Forecasting is an integral part of business success in an industry that is prone to seasonality, supply constraints and a range of other factors that might converge to influence the price of forest raw materials. Consequently, it is always a good practice to examine historical prices and trends to better understand the market, as such knowledge helps business leaders make better decisions in both the present and the future.

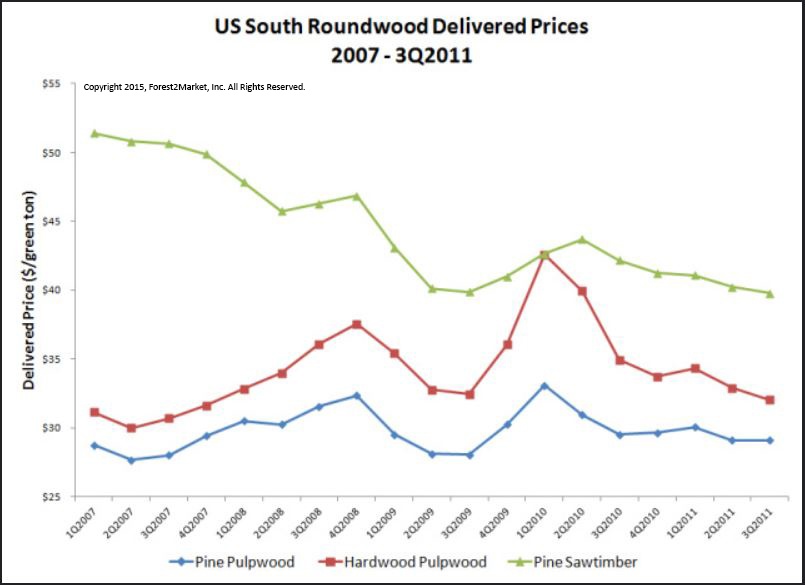

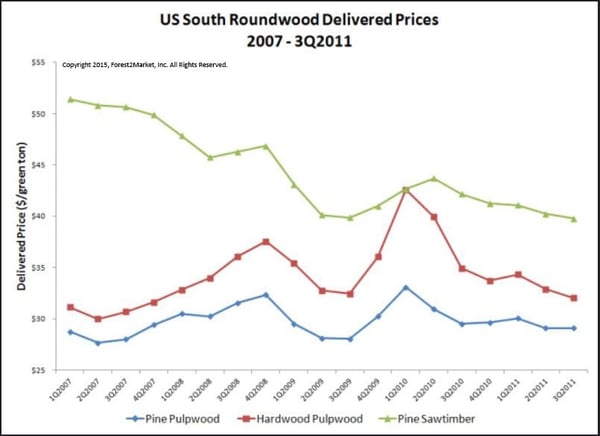

In 3Q2011, the last time we reported on multi-year delivered prices for US South roundwood, the market for pine sawtimber, pine pulpwood and hardwood pulpwood over the timeframe was volatile. This volatility was the result of the Great Recession of 2008 and the market uncertainty that developed over the roughly 24 months that followed. Note the price fluctuations in the illustrated peaks and valleys on the chart below.

As market volatility began to wane in 2011, the prices reflect a slow return to stability; for example, delivered hardwood pulpwood prices returned to their 5-year trend levels ($33) by 3Q2011.

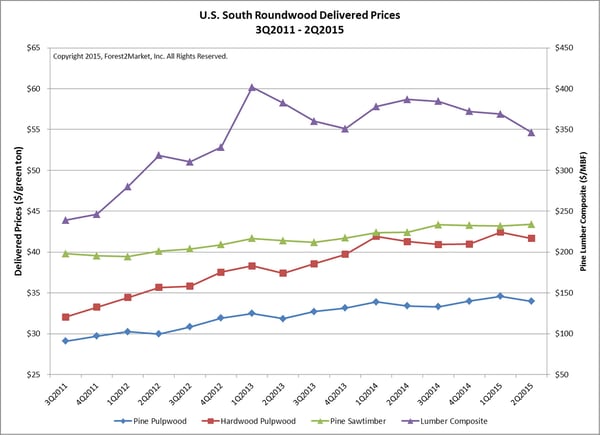

Fast-forward four years and prices for these products have remained reasonably stable. Though all are on upward trends, the only standout has been hardwood pulpwood.

Pine Sawtimber

From a Jan. 2007 high of $52, delivered pine sawtimber prices declined steadily before settling around the $40 mark in 3Q2011, which represents a 23 percent decrease over the 19-quarter timeframe. Since then, prices have remained relatively stable, increasing only slightly into the mid-$40 range by late 2014. Over the last four years, delivered pine sawtimber prices have increased at a compound annual growth rate (CAGR) of roughly 3.5 percent.

Pine Pulpwood

From Jan. 2007 to 3Q2011, delivered pine pulpwood prices experienced moderate volatility only to return to pre-2008 pricing of roughly $30. Since 2011, pine pulpwood has experienced a slight increase that closely resembles pine sawtimber from a percentage standpoint. Over the last four years, delivered pine pulpwood prices have increased at a CAGR of roughly 4 percent.

Hardwood Pulpwood

Since 3Q 2011, delivered hardwood pulpwood prices followed a similar, although more intense track to pine pulpwood prices. From a starting point of roughly $31 in 1Q2007, the price jumped to almost $43 in 1Q2010—a 38 percent increase—before falling back to the $32 range by late 2011. Since then, hardwood pulpwood prices have increased roughly $10/green ton, or 30%. Over the last four years, delivered hardwood pulpwood prices have increased at a CAGR of roughly 7 percent.

Southern Yellow Pine Lumber

The composite price for kiln-dried SYP lumber (dimension lumber and timbers combined) was at a low point of $240/MBF in 3Q2011, but quickly increased to the $400/MBF range in early 2013—a 66 percent increase. These prices have since decreased to the $350/MBF level and recent weekly prices have continued to move downward, trending towards the $300/MBF mark as we head past peak building season and into the cooler fall weather. Over the last four years, the composite lumber price has increased at a CAGR of roughly 9 percent.

Make Better Decisions with Five-Year Forecasts

Pricing volatility related to forest products can undermine forecasting efforts and destroy budgets. Forecasts that will drive cost savings and improve efficiencies demand a collection of tools that help wood-consuming businesses make the right decisions. A Forest2Market five-year forecast is designed to be the most data-intensive tool available on the market. With 2015 editions specific to pine sawtimber, pine pulpwood and hardwood pulpwood in the US South, the five-year forecast provides regional and historical market insights that will be invaluable to budgeting and procurement teams.