US forest industry performance in November and December was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) moved up 0.2 percent in November (+3.4 percent YoY) after posting an upwardly revised increase of 1.2 percent (originally +0.9 percent) in October. Manufacturing output also rose 0.2 percent for a third consecutive monthly gain. Total IP was hampered by a 1.9 percent drop in the output of utilities. The index for mining increased 2.0 percent, however, as oil and gas extraction returned to normal levels after being held down in October by Hurricane Nate. Excluding the post-hurricane rebound in oil and gas extraction, total IP would have been unchanged in November.

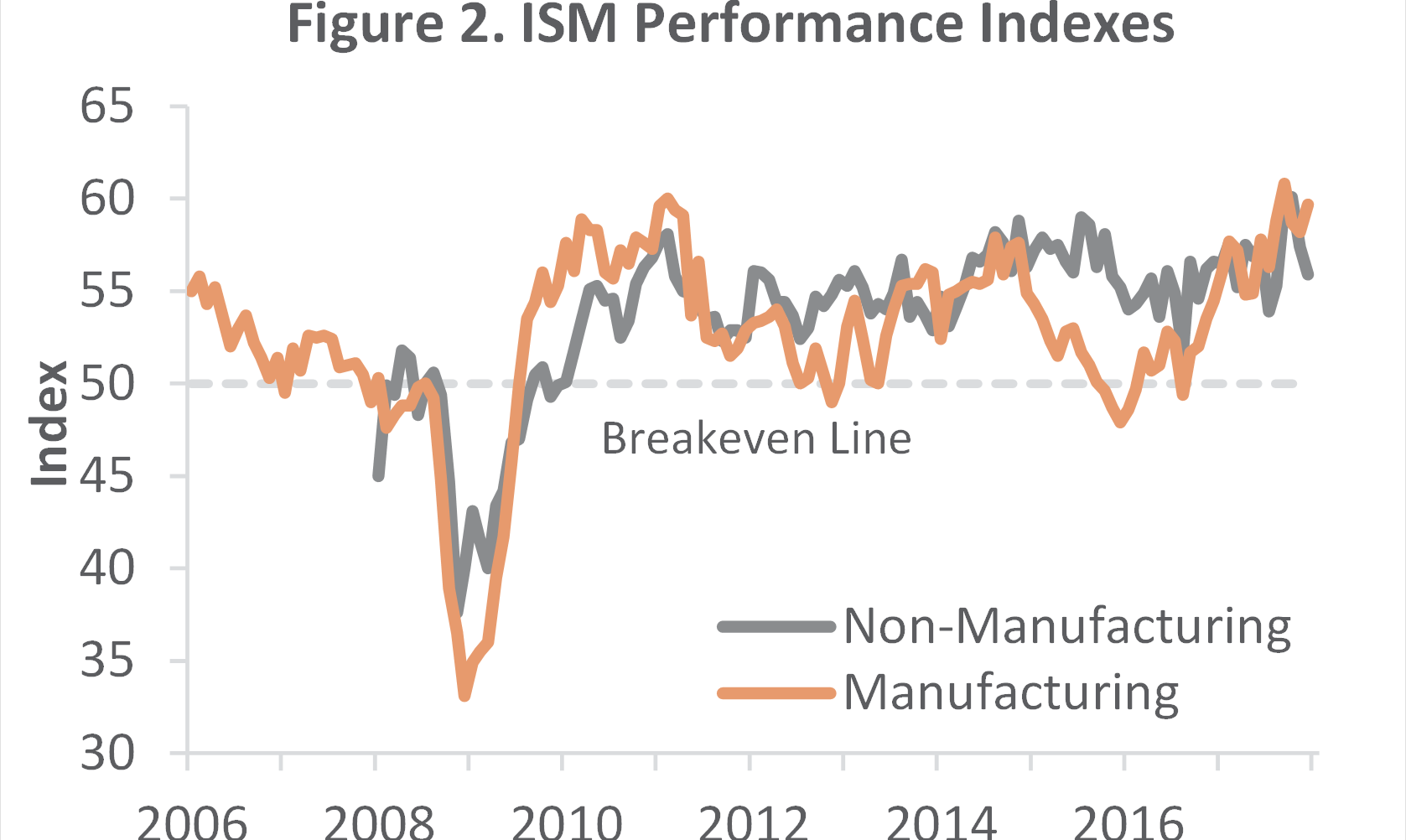

The Institute for Supply Management’s (ISM) monthly sentiment survey showed that the expansion in US manufacturing accelerated in December. The PMI registered 59.7 percent, up 1.5 PP. All of the sub-indexes except employment exhibited higher values in December than in November.

The pace of growth in the non-manufacturing sector decelerated further (-1.5 PP) to 55.9 percent. Only employment, slow supplier deliveries, and input prices had higher sub-index values in December.

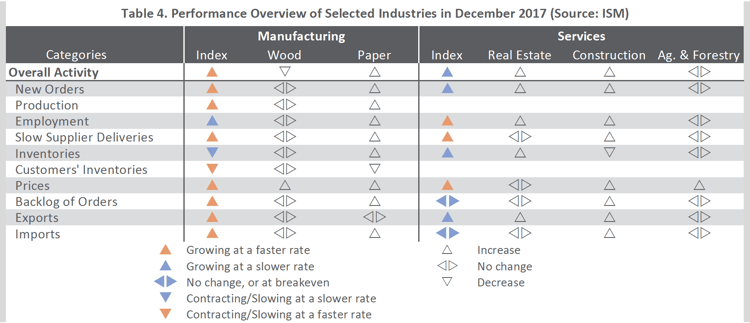

Of the industries we track, Wood Products contracted while Ag & Forestry was unchanged; Paper Products, Real Estate and Construction expanded.

The producer price index (PPI) also moved higher in November (+0.4 percent MoM; +3.1 percent YoY, the largest annual advance since January 2012). Three-fourths of the rise in the final demand index was attributable to a 1.0 percent increase in prices for goods (especially gasoline: +15.8 percent MoM). Higher costs associated with payday loans—which means debt-strapped consumers could be further squeezed in the future—helped spur the index for services to +0.2 percent.

In the forest products sector:

- Pulp, Paper & Allied Products: +0.4 percent (+3.0 percent YoY)

- Lumber & Wood Products: +0.7 percent (+5.1 percent YoY)

- Softwood Lumber: +0.4 percent (+17.4 percent YoY)

- Wood Fiber: +2.5 percent (+0.9 percent YoY)

The consumer price index (CPI) rose 0.4 percent in November (+2.2 percent YoY). The energy index—especially gasoline (+7.3 percent MoM; +16.5 percent YoY), although other energy component indexes also climbed—accounted for about three-fourths of the all-items increase. The shelter index (+0.2 percent MoM; +3.2 percent.

Joe Clark

Joe Clark