2 min read

SYP 2023 Lumber Prices Remain Low with Uncertainty on Interest Looming

Harvey Greer

:

January 23, 2023

Harvey Greer

:

January 23, 2023

SYP wood pricing trickled up slightly as 2023 started. However, expected interest hikes by the Fed and murmurings of a recession may keep 2023 lumber prices muted through the first quarter.

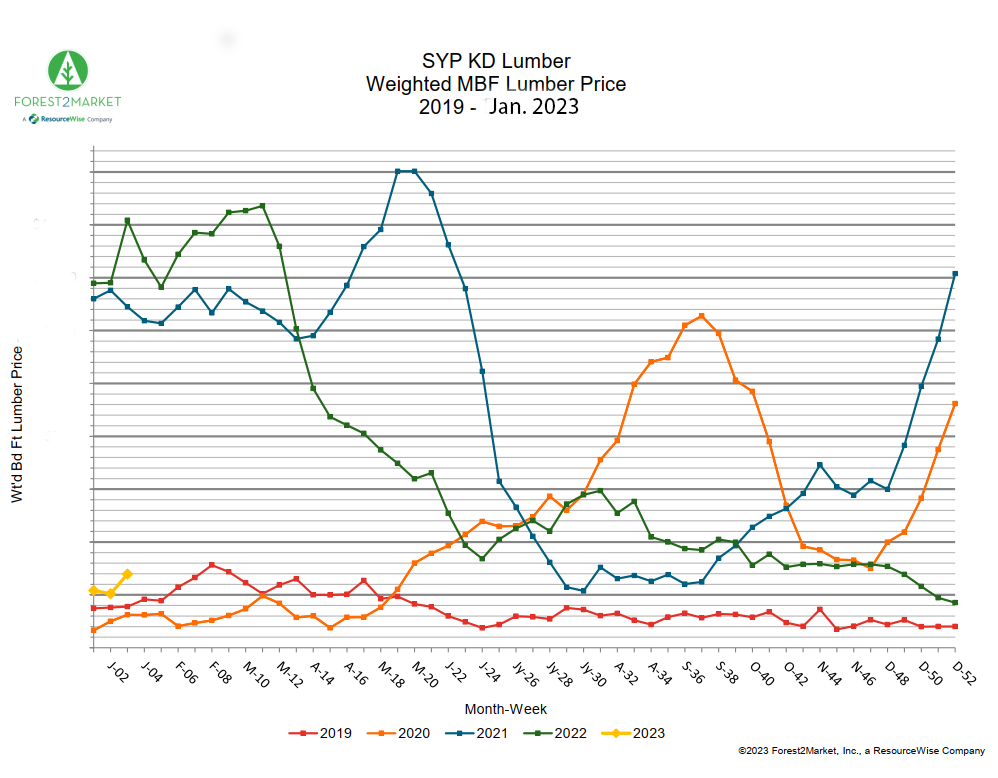

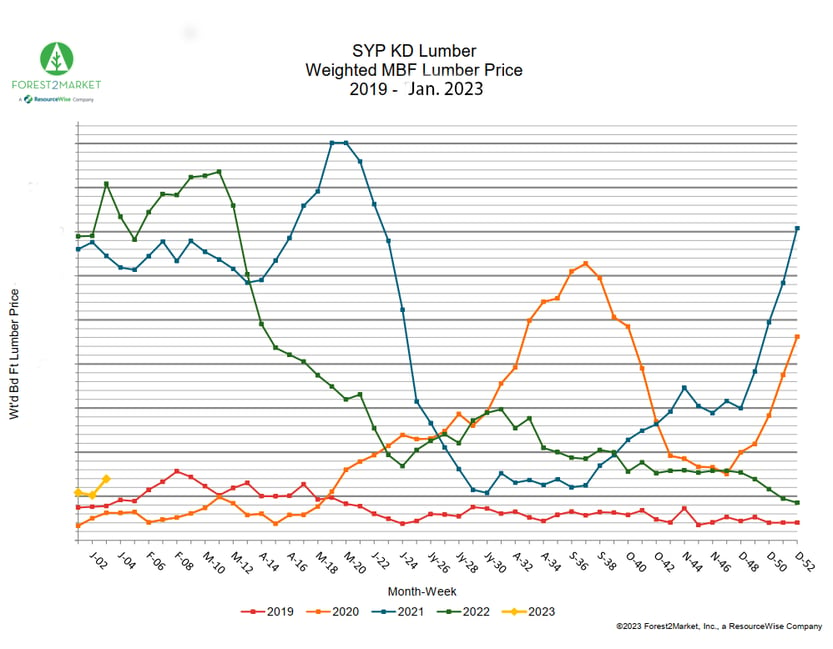

Last year’s highs and lows reflected a volatile SYP market. After a 59% SYP price plunge in June from its 2022 high of $1,136/MBF, it somewhat stabilized throughout September. Thanks to notable decreases in home starts and predictions of a recession, the price fell to below $500/MBF into October. By the end of 2022, the price had continued its downward plunge to just below $400/MBF.

Pricing Data Reveals Insecurity About Interest Rates, Recession

Early data in January shows a somewhat reassuring recovery with prices quickly rebounding above the $400/MBF mark. This number hits exceptionally lower than the year-over-year with a week 1 loss of 58% in 2023 from just below $1000/MBF in the first week of 2022.

While the year-over-year drop reveals a major shift in prices, the change over the last 3 months has remained much more gradual. This shows, at least to some extent, more stability in the market.

Whether this drops below the EOY 2022 figures remains to be seen.

Inflation Continues to Drive Interest Hikes

Ongoing concerns about recession and interest rates are playing their part in the current numbers as well. Another interest hike expected by the Fed on February 1 will likely keep lumber prices pushing lower as investors await the exact numbers. Continued pressure to adequately respond to inflation is fueling these increases.

Most predictions call for the Fed to announce a .25 percentage point bump to 4.5%. But there's a very real possibility that it will actually end up with a .50 percentage point increase to 4.75%.

The CPI showed inflation at 7% in November 2022 – down from the 9% high in June. Despite these decreases, the number is likely too high for the Fed. And it’s why interest rates will continue rising.

Housing Sentiment Also Unsteady

Homebuilding sentiment seriously dipped in November, with its reading of 33, the worst level since June 2012 (pandemic excluded). Starts decreased at 0.5% month-over-month October to November, which was not as low as the forecasted -1.8% drop. However, permits jumped much further at 11.2% month-over-month against an expected 2.0% dip.

Again, pandemic notwithstanding, we’re seeing the largest drop in starts since April 2011 and permits since October 2009. This certainly does not bode well in terms of market sentiment.

Looking more closely, November reflected the ninth consecutive month in decreasing permits for single family homes. Similarly, multi-family permits dropped as well.

Residential spending on construction fell at 0.5% month-over-month from October to November. While sales in new homes did post a gain, 59% of builders noted that they needed various incentives to attract buyers.

To further highlight the push for new buyers, mortgage rate buy-downs increased to 27% - up from 19% year-over-year. In addition, 37% of builders reduced their prices in November, although numbers were still 9% higher than September’s. The average reduction in price was 6%, a much lower cut relative to the 10-12% hike at the height of the Great Recession.

Real Data for Better Decisions

Forest2Market, a ResourceWise company, provides a wealth of reporting tools for lumber companies, sawmill executives, and other forestry professionals. The data used here comes from our weekly Lumber Report outlining the mill realizations in the US southeast region.

Our customers enjoy streamlined data and reporting relevant to their needs and strategic planning. Reach out to our team today to learn more about how we can help your business stay connected to the realities of this industry.