US forest industry performance in June and July was recently reported by both the US government and the Institute for Supply Management.

After declining 0.5 percent (previously -0.1 percent) in May, total industrial production (IP) rose 0.6 percent in June (+3.8 percent YoY). For 2Q2018 as a whole, total IP advanced at an annualized rate of 6.0 percent, its third consecutive quarterly increase. Manufacturing output bounced back (+0.8 percent) in June, thanks mainly to a truck parts supplier resuming production after an earlier fire. Factory output, aside from motor vehicles and parts, increased 0.3 percent.

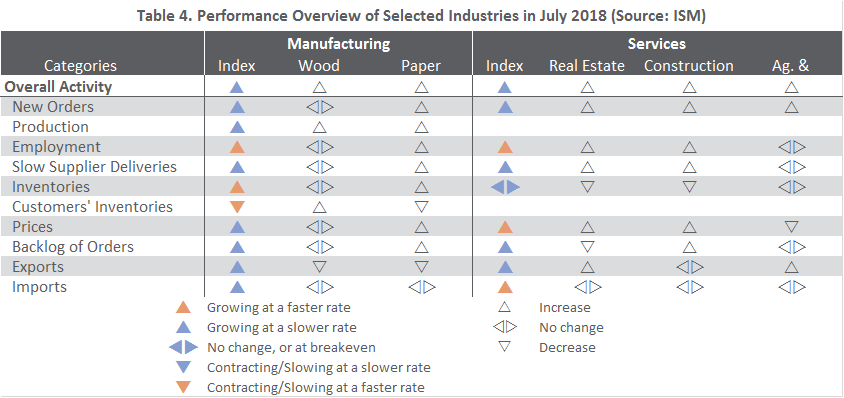

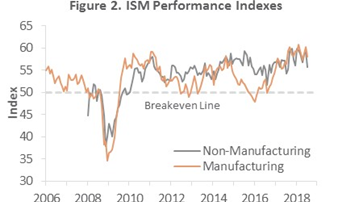

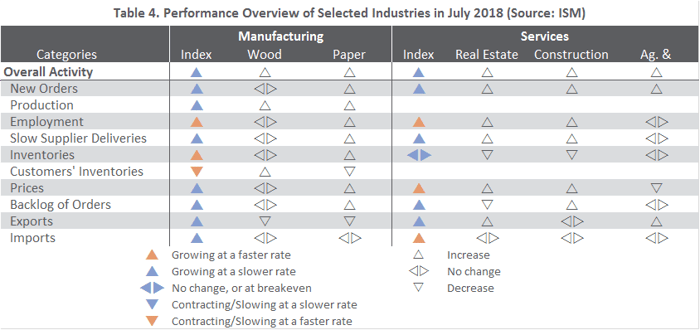

The Institute for Supply Management’s (ISM) monthly sentiment survey showed that the expansion in US manufacturing decelerated (-2.1PP) in July, to 58.1 percent. The only sub-indexes with higher July values included employment and inventories. The pace of growth in the non-manufacturing sector also slowed (-3.4PP) to 55.7 percent. Only employment, input prices and imports exhibited significant increases.

All of the industries we track expanded in July. As the following examples indicate, trade and tariff concerns were common themes among respondent comments:

- Wood Products: “The so-called trade war is now taking its toll on business activity, resulting in substantial reductions to new export orders. China has all but stopped [placing] orders, causing inventories to build up in the United States. Domestic business is steady. However, it is too small to carry the load that export markets have retreated from.”

- Wholesale Trade: “Import tariffs on wood and steel. Shortages of rail cars, truck drivers and skilled labor. High-priced construction materials.”

To put the Wood Products respondent’s comment in perspective, we note that YTD through May, US softwood lumber exports to China and Canada (the top two US softwood lumber export destinations) were up, respectively, 46 percent and 26 percent relative to 2017. Thus, we interpret the comment to mean domestic demand has not grown enough to compensate for a slowdown in Chinese orders (June exports to China: -6.8 percent MoM).

The consumer price index (CPI) increased 0.1 percent in June (+2.9 percent YoY, the largest annual increase since February 2017) after rising 0.2 percent in May. Higher indexes for shelter (+0.1 percent), gasoline (+0.5 percent), and food (+0.2 percent) were only partially offset by electricity (-1.4 percent) and natural gas (-1.7 percent).

The producer price index (PPI) rose 0.3 percent in June (+3.4 percent YoY), thanks primarily to a 0.4 percent advance in prices for final demand services (especially fuel and lubricants retailing). The index for final demand goods edged up 0.1 percent.

Forest products sector performance included:

- Pulp, Paper & Allied Products rose 0.3 percent (+2.0 percent YoY)

- Lumber & Wood Products: +1.9 percent (+10.1 percent YoY)

- Softwood Lumber: +4.0 percent (+23.2 percent YoY)

- Wood Fiber: +1.1 percent (+3.7 percent YoY)

Joe Clark

Joe Clark