There has been a lot of interest in the disconnect between log and lumber prices over the last year. While the reason behind this disparity is oftentimes perplexing, the reality is that the market for trees is vastly different than the market for lumber. In the US South, the inventory of standing timber has risen unimpeded since the onset of the Great Recession in 2007, which has resulted in an oversupplied market. The surplus of logs combined with improved mill efficiencies has kept log prices suppressed, even as demand for lumber surges and sawmill production continues to increase.

There are emerging signs, however, that this trend is beginning to change.

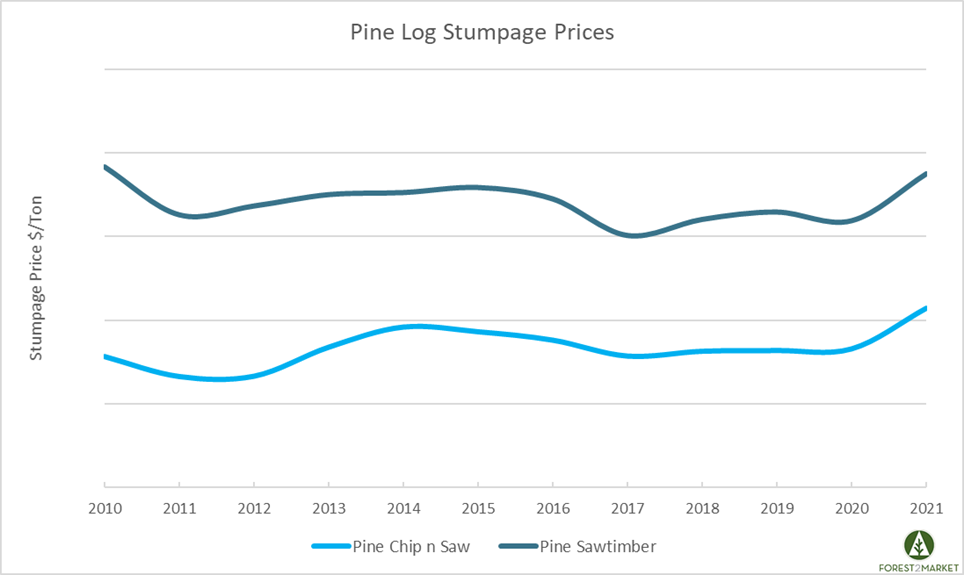

The last 12 months have been far from “normal,” but lumber demand has been strong and prices for pine log products (sawtimber and CNS) have surged. Per Forest2Market’s Stumpage 360 database, YTD pine log stumpage prices across the South are up 11% over 2020 prices, and they have now reached a 10-year high.

For many southern sawmills, log costs can make up 70+% of the total cost of the mills’ finished product. It is therefore the single most important cost component in the supply chain. Sawmill procurement teams are tasked with finding the perfectly sized log, maximizing the mill’s market share of that log (while not overpaying), and reducing the variability in log size and quality as much as possible to maintain profitability.

According to Sawmill TQ benchmarking data, southern mills keep an average of about 6 days of log inventory on hand compared to an average of nearly 40 days among mills in the Western US. Any upset in the SYP supply chain can quickly affect sawmill operations.

The Inevitable Increase on the Horizon

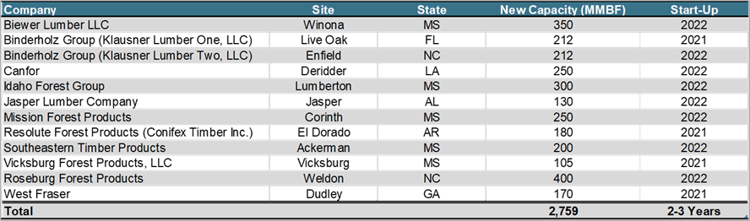

While the record high lumber prices we have witnessed over the last year have been demand driven, southern sawmills are incrementally increasing production to meet the needs of homebuilders. New capacity in the form of both greenfield mills and existing mill expansions will help meet demand targets and establish more surge flexibility in the supply chain. Throughout the South, nearly 2.8 billion board feet (BBF) of new lumber capacity is scheduled to come online by the end of 2022.

To demonstrate the raw materials needs of a modern lumber facility, a new greenfield mill producing 250 million board feet (MMBF) of lumber with a yield of 1 MBF per 4 tons will consume a million tons of logs each year. Scaling up to meet the demands of the additional 2.8 BBF of announced capacity by 2022 will require 11.2 million tons of logs. It takes a resource-rich wood basket to sustainably supply this much timber to a growing market and thankfully, timberland owners in the US South are certainly up to the task. Tree growth in the region is outpacing removals by 80%.

But as log consumption increases to meet new supply needs, added competition will drive localized stumpage prices higher as well as force some procurement zones to increase, which will translate to longer haul distances, higher freight costs and ultimately higher delivered costs.

Increased regional log consumption will also require new logging and trucking capacity to meet the needs of larger, more modern sawmills. Contractor cost components (equipment, fuel, labor and insurance costs) continue to increase rapidly as well; skyrocketing insurance costs alone have become a real concern for many regional log transport companies, and wages may have to be markedly higher to attract new entrants in an economy struggling to maintain adequate labor participation.

All of these factors suggest a coming increase in log price volatility across the South, both in stumpage prices and costs on a delivered basis. To prepare for this coming change, sawmillers are becoming more sophisticated in how they collect and share data. The newest mills and most sophisticated operators will use the increasing abundance of information to make data-driven decisions to rapidly identify and respond to changing trends. Improved output, lumber recovery, superior grade yields and data-driven decision making will allow these mills to maximize their productivity in a highly competitive environment.

Sawmillers must prepare now in order to maintain a strong market position and mitigate risk over the next several years. Are you ready to take the next step?

Joe Clark

Joe Clark