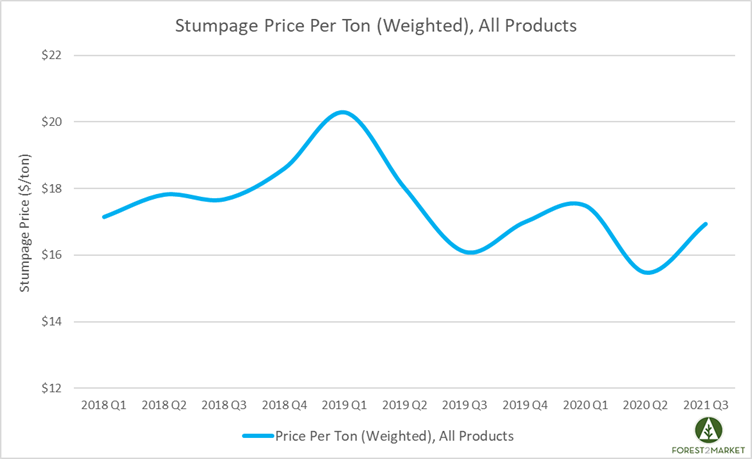

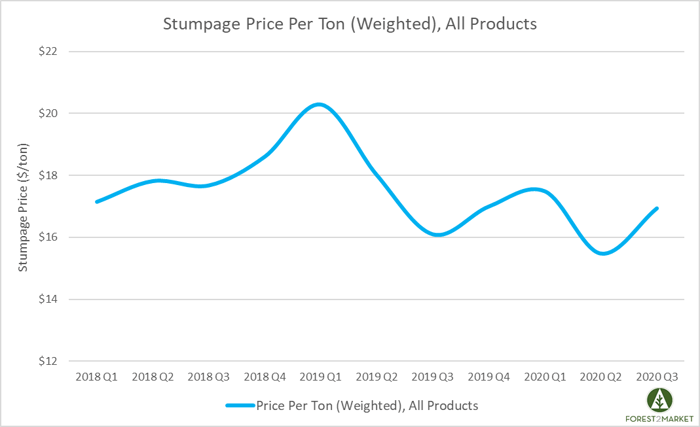

After predictably losing ground during the worst of the COVID-19 pandemic in 2Q2020, the southern timber market bounced back in 3Q led by strong demand for pine products across the board. Demand for hardwood products tanked, however, as prices dipped significantly to some of the lowest points in recent years.

In 3Q2020, the weighted average price per ton of all southern timber products increased +9.4 percent quarter-over-quarter (QoQ), and +5.2 percent year-over-year (YoY).

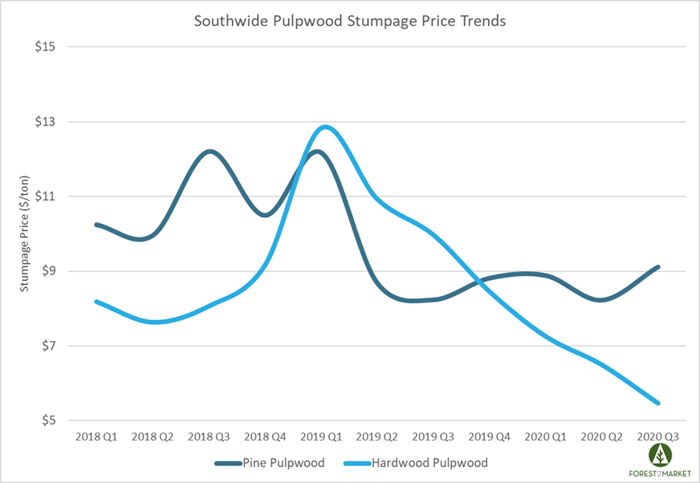

Pulpwood

On a Southwide basis, pine pulpwood prices increased +10.8 percent to $9.12/ton during 3Q2020, as two regions saw double-digit price increases for this product. Prices in the West-South experienced a decrease of -6.0 percent to $5.79/ton. However, prices in the Mid-South jumped +15.0 percent to $7.66/ton and prices in the East-South were up +13.0 percent to $12.23/ton.

Conversely, hardwood pulpwood prices Southwide plunged -16.0 percent during 3Q to $5.46/ton. While prices in the East-South were up +6.7 percent to $4.46/ton, prices in the Mid-South dropped -36.8 percent to $6.84/ton and prices in the West-South sank -17.4 percent to $4.38/ton.

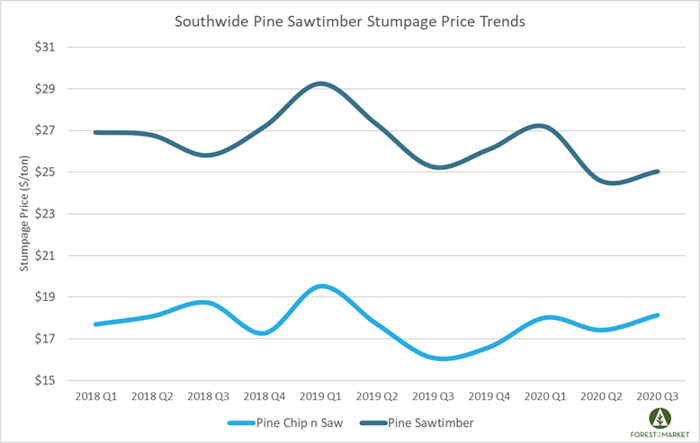

Pine Sawtimber

Pine chip-n-saw prices jumped to $18.14/ton on a Southwide basis, an increase of +4.1 percent. The Mid-South experienced the only decrease of -2.7 percent to $16.85/ton. Prices in the East-South increased +7.3 percent to $21.54/ton, and prices in the West-South region rose by +2.4 percent to $13.45/ton.

Pine sawtimber prices were up +2.0 percent to a Southwide average of $25.04/ton and all three regions experienced increases. The East-South experienced the largest increase, jumping by +7.9 percent to $25.57/ton. The West-South gained +6.8 percent to $28.07/ton, and prices in the Mid-South were up +3.9 percent to $23.11/ton.

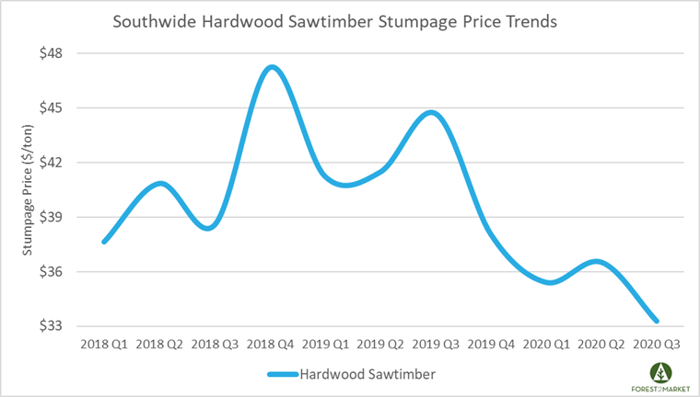

Hardwood Sawtimber

After experiencing a brief uptick in 2Q2020, hardwood sawtimber prices plunged on a Southwide basis during 3Q; prices were off -9.0 percent to $33.29/ton. In the East-South region, prices dropped -3.3 percent to $37.25/ton. Prices in the Mid-South were down -18.2 percent to $33.06/ton, and prices in the West-South region dropped -12.7 percent to $29.36/ton.

Outlook

Real gross domestic product (GDP) increased at an annual rate of 33.1 percent in the 3Q2020, as efforts continued to reopen businesses and resume activities that were postponed or restricted due to COVID-19. The increase is the same as in the “advance” estimate released in October. In 2Q2020, real GDP decreased 31.4 percent. Many sectors of the economy have bounced back quickly since early summer, which is reflected in recent economic data:

- Although manufacturing output rocketed up by an annualized rate of 53.7 percent in 3Q, activity in that sector decreased 0.3 percent in September and was 6.4 percent below February’s level.

- Non-farm employers added a surprising 638,000 jobs in September (600,000 expected).

- September total housing starts rose by 1.9 percent to 1.415 million units SAAR; permits: +5.2 percent, to 1.553 million units.

- New-home sales fell by 3.5 percent to 0.959 million units; resales: +9.4 percent, to 6.540 million units (a 14-year high).

To say that 2020 has been brimming with “uncertainty” would be an understatement. Despite a high-flying stock market, a booming housing market and an economic engine doing its best to power through government-mandated lockdowns, the uncertainty is still pervasive.

Southern stumpage markets have largely been soft in 2020, and the pandemic situation has not helped matters. The market has been oversupplied for a decade, which is reflected in price reactions during most of 2020. However, stumpage prices across the South are now climbing back out of the hole after a dismal 2Q, when demand dropped in tandem with the economic shutdown.