US forest industry performance in December 2019 and January 2020 was recently reported by both the US government and the Institute for Supply Management.

Total industrial production (IP) declined 0.3 percent in December (-1.0 percent YoY), as a warm-weather-induced decrease of 5.6 percent for utilities outweighed increases of 0.2 percent for manufacturing and 1.3 percent for mining. For 4Q as a whole, total IP moved down at an annual rate of 0.5 percent. Total IP contracted during seven months in 2019, the worst record since 2015.

As mentioned above, manufacturing output posted a 0.2 percent advance in December but decreased at an annual rate of 1.0 percent in 4Q. December’s gain came despite a 4.6 percent decrease in motor vehicles and parts; assemblies of light motor vehicles fell from 11.2 million units (annual rate) in November to 10.3 million units in December. Excluding the motor vehicle sector, factory output rose 0.5 percent.

Capacity expansions in the wood products sector (+0.3 percent MoM; +4.1 percent YoY) are also reflected in higher output (+1.1 percent MoM; +3.7 percent YoY). Paper products, by contrast, keeps gradually taking on water (production: +0.1 percent MoM, -3.5 percent YoY; capacity: 0.0 percent MoM, -0.3 percent YoY).

New orders jumped by 1.8 percent in December (the largest increase since August 2018) on a 168 percent increase in orders for military aircraft and parts, and a downward revision to November’s data (from -0.7 percent MoM to -1.2 percent MoM). Excluding transportation, new orders rose by 0.6 percent (+2.6 percent YoY). Business investment spending, by contrast, fell by 0.8 percent (but +1.8 percent YoY).

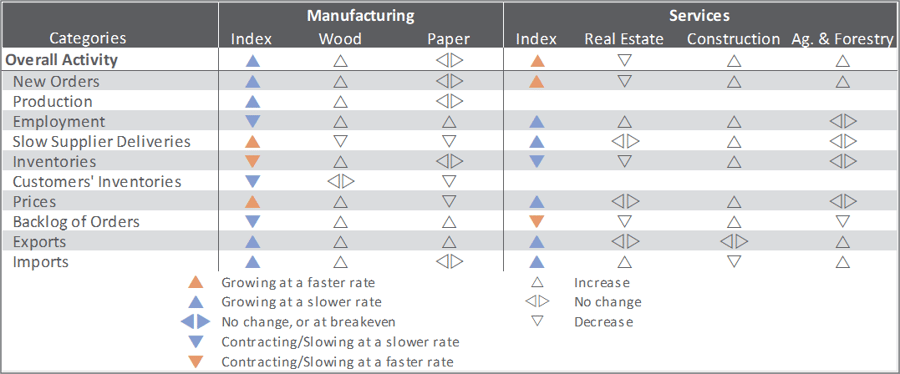

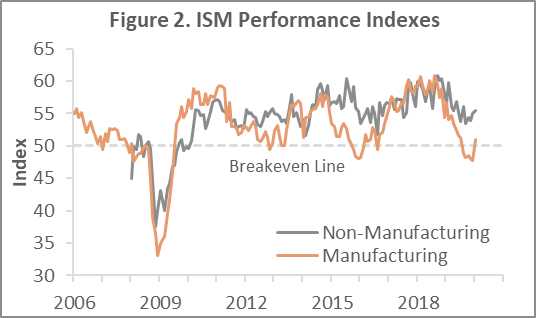

The Institute for Supply Management’s (ISM) monthly sentiment survey showed U.S. manufacturing returning to expansion in January—the first time in six months. The PMI registered 50.9 percent, up 3.1PP from the revised December reading. (50 percent is the breakpoint between contraction and expansion.) Production (+9.5PP), exports (+6.0PP), new orders (+4.4PP) and imports (+2.5PP) all flipped into positive territory.

The pace of growth in the non-manufacturing sector accelerated (+0.6PP, to 55.5 percent). Imports (+7.1PP), business activity (+3.9PP) and new orders (+0.9PP) drove the increase.

Of the industries we track, only Paper Products and Real Estate did not expand. Respondent comments included the following:

- Construction: “1Q sales are improving, which makes us more optimistic.”

- Real Estate: “Customer inquiries are strong to start the new year.”

As has become common in recent months, findings of IHS Markit’s January surveys were mixed relative to their ISM counterparts. Manufacturing growth slowed, whereas growth in service-sector business activity accelerated to a 10-month high.

“The PMI data indicate that the U.S. economy is ticking along at a steady but unspectacular annualized rate of growth of approximately 2 percent at the start of 2020,” wrote Markit’s Chris Williamson. “Growth has gained some momentum from the lows seen in the fall as the service sector enjoys stronger growth and manufacturing has also shown signs of the trade-led downturn easing. However, factory activity remains worryingly subdued, and optimism about future growth across the business community as a whole continues to run at one of the lowest levels seen over the past decade.

The consumer price index (CPI) rose 0.2 percent in December (+2.3 percent YoY) after rising 0.3 percent in November. The indexes for gasoline (+2.8 percent), shelter (+0.2 percent), and medical care (+0.4 percent) accounted for most of the MoM increase in the headline index. These results confirm the observation by MarketWatch’s Jeffry Bartash that “consumer prices rose in 2019 at the fastest pace since 2011, but most of the increase was concentrated in rent, gas and medical care.”

The producer price index (PPI) edged up 0.1 percent (+1.3 percent YoY). The increase in the final demand index was the result of a 0.3 percent rise in prices for final demand goods (mainly gasoline: +3.7 percent). The index for final demand services was unchanged.

In the forest products sector, index performance included:

- Pulp, Paper & Allied Products: +0.1 percent (-2.1 percent YoY)

- Lumber & Wood Products: 0.0 percent (-0.5 percent YoY)

- Softwood Lumber: -0.2 percent (+4.8 percent YoY)

- Wood Fiber: 0.0 percent (-3.5 percent YoY)

Joe Clark

Joe Clark