2 min read

Southern Yellow Pine Lumber Prices Hit New High in February

Marcus Hunter

:

February 14, 2018

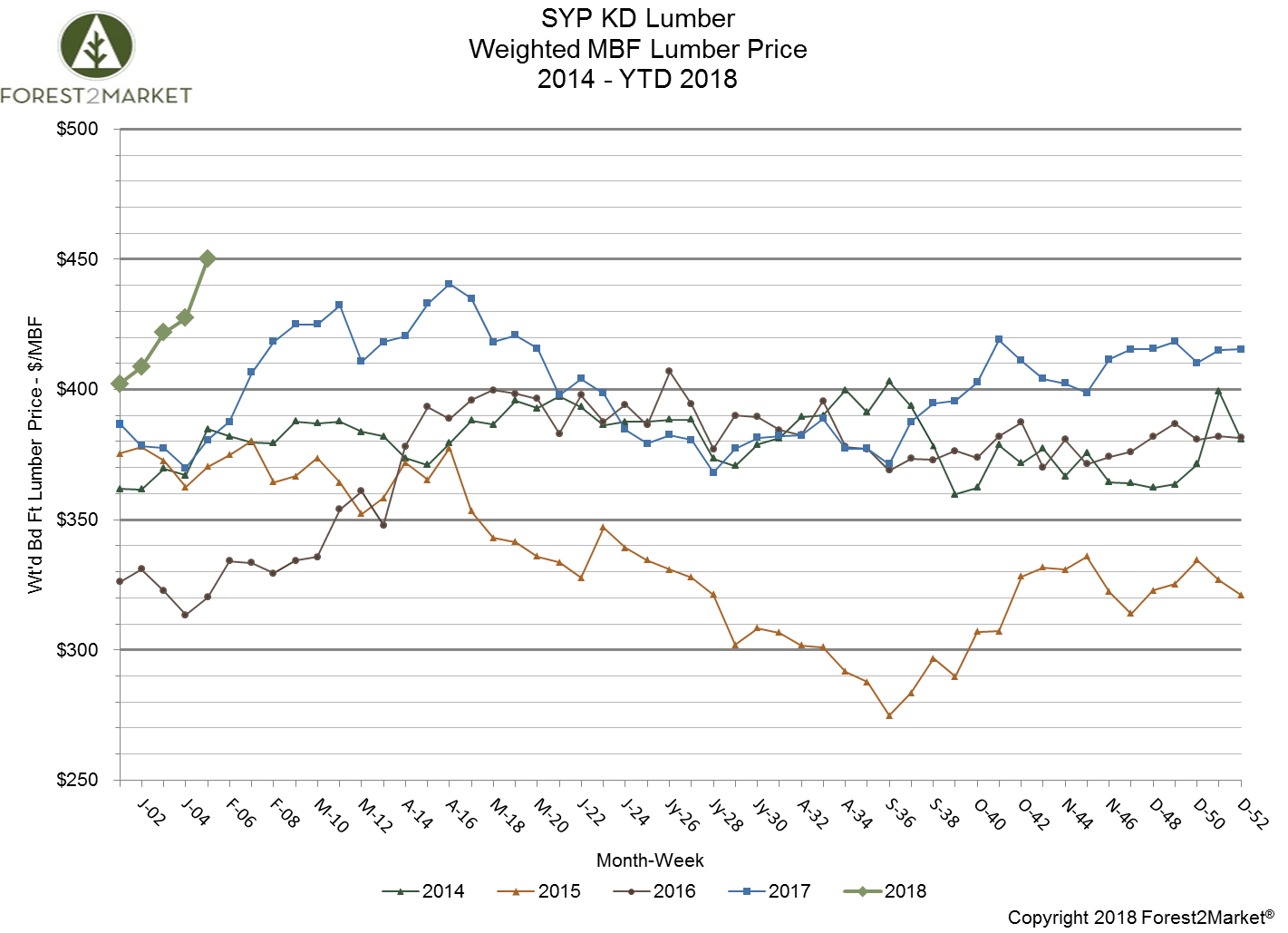

As we get into the swing of a new year, the lumber market continues to feel the collaborative effects that helped drive southern yellow pine (SYP) prices to sustained high levels throughout most of 2017. Forest2Market’s southern yellow pine lumber composite recently hit its highest level ($450/mbf) since we began compiling the data over eight years ago.

Multiple factors are contributing to these high prices, including:

- In November 2017 the US Department of Commerce (DOC) ruled that duties would be imposed on imports of Canadian softwood lumber. The DOC slightly tweaked the final numbers in early January, which will range from roughly 10 percent to nearly 24 percent—lower than the preliminary range of 17 percent to 31 percent.

- Last year’s catastrophic wildfire season, mountain pine beetle infestation and the devastation from Hurricanes Harvey and Irma continue to affect US lumber supply and price. Tight demand has driven log prices in the Pacific Northwest to record highs and no end is in sight; profit margins at regional mills have decreased as a result, making PNW producers less competitive in the North American market.

- Beginning in December 2017, the U.S. Federal Motor Carrier Safety Administration began requiring many freight carriers to install and use electronic logging devices (ELD) that integrate with a truck’s engine and record engine run time, mileage and other operational information. The mandate aims to make roads safer by limiting professional truck drivers to 11 hours of driving during a 14-hour period each day. While this change won’t likely affect loggers, it will affect interstate transportation; a shortage of available driving hours would boost freight rates, and many businesses may have trouble finding independent drivers or may have to pay more when they do.

The North American Free Trade Agreement (NAFTA) is also on the radar as we head into President Trump’s second year in office. The odds of the President leaving NAFTA untouched are not particularly high in the near term, but the US, Canada and Mexico are still at odds over a number of important points; the latest round of talks resulted in little headway.

Another year of sustained high lumber prices in 2018 will also not do much to help an already tight housing market; high prices are forecast to add over $5,000 to the cost of a new US home.

The composite southern yellow pine lumber price soared well above the $400/mbf mark throughout January and into February. Week 5’s price was at $450/mbf, which is up sharply from week 4’s $427/mbf mark. Week 5’s price is 12 percent above its January 2018 starting point of $402/mbf, and 18 percent above the 2017 week 5 price of $381/mbf.