US forest industry performance in January and February was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) edged down 0.1 percent in January (+3.7 percent YoY) following four consecutive monthly increases. Manufacturing production was unchanged (+0.2 percent expected) while both wood products and paper contracted. Mining output fell 1.0 percent, while the index for utilities moved up 0.6 percent.

New orders retreated by 1.4 percent, the largest drop since July 2017, ending five straight monthly increases; on a more positive note, new orders without transportation rose 0.4 percent (+8.4 percent YoY). Durable goods orders decreased by 3.6 percent. Business investment spending also declined (-0.3 percent MoM; +8.1 percent YoY), the first back-to-back MoM drop since May 2016.

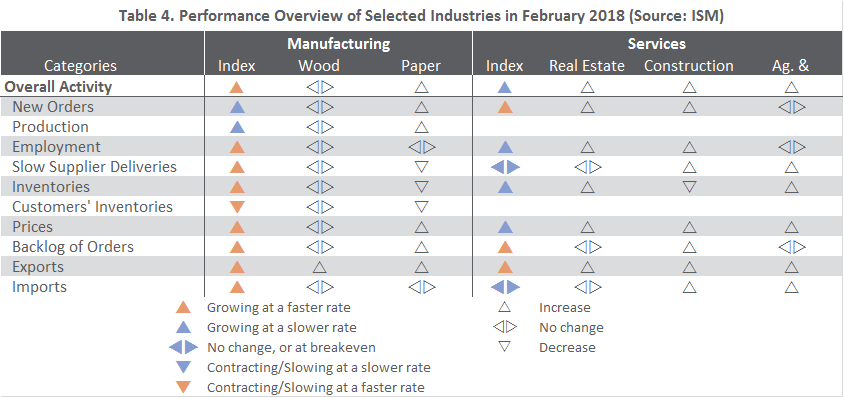

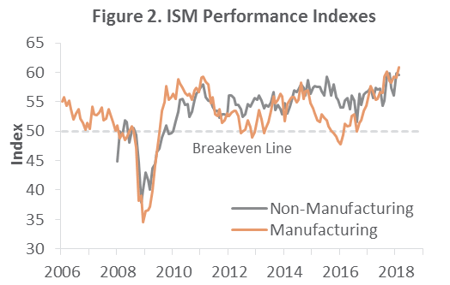

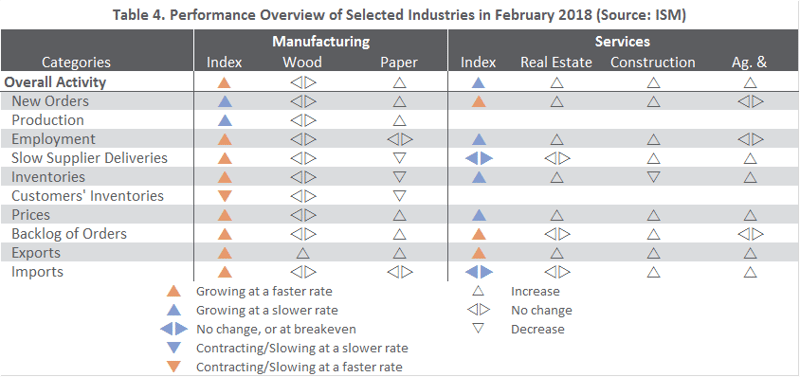

Whereas the “hard” data mentioned above were somewhat subdued, the Institute for Supply Management’s (ISM) monthly sentiment survey was quite upbeat when showing an acceleration in the expansion of US manufacturing in February. The PMI registered 60.8 percent, +1.7PP from the January reading. (50 percent is the breakpoint between contraction and expansion.) All of the sub-indexes except new orders and production were consistent with heightened activity; moreover, no industries reported paying lower input prices.

Of the industries we track, all except Wood Products expanded. “Lumber-related costs continue to increase as supply is also starting to become a problem,” wrote one Construction respondent. “The market volatility of construction materials and the short supply of construction labor have added difficulty to long-term planning.”

The producer price index (PPI) increased 0.4 percent in January (+2.7 percent YoY). The rise derived from a 0.3 percent increase in prices for final demand services (mainly hospital outpatient care: +1.0 percent) and a 0.7 percent advance in the index for final demand goods (especially gasoline: +7.1 percent).

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products rose 0.1 percent (+1.9 percent YoY)

- Lumber & Wood Products: +0.6 percent (+5.8 percent YoY)

- Softwood Lumber: +1.0 percent (+14.5 percent YoY)

- Wood Fiber: +0.9 percent (+1.0 percent YoY)

The consumer price index (CPI) increased 0.5 percent in January (+2.1 percent YoY), thanks to contributions from gasoline (+5.7 percent MoM), shelter (+0.2 percent), apparel (+1.7 percent), medical care (+0.6 percent), and food (+0.2 percent). While used car-and-truck prices also rose (0.4 percent) in January, new vehicles (-0.1 percent) and airline fares (-0.6 percent) declined.

Joe Clark

Joe Clark