2 min read

US South Stumpage Market: YTD 2016 Results and Historic Trends

Daniel Stuber

:

October 20, 2016

Daniel Stuber

:

October 20, 2016

As we approach the end of the year, it’s a good time to analyze year-to-date (YTD) and historical stumpage market trends and prices throughout the US South. While winter seasonal pressure typically drives prices higher, I want to take note of the data before 4Q affects the market.

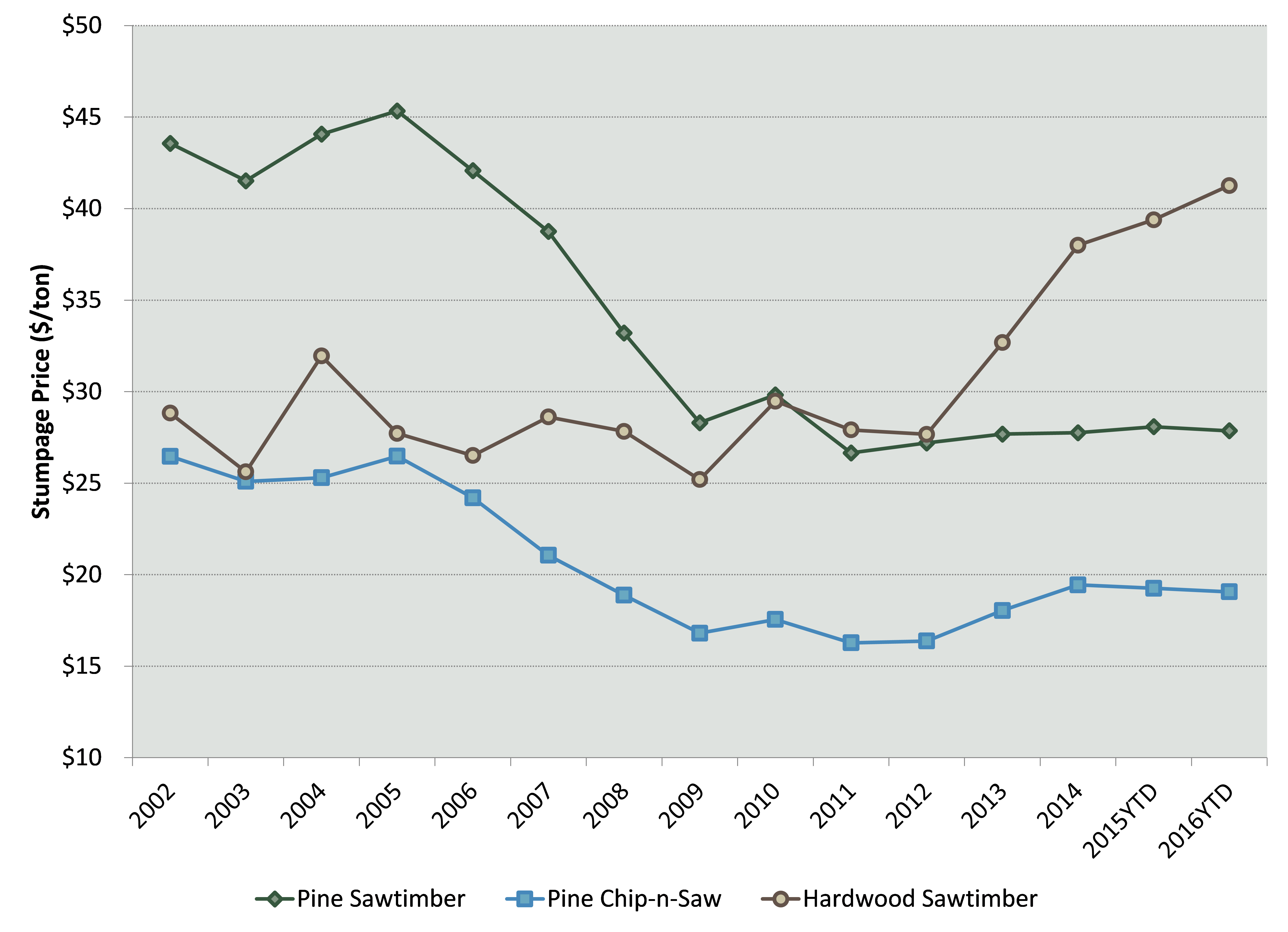

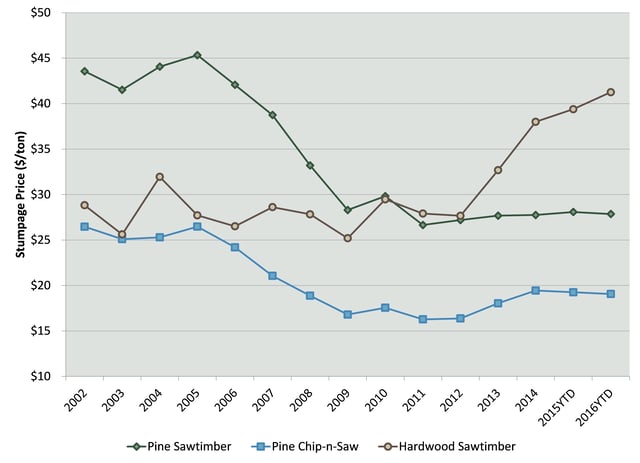

Sawtimber & Chip-n-Saw

A comparison of 2016 YTD average prices over the same period in 2015 shows that pine sawtimber prices and chip-n-saw (CNS) prices have softened while hardwood sawtimber has increased:

- CNS currently averages $19.06/ton, which represents a $0.20/ton or 1.0 percent decrease

- Pine sawtimber currently averages $27.86/ton, which represents a $0.22/ton or 0.8 percent decrease

- Hardwood sawtimber currently averages $41.26/ton, which represents a $1.87/ton or 4.7 percent increase

The decrease in pine CNS and sawtimber pricing is interesting, considering that lumber production is on target to be up 4 percent this year and log purchases are up nearly 6 percent. This points to the oversupply of pine sawlogs in the forest and how buyers have been selective with purchases. In addition, sawmills have built log inventory and currently have many suppliers on quota.

For hardwood sawtimber, log exports appear to be driving the market. While export volume is on track to decrease slightly (-4 percent) from last year, the value of exported logs is on track to be up 19 percent.

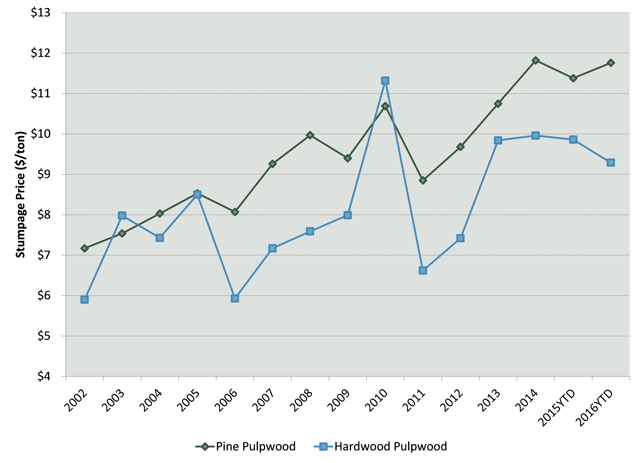

Pulpwood

Pulpwood prices have experienced mixed results when comparing 2016 YTD to 2015:

- Pine pulpwood currently averages $11.76/ton, which represents a $0.38/ton or 3.3 percent increase

- Hardwood pulpwood currently averages $9.29/ton, which represents a $0.57/ton or 5.8 percent decrease

The price growth in pine pulpwood is surprising considering increased lumber production has increased residual chip supply into the market. However, purchases from pulp and paper mills, OSB and pellet mills are up 3 percent compared to the same period last year.

As for hardwood pulpwood, the opposite has occurred. Purchases are down 5 percent compared to the same period last year.

Outlook

Typical seasonality in pine CNS and sawtimber prices does not appear to be materializing and with sawmills carrying full inventories, it is likely that prices will continue to remain flat extending throughout 4Q. More than likely, we will see the winter seasonality materialize as we approach the end of the year and into the beginning of 2017, but strong price increases are not expected. As for hardwood sawtimber, the Federal Reserve’s September decision not to raise the federal funds rate had an immediate effect of devaluing the dollar. However, of late, the dollar has strengthened. If the Fed employs a rate hike in December, expect the dollar to devalue again. This may boost export volumes and allow prices to maintain their high levels going into the new year.

For pine pulpwood, prices should continue to increase due to winter seasonality and improvement in the OSB and pellet markets. Hardwood pulpwood prices are also likely to reverse course as seasonality sets in, but more than likely will decrease if the sawtimber markets stay strong and if drier weather becomes the norm in the spring-summer months of 2017.