US forest industry performance in February and March was recently reported by both the US government and the Institute for Supply Management.

Reflecting annual revisions published at the end of March, total industrial production (IP) edged up by 0.1 percent in February (+0.4 percent YoY). Manufacturing output rose by 0.5 percent (+1.5 percent YoY). Revisions to total IP show lower rates of change in recent years—especially 2014 and 2015. Also, total IP returned to its pre-recession peak in November 2014 instead of the previously reported May 2014.

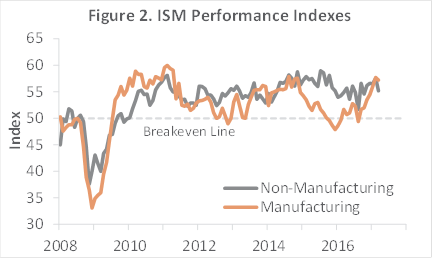

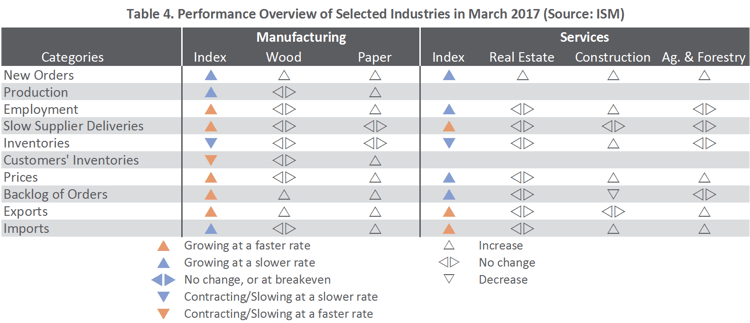

The Institute for Supply Management’s (ISM) survey showed the expansion in US manufacturing decelerated slightly during March. The PMI registered 57.2 percent, down 0.5 percentage point from February. (50 percent is the breakpoint between contraction and expansion.) Sub-indexes exhibited acceleration in employment, input prices (highest value since May 2011) and export orders. The pace of growth in the non-manufacturing sector retreated more significantly when dropping by 4.7 percentage points, to 58.9 percent. NMI sub-indexes were a mixed bag, with rising export and import orders amid decelerating business activity, new orders and employment.

The consumer price index (CPI) increased 0.1 percent in February, the smallest MoM rise since July 2016. The gasoline index declined, partially offsetting increases in several indices, including food, shelter, and recreation. Despite the small MoM increase, the all-items index rose 2.7 percent for the 12 months ending February; the YoY increase has been trending upward since a July 2016 trough of 0.8 percent. The energy index rose 15.2 percent over the last year; rent: +3.9 percent YoY, and medical services: +3.4 percent.

February’s producer price index (PPI) increased 0.3 percent (+2.2 percent YoY). Over 80 percent of the MoM advance is attributable to a 0.4 percent increase in prices for final demand services; final demand goods moved up 0.3 percent primarily on a 1.6 percent jump in electricity prices.

Most of the forest products-related PPIs we track increased in February:

- Pulp, Paper & Allied Products: +0.2 percent (+2.0 percent YoY)

- Lumber & Wood Products: +1.0 percent (+2.7 percent YoY)

- Softwood Lumber: +4.8 percent (+13.4 percent YoY)

- Wood Fiber: -0.2 percent (+0.7 percent YoY)

Joe Clark

Joe Clark