2 min read

Southern Yellow Pine Lumber Prices Remain High in November

John Greene

:

December 7, 2017

Southern yellow pine lumber prices remain high amid October’s hot housing starts numbers. However, the market continues to be affected by the ongoing softwood lumber dispute; Canada is now taking its case to the World Trade Organization (WTO), which will start a potentially lengthy contest before the international commercial body. Canada is also fighting the case through NAFTA’s dispute-resolution system.

Canadian softwood lumber exports to the US are down roughly six percent through 3Q2017 compared to last year. British Columbia (BC) has been most heavily affected, as its exports to the US have dropped 20 percent—partly due to devastating forest fires and damaged timber due to the Mountain Pine Beetle infestation. This has resulted in annual allowable cut (AAC) reductions in BC, which in turn has led the Forest Analysis & Inventory Branch of the Ministry of Forests to forecast a drop in timber supply of 25 percent over the next twenty years, from 76.71 million cubic meters in 2016 to 56.91 cubic meters in 2035.

Offshore lumber producers have moved to take advantage of the gap left by the decline in Canadian exports to the US. For the first half of 2017, offshore imports into the US rose 38 percent and, according to data from the US Department of Agriculture, Russian shipments are 42 percent higher in 2017. Russia is not the only country benefiting from the US/Canada trade dispute; a number of European nations also increased softwood lumber exports to the US during the first six months of the year:

- German softwood imports: +900 percent

- Austrian softwood imports: +178 percent

- Romanian softwood imports: +141 percent

- Swedish softwood imports: +41 percent

The volume of these softwood lumber imports is nothing near traditional Canadian volumes—shipments from Russia totaled 4,214 cubic meters in May—but other foreign producers are beginning to tiptoe into the massive North American market. Cumulatively, these countries could have an impact on meeting near-term demand while filling the supply gap and, long term, could establish supply chains that might make the US a consistently viable destination for their softwood lumber exports.

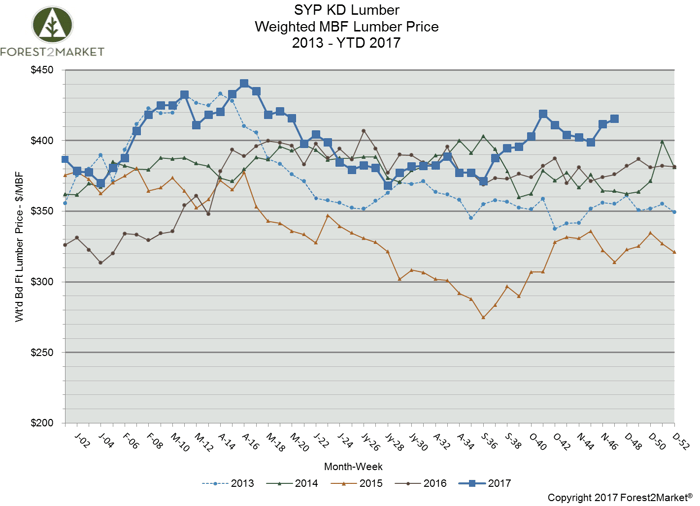

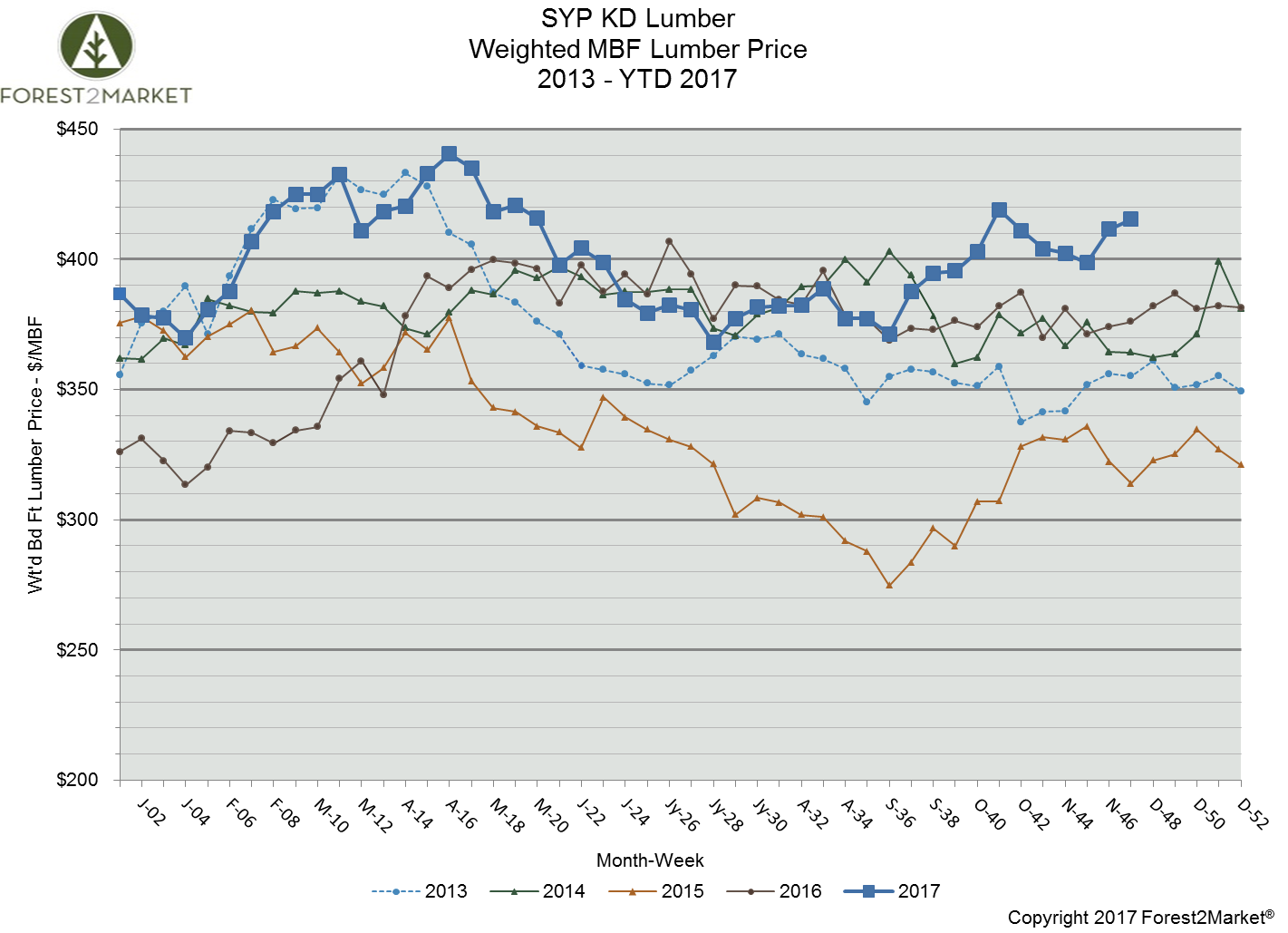

Southern yellow pine lumber prices have remained high since Hurricanes Harvey and Irma made landfall. The composite southern yellow pine lumber price for week 47 was at $415/mbf, which is up from week 46’s price of $412/mbf. Week 47’s price is also 9.7 percent above its January 2017 starting point of $378/mbf, and 10.4 percent above the 2016 week 47 price of $376/mbf.

A closer look at some of the prices we have seen since the beginning of the year:

- YTD Peak Price: $440/mbf (April)

- YTD Low Price: $368/mbf (July)

- YTD Average Price: $400/mbf

- Average Price Since Hurricanes Made Landfall: $405/mbf