1 min read

Shipping & Freight: Costs Fall as Global Economy Slips Toward Recession

Tim Woods

:

December 12, 2022

Tim Woods

:

December 12, 2022

As global economic growth slows, with most of the Northern hemisphere expected to be in recession for much of 2023, the forward indicators – like bulk shipping costs for raw materials – remain pointed down. We can overplay these measures as indicators of a slowing global economy, but when they all point down it is reasonable to assume global economies are slowing.

Mid-November, the online news service container-news.com reported Drewry’s Container Shipping Index had plunged 9% in a single week to plumb a two year low. The Shanghai-Genoa route was reportedly down more than USD10,000 since peaking at USD13,675 in October 2021.

Forecasts are for further container shipping costs to fall, however, the shipping and freight sector is frantically seeking solutions to salvage rates from heading right to the bottom of Davey Jones’ Locker. Meantime, the projections are for the declines to continue but to moderate.

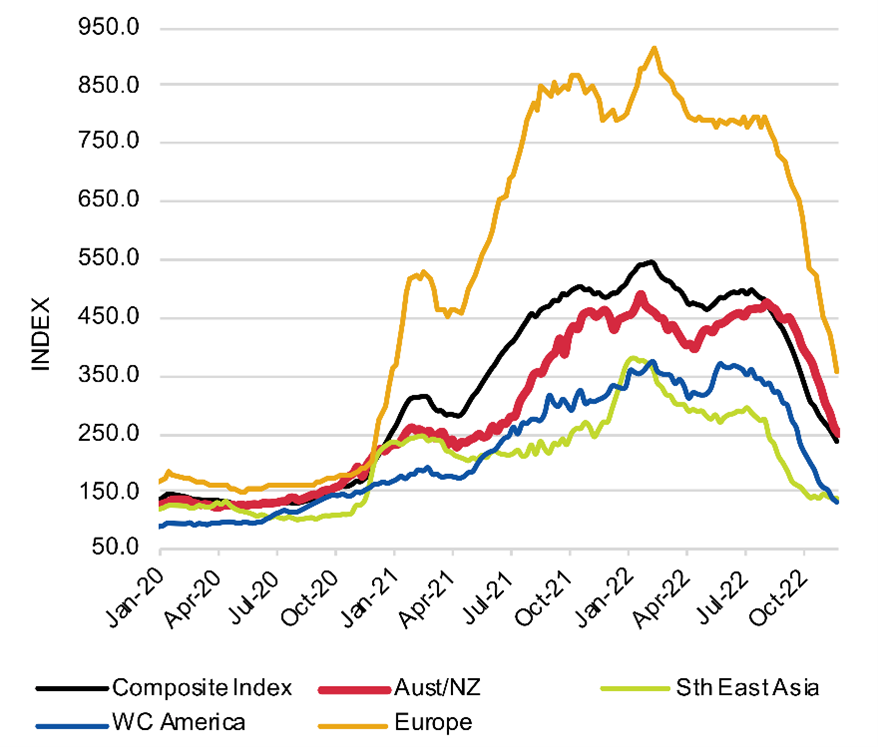

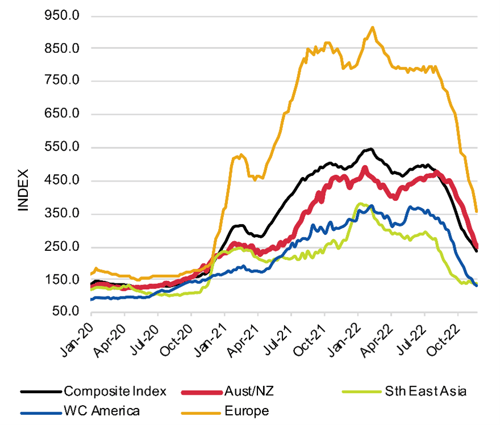

China Consolidated Freight Index (CCFI)

The China Consolidated Freight Index (CCFI) shows the cost of shipping finished goods from China around the world is now moderating.

Over 2021, the weighted average cost of containerized freight doubled. Since the start of 2022 the weighted average cost has declined 53%. The Australia/New Zealand route was 44% lower over the same period.

China Containerized Freight Index: 3 Jan ’20 – 25 Nov ‘22

Source: Shanghai Shipping Exchange

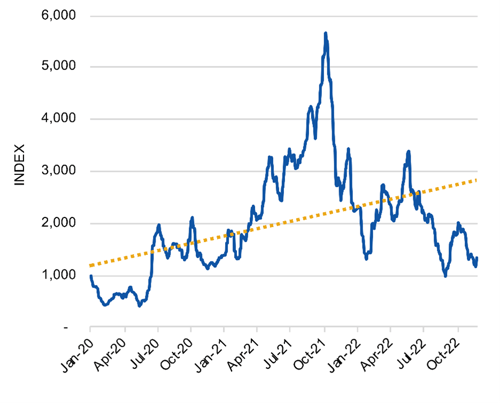

Baltic Dry Index (BDI)

In late-November, the Baltic Dry Index (BDI), the main indices of raw materials shipping costs, was 40% lower than at the end of 2021, with the index showing the cost of bulk shipping is now barely above that recorded at the start of the global pandemic, now almost three years ago.

Baltic Dry Index (Bulk Dry Shipping): 2 Jan ’20 – 25 Nov ‘22

Source: Bloomberg

Of course, further analysis is desirable, and the Wood Market Edge online platform provides a growing array of data and resources to assist subscribers to analyze a wide range of forestry and wood products markets. The IndustryEdge team is available to assist the supply chain to understand markets in great depth and global breadth.