing.

Source: Madison's Lumber Reporter

Source: Madison's Lumber Reporter

- Pulp Mills

There could be a direct impact to those involved with export markets, increasing the need for cost controls at the mill level. Affected companies will be under more financial strain to remain profitable and will have to find ways to cut/minimize costs elsewhere in their operations. However, domestic facilities may benefit from increased chip supply, resulting in lower pricing due to increased supply.

With a potential for a major shift in global markets, it’s more important than ever for supply chain managers to remain nimble and adaptive when circumstances change. Sales and procurement managers must monitor these market changes closely and be prepared to make adjustments quickly.

Forest2Market’s transaction-based data is the best way to stay on top of market trends and pricing, which provides users with the most accurate information to increase value and maintain profitability during periods of high volatility and uncertainty in the markets.