3 min read

US Housing Starts: January Posts Strong Numbers to Kick off New Year

John Greene

:

February 27, 2018

Despite the recent volatility in the Dow Jones Industrial Average (DJIA), which dropped over 2,300 points over the course of a week in early February, things seem to have settled down in the interim. A series of interest rate hikes may be on the horizon, but the housing market marches on; new home construction increased 9.7 percent to 1.33 million units in January (+7.3 percent YoY), marking the highest rise since October 2016.

Housing Starts, Permits & Completions

After a disappointing finish to 2017 in December, US housing starts jumped 9.7 percent to a seasonally adjusted annual rate (SAAR) of 1,326,000 units in January. Single-family starts accounted for 877,000 units, which is 3.7 percent above the revised December figure of 846,000. Starts for the volatile multi-family housing segment surged 23.7 percent to a rate of 449,000 units.

Privately-owned housing authorizations increased 7.4 percent to a rate of 1,396,000 units in January. However, single-family authorizations dropped to 866,000, which is 1.7 percent below the revised December figure.

Privately-owned housing completions decreased to a SAAR of 1,166,000 million in January, down 1.9 percent from December’s revised estimate of 1,188,000, but 7.7 percent above January 2017. Regional performance in January was generally positive, as confirmed by the US Census Bureau report. Seasonally-adjusted total housing starts by region included:

- Northeast: +45.5 percent (-39.6 percent last month)

- South: +9.3 percent (+11.1 percent last month)

- Midwest: -10.2 percent (-12.9 percent last month)

- West: +10.7 percent (+19.0 percent last month)

Seasonally-adjusted single-family housing starts by region included:

- Northeast: +34.7 percent (0.0 percent last month)

- South: +4.5 percent (+8.4 percent last month)

- Midwest: -4.0 percent (-11.1 percent last month)

- West: -0.4 percent (+11.4 percent last month)

Mortgage Rates & Market Outlook

The 30-year fixed mortgage rate increased from 3.95 to 4.03 percent in January, its highest level since 4.05 in April 2017. The National Association of Home Builders (NAHB)/Wells Fargo builder sentiment index remains unchanged at 72 in February (up compared to a YoY level of 65). Per Zack’s Investment Research, “The Housing Market Index (HMI) includes builder perceptions of current single-family home sales, sales expectations for the next six months and traffic of prospective buyers, and a reading above 50 is considered confident enough. The upside was driven by higher sales expectations in the future, which rose two points to 80. Traffic of prospective buyers was steady at 54, but the component gauging current sales conditions dropped one point to 78.”

Current numbers suggest that builders are optimistic about the recent tax cuts and have no long-term concerns about the rising interest rates. NAHB Chairman Randy Noel added that "Builders are excited about the pro-business political climate that will strengthen the housing market and support overall economic growth."

Market Reaction & Outlook

The positive momentum is expected to continue in 2018 due to an improving economy, modest wage growth, low unemployment levels, positive consumer confidence, a tight supply situation and escalating rent costs.

Stephen Stanley, chief economist at Amherst Pierpont Securities noted that most of January’s numbers gains were in the multi-family segment. “The more reliable single-family starts figure posted a decent gain of 3.7 percent to 877,000 in January, in between the November blowout reading of 946,000 (which likely reflected a catch-up after hurricanes disrupted construction in September and October) and December hangover reading of 846,000,” Stanley said.

“To put the figure more in perspective, the 2017 average for single-family starts was 849K, so January’s level represents a continuing solid uptrend, especially considering that weather may have held activity down somewhat last month. The single driving fundamental in the housing market remains that demand is outstripping supply, so upside surprises on housing starts are just what the doctor ordered,” Stanley added.

Despite the scarcity in inventory, strong demand from a solid labor market is keeping the housing market alive. General unemployment rates remain at a 17-year low of 4.1 percent for the fourth straight month, with around 200,000 jobs added in January 2018. The economy is also on solid footing; Gross Domestic Product (GDP) grew at a seasonally adjusted annual rate of 2.6 percent in the 4Q2017 following gains in the previous two quarters of more than 3 percent.

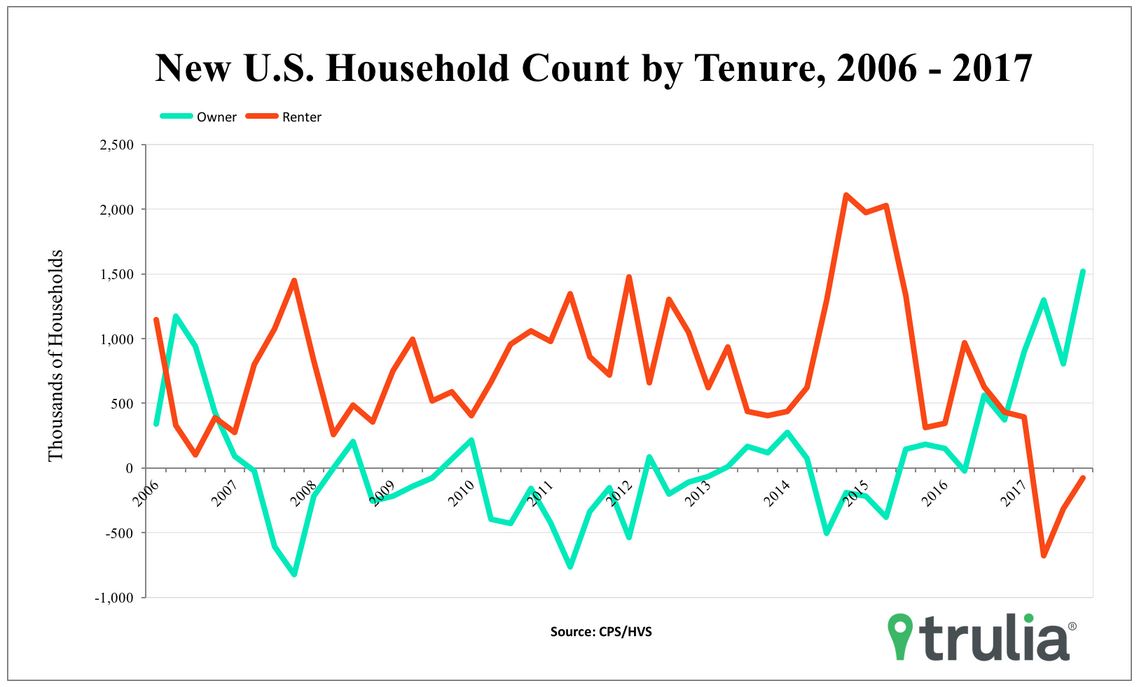

Ralph McLaughlin, chief economist at online real estate marketplace Trulia recently noted that a fresh Census Homeownership and Vacancy Survey (HVS) shows that US homeownership increased in 2017 to an unadjusted rate of 64.2 percent, up from 63.7 percent in 2016. McLaughlin added, “For the fourth consecutive quarter, the number of owner-occupied households grew faster than renter households over the year. The number of new owner households grew by 1.518 million from a year ago, while renters lost 75,000 households. Strong renter household formation is one of the reasons why the homeownership rate has continued to drop since the onset of the housing crisis. The fact that we now have four consecutive quarters where owner households outpaced renters is a strong sign this is a true trend and that the decline in homeownership caused by the Great Recession is reversing course.”

President Trump’s recently-enacted tax cuts, a proposed $1.5 trillion infrastructure package and a focus on increasing deregulation are designed to drive economic growth at a quickening pace in 2018 and beyond. While political obstacles will be expected along the way, the general sense of optimism within the building community should be enough to keep housing starts on a steadily-increasing trend in the near term.