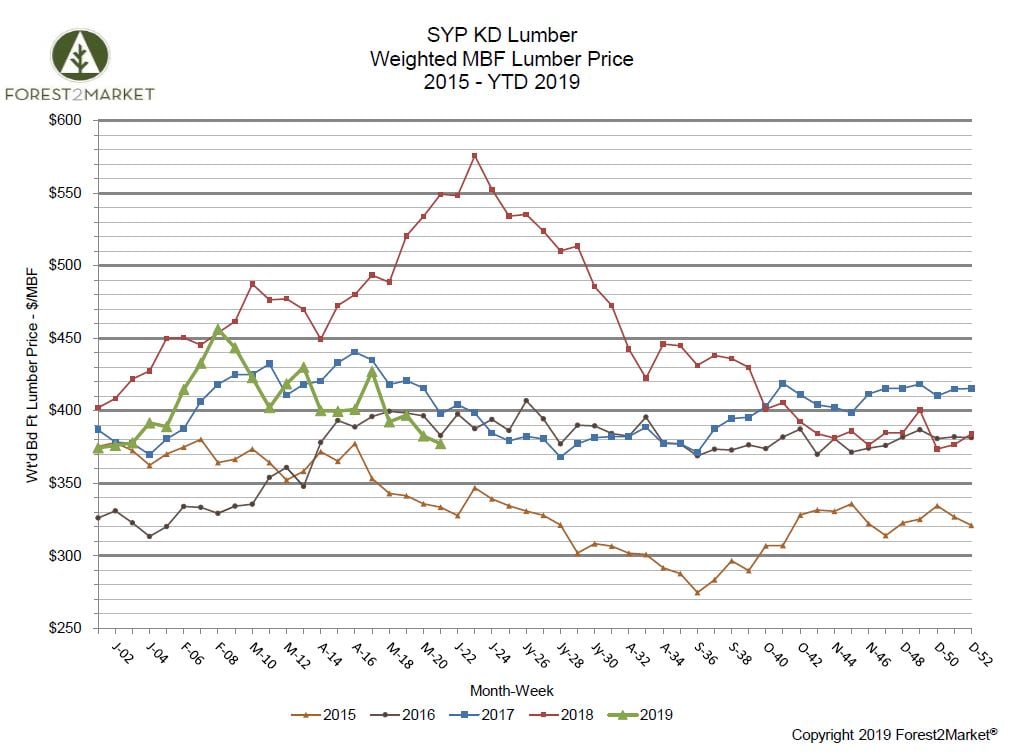

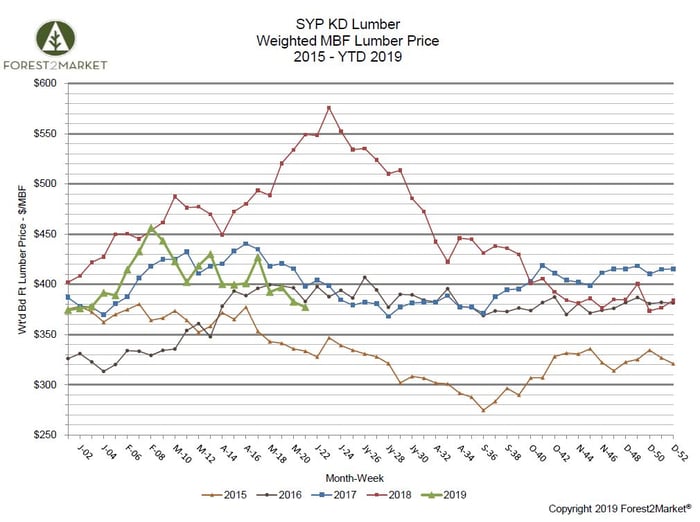

After temporarily spiking to over $400/MBF in late April, southern yellow pine (SYP) lumber prices plunged in late May to their lowest level in nearly five months. The slump is not unique to the South, however, as producers in the Pacific Northwest have also been wondering what happened to the spring rally. Construction markets remain quiet even after a modest improvement in housing starts last month.

Forest2Market’s composite southern yellow pine lumber price for the week ending May 24 was $377/MBF, a 1.6% decrease from the previous week’s price of $383/MBF, and a 31.3% decrease from the same week in 2018. At this point of the year (week 21), SYP lumber prices are now lower than they have been since 2015.

- 1Q2019 Average Price: $410/MBF

- YTD Average Price: $405/MBF

Meanwhile, log costs continue to increase across the South—a situation that is pinching sawmill profits. As we reported earlier this month, pine chip-n-saw prices experienced a significant increase to $20.07/ton on a Southwide basis, a jump of +15.7 percent; pine sawtimber prices increased to a Southwide average of $28.70/ton, an increase of +7.2 percent. We look for log prices to correct downward in 2Q2019, especially if housing starts fail to gain any clear momentum through the early part of the summer.