Despite high expectations for a late spring surge in homebuilding, US housing starts fell for the third straight month in May to their lowest level in eight months. The latest numbers raise concerns about the continued lack of available housing inventory—which compounds the challenges faced by Millennials as they struggle with household formation—as well as concern that the housing market recovery may be faltering.

Housing Starts, Permits & Completions

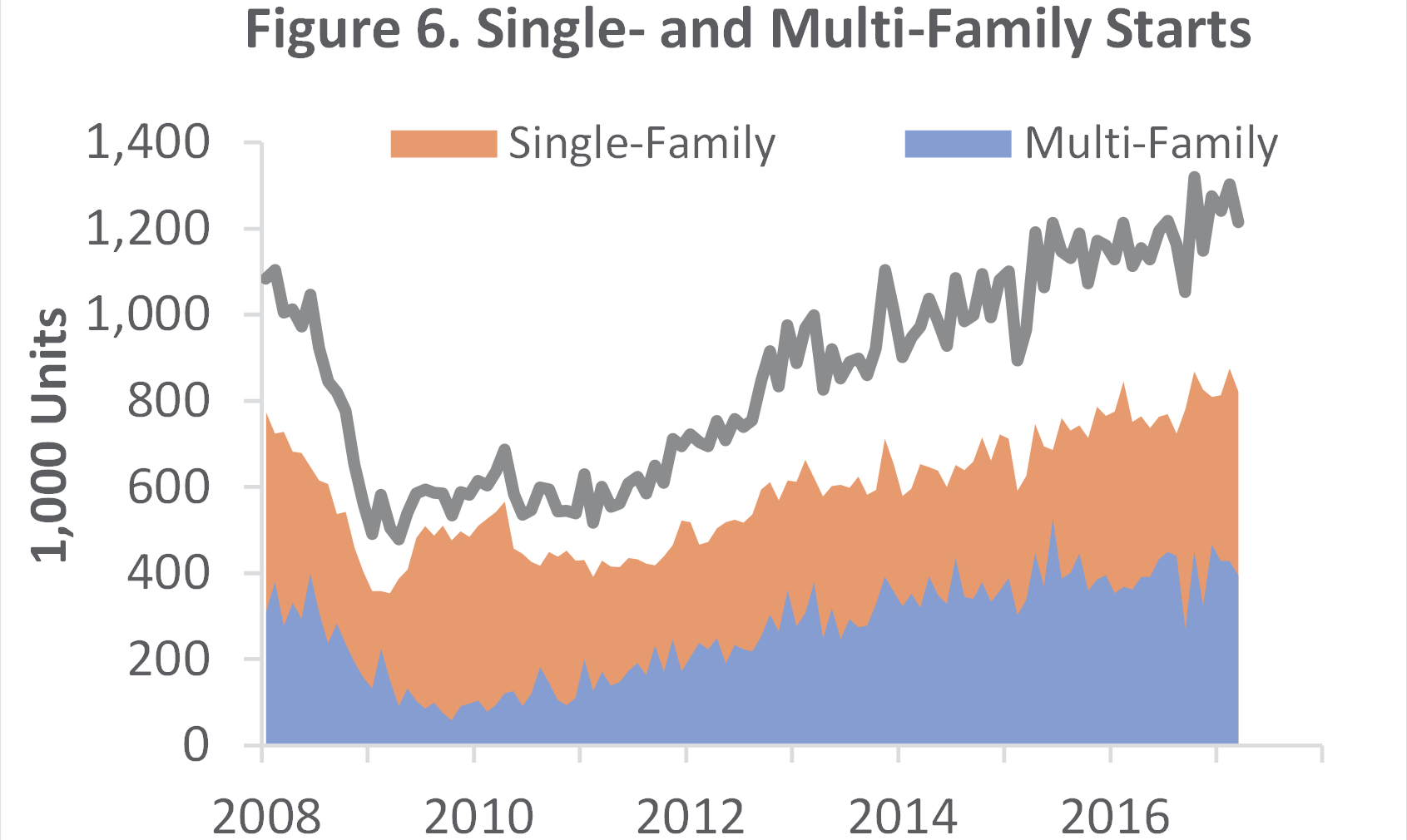

US housing starts were down 5.5 percent to a seasonally adjusted annual rate (SAAR) of 1,092,000 units in May. Single-family starts accounted for 794,000 units, which is 3.9 percent below the revised April figure of 826,000. Starts for the volatile multi-family housing segment also fell in May, declining 9.7 percent to a rate of 298,000 units, which now makes five straight months of declines for this segment.

Privately-owned housing completions were 5.6 percent above April’s estimate of 1,102,000 units. Single-family permits dropped 1.9 percent to a rate of 779,000 units in May, while multifamily permits plunged 10.4 percent to a pace of 389,000. Regional performance was less volatile for the single-family segment than it was in April, as confirmed by the US Census Bureau report. Seasonally-adjusted, single-family housing starts by region included:

- Northeast: +12.5 percent (-29.2 percent last month)

- South: -8.9 percent (-3.4 percent last month)

- Midwest: +9.5 percent (+19.4 percent last month)

- West: -4.9 percent (+9.1 percent last month)

Mortgage Rates & Market Sentiment

The 30-year fixed mortgage rate ticked down in May from 4.04 to 4.01 percent. The National Association of Home Builders (NAHB)/Wells Fargo builder sentiment index that was just released declined to 67—down two points from a reading of 69 in May. The index has been above 60 since September, 2016 and readings above 50 indicate more builders view sales conditions as favorable rather than poor.

"The recent stall in homebuilding is bad news for growth," said Gus Faucher, chief economist at PNC Financial. "A shortage of construction workers may be weighing on the construction industry, and in some parts of the country short supply of land to build on is also a factor."

Lack of Land, Inventory

Demand for housing remains strong, but available housing inventory and lot supply both remain tight. A recent report by online real estate marketplace Trulia compared the national housing inventory in the 100 largest metro areas from 1Q2012 to 1Q2017 shows that starter homes experienced the largest drop in inventory. During that period, the number of starter and trade-up homes fell roughly 9 percent and 8 percent, respectively. "The lack of inventory of homes for sale is one of the most pressing challenges in the housing market today," said Mark Fleming, chief economist at insurance company First American Financial.

Greg Ugalde, president of Connecticut-based T&M Building Co., said that home builders are looking at smaller land options based on the tight availability of land. "A lot of the other builders now that used to pick up these subdivisions of up to 50 lots don't have as great an opportunity anymore.”

Homebuilders remain optimistic about sales prospects, but the level of construction has done little to meet demand from potential buyers. The number of existing homes listed for sale—not just starter homes—have been registering annual declines for roughly two years. But as this available inventory becomes scarcer, median home prices also continue to rise. Starter and trade-up homebuyers need to spend 3 percent and 2 percent, respectively, more of their income to buy a home now than they did in 2016.

Economists blame the lackluster housing numbers through 1H2017 on supply constraints rather than demand for housing, which is supported by a strong labor market. With the unemployment rate at a 16-year low of 4.3 percent, wages are slowly rising. “Homebuilders continue to caution that construction may be limited by a lack of available lots or skilled labor, but the market fundamentals suggest that demand should remain solid,” said Tom Simons, an economist at Jefferies LLC.

The increasing home prices that Trulia referenced also add a new kink to the already complex housing market dynamic. As availability remains tight, the issue becomes compounded if families in starter homes simply can’t afford to trade up; they will stay put, and available inventory for first-time homebuyers will continue to shrink.

Despite normal monthly fluctuations, the industry remains hopeful that the housing market will continue its slow recovery—nearly 10 years in the making. "Ongoing job growth, rising demand and low mortgage rates should keep the single-family sector moving forward this year, even as builders deal with ongoing shortages of lots and labor," said Granger MacDonald, chairman of the NAHB.