1 min read

Tight Wood Fiber Supply Has Pushed Global Costs for Pulplogs and Wood Chips Up 10%

Håkan Ekström

:

October 4, 2022

Håkan Ekström

:

October 4, 2022

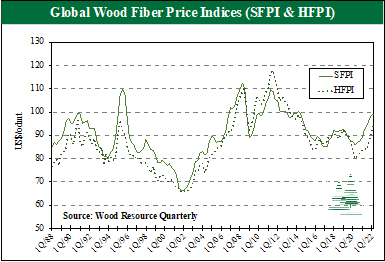

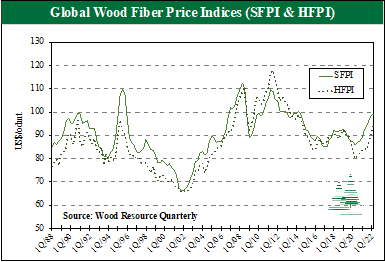

Wood fiber prices continued their two-year upward trend in 2Q22, with hardwood increasing faster than softwood. These trends are reflected in WRI's two global wood fiber price indices (denominated in US dollars), which reached their highest levels since 2014 despite the strengthening of the US dollar against most other currencies.

The global Hardwood Fiber Price Index (HFPI) jumped 5.3% quarter-over-quarter (QoQ) in 2Q22, which was more than 13% higher than a year ago, while the global Softwood Fiber Price Index (SFPI) has gone up only +7% since 2Q21 to $99.01/odmt (see chart). A combination of record-high prices for market pulp, low pulp inventories, and tight wood fiber supply have pushed costs for pulplogs and wood chips higher in both local currencies and US dollars in the past year. In local currencies, prices have increased the most in Europe (10-55%) and Latin America (25-45%) in 12 months, while the increases have been more modest in North America and Oceania.

Strong global demand and record high prices for wood pulp have kept the wood chip trade close to the highest levels ever recorded. During the first half of 2022, global trade was up almost five percent from the same period in 2021. On a worldwide basis, close to 10% of the pulp sector's total wood fiber needs by the pulp sector are currently met by imported wood chips and pulplogs. In Asia, many pulpmills rely upon wood fiber grown in foreign countries for as much as 50-100% of their fiber furnish.

While most of the softwood chip trade has been in Europe, hardwood wood chip shipments are concentrated mainly in the Pacific Rim region, with China and Japan accounting for almost 90% of worldwide imports. The most significant changes in hardwood chip trade flow to report from 1H22 are those of China and Portugal: China increased imports by 13% year-over-year (YoY), and Portugal reached all-time highs in their import market. Portugal filled its increased demand primarily from the hardwood wood chip exporting countries Brazil and Uruguay.

Are you interested in worldwide wood products market information? The Wood Resource Quarterly (WRQ) is a 70-page report established in 1988 with subscribers in over 30 countries. The publication tracks prices for sawlog, pulpwood, lumber & pellets and reports on trade and wood market developments in most key regions worldwide. For more insights on the latest international forest product market trends, please go to www.WoodPrices.com.