US forest industry performance in December and January was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) rose 0.9 percent in December (+3.6 percent YoY, its largest calendar-year gain since 2010), primarily on a 5.6 percent jump in utilities and to a lesser extent by a 1.6 percent increase in mining (mainly oil and gas extraction). Manufacturing output eked out a fourth consecutive monthly increase when edging up by 0.1 percent (+0.3 percent expected). After being held down in 3Q by hurricanes Harvey and Irma, 4Q total IP jumped by an annualized rate of 8.2 percent.

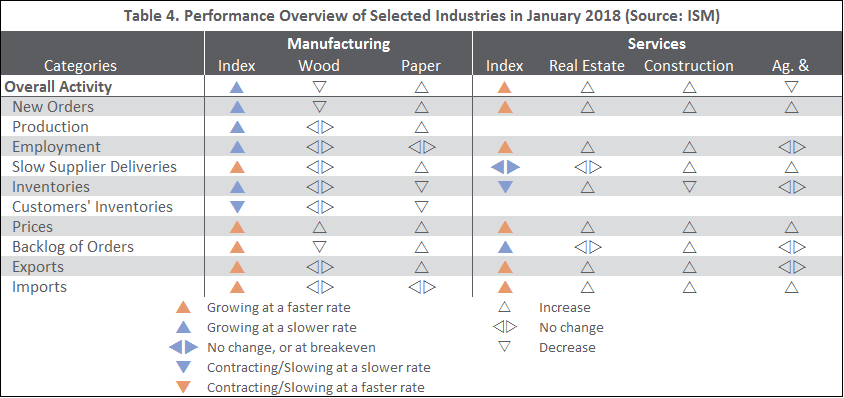

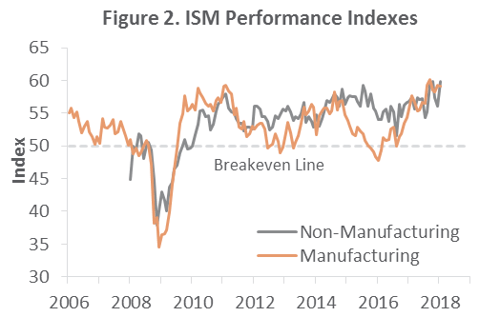

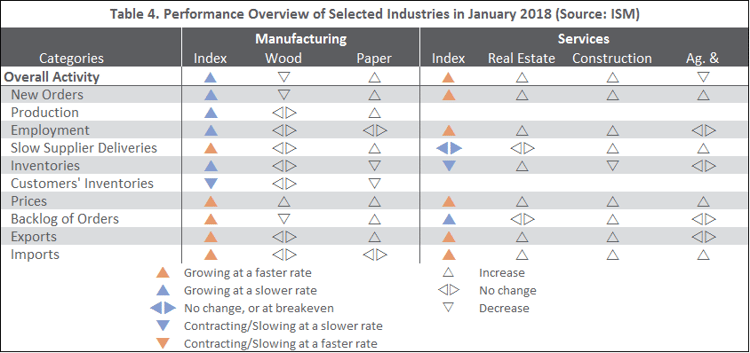

The Institute for Supply Management’s (ISM) monthly sentiment survey indicated that the expansion in US manufacturing decelerated slightly in January. The PMI registered 59.1 percent, down 0.2PP from December’s re-benchmarked and revised reading. New orders, production and employment exhibited lower values in January than in December.

By contrast, the pace of growth in the non-manufacturing sector accelerated markedly (+3.9PP) to 59.9 percent. Only inventories and inventory sentiment had lower sub-index values in January.

Of the industries we track, Wood Products and Ag & Forestry contracted; Paper Products, Real Estate, and Construction expanded.

The producer price index (PPI) countered expectations of a 0.2 percent increase when edging down by 0.1 percent MoM (+2.6 percent YoY). Most of the December decline was attributable to a 0.2 percent decrease in prices for final demand services—in particular, transportation and warehousing services. The index for final demand goods was unchanged.

Indexes within the forest products sector included:

- Pulp, Paper & Allied Products: unchanged (+2.3 percent YoY)

- Lumber & Wood Products: +0.1 percent (+5.2 percent YoY)

- Softwood Lumber: -1.0 percent (+14.3 percent YoY)

- Wood Fiber: -0.7 percent (-0.3 percent YoY)

The YoY increase in softwood lumber is notable; a December survey by the National Association of Homebuilders revealed that building-materials prices are in a dead heat with labor cost and availability as builders’ number one concern in 2018.

The consumer price index (CPI) rose 0.1 percent in December (+2.1 percent YoY). An increase of 0.4 percent in the shelter index accounted for almost 80 percent of the MoM all-items increase. The energy index gave up some of November’s sharp increase, as the gasoline index fell (-2.7 percent MoM; +10.7 percent YoY).

Joe Clark

Joe Clark