3 min read

Regional Changes Impacting the Sawmill Sector: Follow the Money… and the Wood

Joe Clark

:

May 9, 2019

Joe Clark

:

May 9, 2019

As we noted in the last installment on this topic, the southern pine lumber and pulp markets are fully recovered from the lows associated with the Great Recession of 2008, and investment capital is actively flowing into the forest industry in the US South. However, the situation is quite different in the US Pacific Northwest (PNW), where the market is hamstrung due to the tight log supply and high costs. How has this change in the supply/demand dynamic affected the number of active mills, as well as the flow of logs and residual material in these two regions? More importantly, how is this situation affecting capital investment in the regional forest industries?

US South

The forest industry in the South is solidly profitable with globally-low cost structures. In addition, since pine sawtimber growth widely outpaces demand (and will continue to do so even after new lumber production capacity is brought on line), price volatility is not widespread, although there are regional pockets where competition for wood resources has driven prices higher.

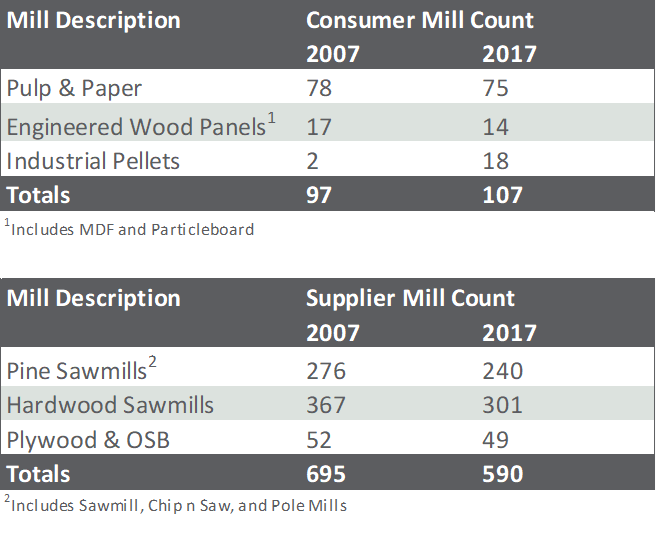

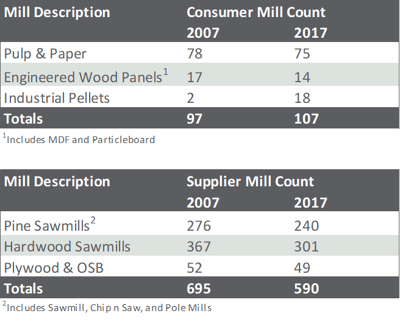

Over the last ten years, the US South mill portfolio has been dynamic. The permanent closure of three pulp and paper mills and three particleboard plants was met with the opening of 16 new industrial pellet facilities, which led to a 10% increase in the total number of residual wood fiber consumers. Conversely, 36 pine sawmills and 66 hardwood sawmills have closed during the same period, which led to a 15% decrease in the total number of residual wood fiber producers. The combined total number of residual wood fiber consumers and suppliers has decreased by 12% over the last decade.

Despite the lower supplier mill count, pine sawmills in the South are more competitive, profitable and productive than they were ten years ago. While the total number of operating pine sawmills in the region has decreased over the last decade, five new facilities were established in 2017 and are now fully operational. The segment is booming, but only after a very lean, transitional period in the years immediately following the Great Recession.

- Recently, several sawmill projects have been proposed or are on track to begin construction in the near future. Most of these facilities plan for annual capacities of 250 to 350 million board feet—roughly 2 to 3 times the size of the previous generation of mills.

- Existing mills are also expanding—adding drying capacity, running longer hours and upgrading equipment to take advantage of the lumber market and plentiful supplies of cheap timber. When these new sawmills are operational, the supply of wood fiber residuals will increase between 0.32 and 0.44 million dry tons per year based upon the published capacity estimates.

The situation in the South is very much supply driven, as there is an abundance of conifer/softwood fiber from surpluses that accumulated during the Great Recession and its aftermath. The sale of pine sawtimber drives forestland owner returns, and these prices are stuck at all-time lows. Even with new lumber demand, excess inventory will limit an upside price correction for years. As a result, new capital investment is pouring into the region from around the globe, and profitability remains at record highs.

US Pacific Northwest

The situation is quite different in the PNW, where market growth is severely limited due to the tight log supply. The added demand of export markets further complicates this situation. PNW lumber capacity has never recovered from the spotted owl crises of the mid-1980s, let alone the aftermath of the Great Recession.

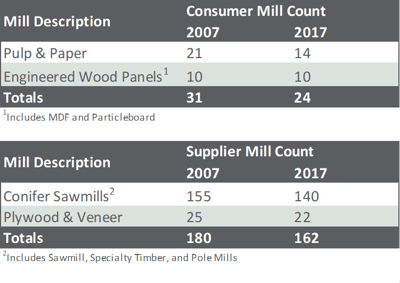

The PNW lost seven major pulp and paper operations in the wake of the Great Recession. Three plywood and veneer mills and 15 conifer sawmills also closed. This represents 10% of the PNW's mill portfolio, which pales in comparison to the mill portfolio in the US South.

That said, the existing market in the PNW is reasonably healthy despite its stagnation and the high cost of fiber. While there have been a handful of recently-announced mill closures and curtailments, many sawmills in the PNW are profitable and forestland owners are enjoying near record prices for logs. However, the upside potential of the PNW industry is severely limited due to the structural changes in log supply. With no additional supply, there can be no additional lumber production (or residual production) and, of course, no new pulp capacity.

The PNW market is very likely the same size it will be for the foreseeable future. As a result of supply constraints and a limited upside, very little capital is flowing to the PNW forest industry.