4 min read

Three Causes of Volatility in Old Corrugated Container Prices

Suz-Anne Kinney

:

February 18, 2014

Suz-Anne Kinney

:

February 18, 2014

How do sustainability or recycling program managers know what these payments or rebates should be? And when these payments change month-over-month or quarter over quarter, how do these managers know that the changes accurately reflect what is going on in the market? Unfortunately, all too often, large retailers must rely either on the word of their vendors or on an index that is constructed on the recollections of just two of the three participants in the supply chain: the waste recovery vendors (called suppliers in the recycling industry) and mills. This puts the generators of OCC—grocery stores, big box stores and other large retailers—at a disadvantage.

A better understanding of the OCC market, especially a more comprehensive understanding of what market forces drive price changes, allows retailers to overcome this disadvantage.

Price Volatility: 2011-2013

Forest2Market began collecting actual transaction data from a wide range of participants in the OCC supply chain in April 2011. Since that time, volume weighted average open market prices for OCC have ranged from $82.87 per ton to $181.99 per ton; for contract purchases, prices ranged from $81.66 per ton to $168.05 per ton.

In 2011, the difference between the high and the low in open market OCC prices for the year was $63.27 per ton; for contract purchases, the difference was $45.93.

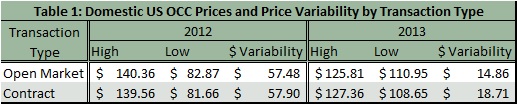

Table 1 shows the range and variability for the full years of 2012 and 2013.

As this data shows, price volatility was extreme in 2012. Imagine having to explain a change of $60 per ton quarter-over-quarter difference for that budget line item. The market in 2013 was more stable, with less opportunity to take advantage of higher prices, but less volatility that might need to be explained.

What Causes OCC (Corrugated Container Prices) Price Volatility?

1. Mother Nature

Mother Nature can be a friend or foe to OCC demand and recovery, either shifting demand or restricting supply.

• Snow and ice, tornadoes and hurricanes—Severe weather limits the amount of OCC that can be recovered. These supply restrictions generally lead to increases in price.

• Rain—Some mills use both trees (virgin fiber) and recycled OCC (recovered fiber) as raw materials for their production processes. Rainy seasons with above normal rainfall amounts can impede logging, and when this happens, mills using both types of fiber may increase the use of OCC recovered from the waste stream to replace higher priced virgin fiber. This increased demand may also result in higher prices.

2. Export Markets

OCC recycling is truly a global undertaking. Since many of the products sold in US grocery and big box stores originate in other countries, boxes need to be manufactured everywhere. As a result, recycled OCC is in demand everywhere. The top three export markets by volume are China, Mexico and India. When this demand is at its highest, prices are higher. The $181.99 per ton price that we clocked in August 2011 was one of these times, as China was buying massive quantities of OCC from the US and was willing to pay whatever it took in order to capture this supply.

When demand is lower in these countries and especially when China backs off the market, as they did in September 2012, prices fall (the low then was in the $80 per ton range). China was also a factor in the dampening of price volatility in 2013, as it was a less aggressive player in the market that year.

In many regards, export markets drive what happens in the domestic market for OCC as well. China, for instance, tends to pull the highest quality material from US markets. (It should be noted that the OCC generated by large retailers is the cleanest on the market; OCC that is gleaned from single-stream recycling is much dirtier as it is mixed with a variety of contaminants found in residential waste streams.)

Because the highest quality OCC goes off-shore, domestic users are forced to take lower quality materials, and this means their yields are lower (i.e., it takes a higher number of tons of material to produce one ton of new packaging). When the final accounting is done, domestic buyers lower the prices they will pay because they have to buy more tons of lower quality material, and this creates a differential between export and domestic pricing.

Export prices are generally higher by $5-$20 per ton. If the high quality OCC generated by large retailers is sold on the domestic market, the price premium that high quality OCC typically receives is erased, leaving this $5-$20 per ton on the table.

3. Survey-Based Price Reports

These days, the term “big data” has been losing some of its cachet. But the even worse culprits are the alternatives: “little data” and “no data.” Survey-based price reports and indexes fall into the latter category. They:

Use a small sample of mills and waste recovery vendors

Rely not on actual sales and purchases extracted from accounting systems, but on the observations of staff via phone or email

Any pricing data available in the marketplace that fails to take into consideration the fact that the OCC recycling industry is transaction intensive, with hundreds of players buying and selling multiple loads every day, cannot accurately provide a comprehensive, up-to-date and accurate view of the market.

Moreover, when a contract is pegged to a survey-based price that relies on hearsay instead of transactions, the credibility of the index is questioned by both parties and trading relationships deteriorate. And when parties can no longer trust that the index is a true reflection of supply and demand forces in the market, volatility ensues.

By understanding OCC market volatility and the market factors that drive it, sustainability and recycling program managers at large retailers can negotiate their OCC recycling contracts from a level playing field and maximize the revenue these programs generate.