3 min read

Quality of OCC generated by large retailers demands a premium

Suz-Anne Kinney

:

February 21, 2014

Suz-Anne Kinney

:

February 21, 2014

Most OCC originates in one of two places:

- Large retailers that separate OCC from the rest of their waste streams and bale and store it separately.

- Single-stream or curbside recycling programs that co-mingle OCC with all other recyclables.

Because of its origin, OCC generated at large retail stores is among the cleanest on the market; as a result, this OCC is worth more.

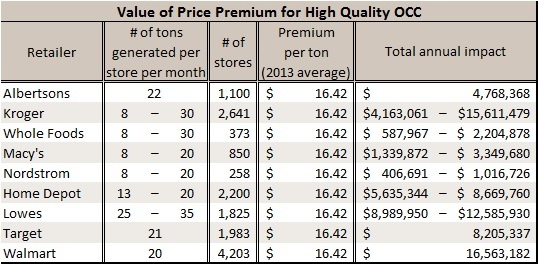

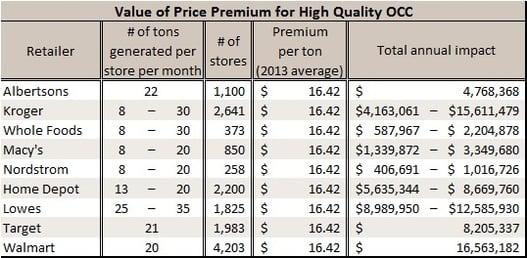

How much more? Data from Forest2Market’s recycled benchmark service, Market2Mill, shows that in 2013 alone, the quality premium averaged $16.42 per ton. The following table shows just what the impact of leaving this premium on the table could have.

As these numbers show, the value of the premium alone can boost a large retailer’s bottom line.

Why is there a price premium for high quality OCC? A closer look at both domestic and export markets yields an explanation.

Producing high quality end products (paper and packaging) from low quality raw materials (OCC with high levels of contaminants) can be a costly challenge for pulp and paper mills. When they purchase lower quality fiber shipments, mills incur additional expenses for handling, disposal, maintenance and repair. At the same time, the recycled paper and packaging they produce must be priced to compete in a global market. The extra costs mills incur from cleaning up the OCC they purchase result in lower profit margins.

Why do mills purchase lower quality OCC? In the US, a variety of circumstances have pushed the quality of recycled fiber down; these include :

- Curbside recycling is at an all-time high, specifically single-stream recycling that mixes all recyclables in a single container at the curb and relies on a post-collection sorting process.

- Processors, collectors and brokers are accepting lower quality waste streams and passing them along to recycled mills.

- ISRI specifications are being ignored, as processors blend grades together in order to produce higher volumes of fiber.

- In attempts to cut manufacturing costs, producers have begun to source additives globally (adhesives, for instance). Domestic manufacturing processes are sometimes unable to handle these new additives.

- When the cost of fiber increases, mills have reduced inventories, sometimes to as little as four days. Sourcing just-in-time supply places recycled mills under increased pressure to be less selective when procuring fiber.

How bad is the contaminant and prohibitive problem at domestic recycled mills? The extent of the problem varies with grade and ranges from 3 percent to 15 percent. OCC sourced from material recovery facilities (MRF) have more contamination, including glass, plastic bottles and containers and cans. The most serious of these contaminants is glass. When glass shards pass through the cleaning process and are carried to paper machines, they can lead to a lower quality end product and/or the need to replace costly machine clothing. Mills are also purchasing a higher percentage of Asian board and board with coatings. Some of these coatings are water insoluble and either don’t break down during processing or take longer to do so, driving manufacturing costs higher.

The effects of receiving lower quality fiber include the added costs of:

- Lower yields as volume of contaminants increases

- Removing the contaminants from the waste stream

- Disposing of contaminants

- Wear and tear on machinery, including the cost of maintaining and repairing machines damaged by contaminants

- Downtime associated with the repair of damaged machines

While these extra costs are major concerns for US mills, export markets are less likely to face the additional costs brought on by a spike in contaminant levels. Why? US producers, collectors and brokers reserve the higher quality fiber shipments for export markets so they can avoid incurring the cost of higher claims for rejected overseas shipments. Even when contaminants sneak through, they can be removed from the process more efficiently. In places like China, for instance, mills sport the latest technology, including state-of-the-art cleaning systems. In addition, the lower cost of labor in Asian markets makes it cost-effective for them to re-sort shipments before they are processed.

For these reasons, clean OCC is worth more on the market. Generally, this means that the index used for contracted transactions should be pegged to a price plus an additional amount that captures the value of the higher quality or that accounts . Open market transactions should be negotiated on a price plus basis as well.