I really do hate to keep harping about the overwhelming uncertainty that is causing a paralysis of sorts in so many markets. We have witnessed and covered this issue in our monthly forest industry performance reports, and seen it at work in markets all over the world for some time now. But as we recently noted, objectivity is becoming a lost art. In this bizarro world, is it any wonder that head-scratching and trepidation have become the norm?

But people will always need a roof over their heads and, thankfully, the housing market continues to chug along at a relatively stable pace.

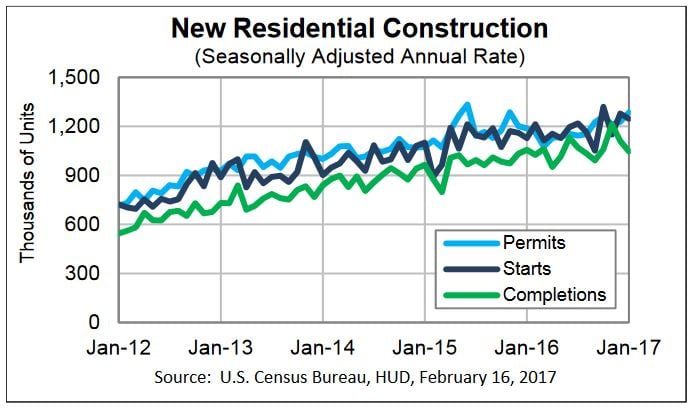

Housing Starts, Permits & Completions

Housing starts inched down 2.6 percent to a seasonally adjusted annual rate (SAAR) of 1,246,000 units in January. Single-family starts accounted for 823,000 units, which is 1.9 percent above the revised December figure of 808,000. The volatile multifamily segment sank 10.2 percent to a SAAR of 421,000.

Single-family permits dropped 2.7 percent to a rate of 808,000 units in January, while multifamily permits rose 19.8 percent. Privately-owned housing completions were 5.6 percent below December’s estimate of 1,109,000 units.

Regional performance was volatile (despite the mild winter weather in much of the country), as confirmed by the US Census Bureau report. Seasonally-adjusted housing starts by region included:

- Northeast: +55.4 percent; (+18.5 percent last month)

- South: +20.0 percent; (-1.4 percent last month)

- Midwest: -17.9 percent; (+31.2 percent last month)

- West: -41.3 percent; (+23.5 percent last month)

Mortgage Rates & Market Sentiment

The 30-year fixed mortgage rate ticked down in January from 4.20 percent to 4.15 percent, which still represents a significant increase compared to the average 2016 rate of 3.65 percent. There was also an unexpected decrease in homebuilder confidence recently reported; the NAHB/Wells Fargo Housing Market Index dropped to 65 in February from 67 in January. The decrease was a surprise, as the index was expected to inch up to 68.

Recent commentary from the National Association of Home Builders (NAHB) captured the current mood of the market, saying that, “Housing starts returned to trend…” after surging in December. The report notes that the drop in multifamily production occurred after an “unusually high December 2016 reading,” and draws many of the same conclusions that we do about the segment—namely, slow (and unsteady) growth is the near-term forecast.

NAHB Chief Economist Robert Dietz stated that “Some pull back in housing production is unsurprising after an overly strong multifamily reading last month. As we move forward in 2017, we can expect the multifamily sector to continue to stabilize and single-family production to move forward at a gradual but consistent pace.”

Outlook

Near-term, the lingering carnage from the Great Recession will continue to prevent housing’s push above the long-term average of 1.5 million annual starts. Longer term, however, pent-up pressure by the Millennial demographic should provide steady work for builders. Harvard’s Joint Center for Housing Studies (JCHS) projects the United States will add 8.9 million homeowner households and 4.7 million renter households by 2025, which translates into an average of roughly 1.7 million annual starts during the intervening period based on demographics alone.

“A settling of housing production is in line with what we are hearing from builders—that they are largely optimistic about current market conditions but still face supply-side headwinds and regulatory hurdles,” added Granger MacDonald, chairman of the NAHB. Slow housing starts data and the market settling is not an altogether undesirable situation; in an environment with very little objective perspective, “settling” is actually a pretty comfortable spot.