2 min read

The Conversion of Planted Forests in Paraná, Brazil and its Effects on the Market

Marcelo Schmid

:

April 12, 2018

Marcelo Schmid

:

April 12, 2018

The conversion of planted forests to agricultural land in Brazil’s southern region of Paraná is not a recent phenomenon. Over the last several years, Forest2Market do Brasil has observed the change taking place as small and medium-sized producers have given up on forestry and migrated (or returned) towards agriculture.

While a number of reasons explain this phenomenon, the primary reason is simple: landowners generally seek to make the best economic use of their land and soil.

In 2017, during a panel debate hosted by Forest2Market do Brasil in Guarapuava, Paraná, a small landowner asked the following question: "A few years ago, I was convinced to replace my crop with eucalyptus trees. This planting is now four years old but hasn’t resulted in any marketable yield—what should I do with my land now since it is surrounded by agriculture rather than eucalyptus plantations?"

The answer I offered at the time remains the same today. Eucalyptus (or any other forest culture) should generally not be planted in an agricultural area. With rare exceptions, it would simply not make sense to replace a valuable culture or crop with a less valuable one, regardless of temporary market conditions.

This particular landowner was not alone. Several other regional producers opted to convert their agricultural land to eucalyptus plantations at the same time when the price of wood was much higher and more attractive. However, these landowners were not aware that they were embarking on a completely different, long-term business model where the return takes much longer to mature.

Eucalyptus conversions became popular because of the high market price of wood, which turned out to be temporary. Landowners were motivated to plant pine or eucalyptus to sell process logs (up to 7”) to a large company/wood consumer in the region. Forest2Market do Brazil has monitored actual timber transactions and prices in Brazil since 2014 and knows that the price paid for forest raw materials—especially small-diameter wood—has decreased in recent years.

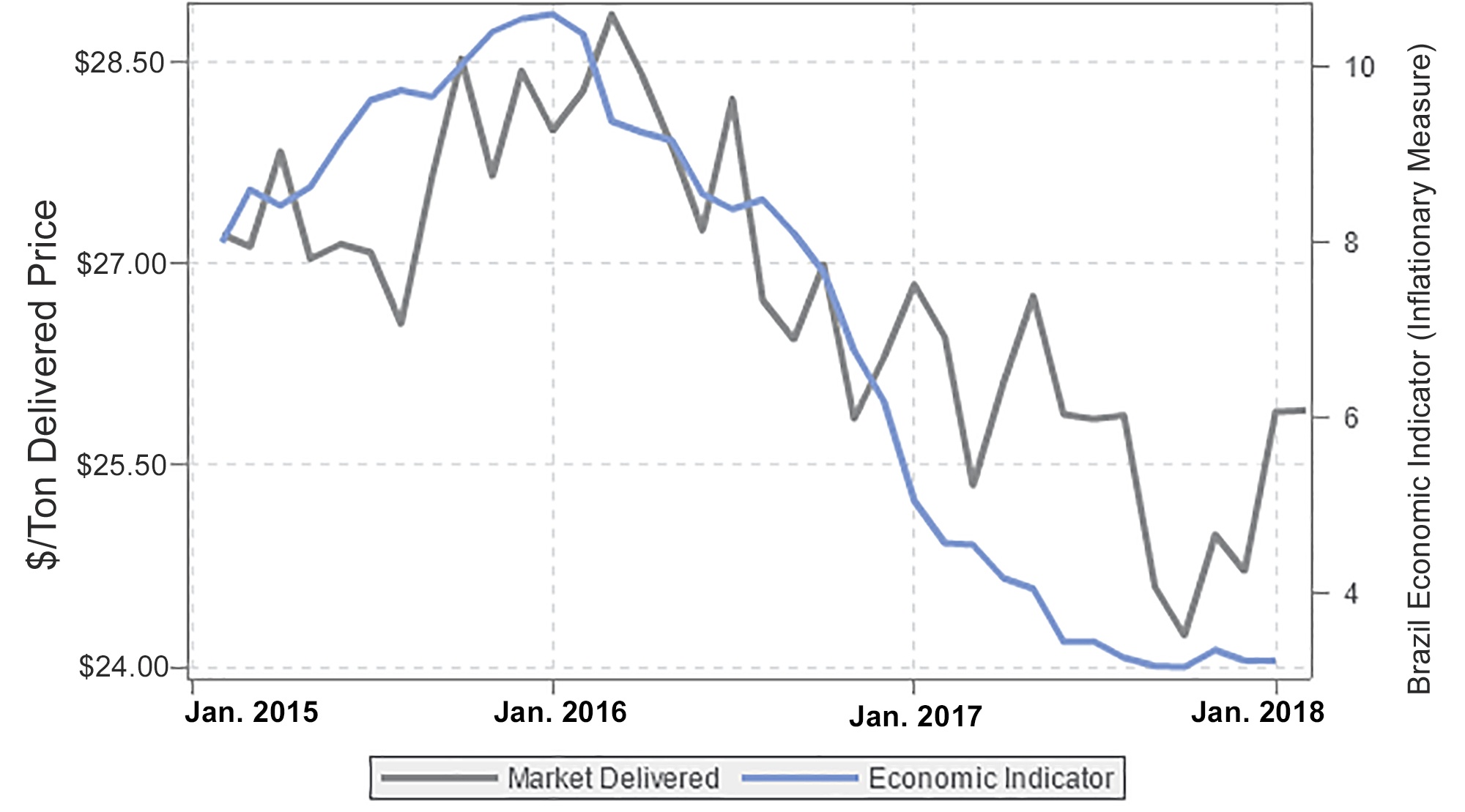

Figure 1 shows the delivered price change of small-diameter pine (3-7”) in the state of Paraná between January 2015 and January 2018 compared to changing inflation (IPCA). Between January 2016 and 2018, the price dropped by more than 10 percent.

Figure 1. Average delivered price change of 3-7” pine pulpwood in Paraná and Brazil Economic Indicator (inflation)

Figure 1. Average delivered price change of 3-7” pine pulpwood in Paraná and Brazil Economic Indicator (inflation)

Forest2Market do Brasil has recently observed that this phenomenon has become more pronounced in certain regions of Paraná. A fresh market study detailing the central region (Guarapuava and its surrounding area), identified several small producers that are currently exiting the plantation forestry model and are returning to traditional agriculture. Naturally, this conversion trend is concerning for wood-consuming businesses in the area.

The full effect of these conversions should be felt soon. In a region like Guarapuava, where wood products companies generally rely on access to timber managed by local timberland producers, the reliability of future supply could create significant challenges as more and more landowners exit the forestry business. This dynamic will increase the demand for logs and, consequently, log prices.